SomaLogic Stock: A Significant First-Mover Advantage?

Table of contents

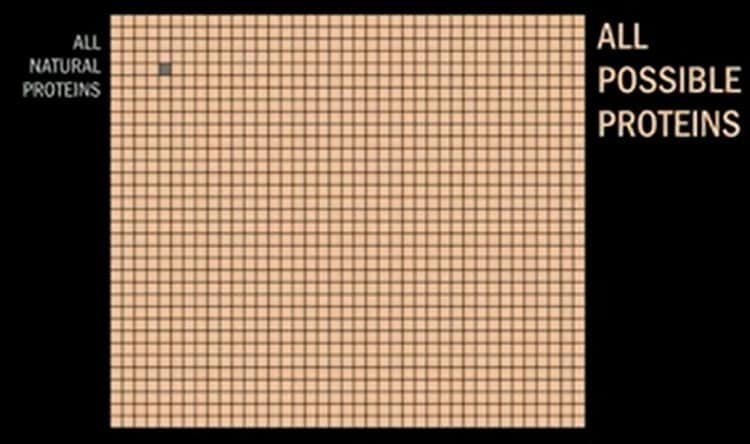

Proteomics – the study of proteins – is incredibly complex stuff. That’s why fund managers often hire subject matter experts to navigate such topics. We disagree with this approach. You cannot invest in what you know if you need an interpreter to do so. A simple understanding of the opportunity can suffice in most cases. For example, this basic chart sums up the proteomics thesis quite well.

Think about all the things we can accomplish by harnessing the power of nature through engineering proteins that don’t exist in nature yet, something that falls squarely under the umbrella of synthetic biology. That’s why we published our piece on A List of 7 Proteomics Stocks For Investing in Proteins and invested in just one of those companies – Quanterix (QTRX). Today, we want to check in with a proteomics company that claims to have the leading proteomics platform on the market with “a significant first mover advantage.”

About SomaLogic

SomaLogic (SLGC) was one of three proteomics companies that merged with a special purpose acquisition company (SPAC) to become public. Now that the company has filed their first 10-Q, we now have some information to analyze. Just today, SomaLogic filed an 8-K with the SEC stating that revenue for the full year 2021 is expected to exceed $79 million, representing over +41% year-over-year revenue growth. On a quarterly basis, the growth has been relatively consistent over the last several years, though growth in 2021 hasn’t been overly exciting from quarter to quarter.

Just over 87% of SomaLogic’s Q3-2021 revenue was derived from services which entail performing the SomaScan® assay on customer samples to generate data on protein biomarkers. A fair bit of customer concentration risk can be seen last quarter, a problem that’s persisted over time, but will hopefully improve as the company grows.

The sort of business model that SomaLogic employs today – one that revolves around services – has pros and cons.

The Importance of Business Models

Before they managed to catastrophically insult their entire male customer base by pretending to be woke, Gillette had a successful razor and blades business model which was simple and elegant. Get a customer to use a Gillette razor and they’ll be buying the blades for life. Hewlett-Packard also managed a similar feat with their once-popular inkjet printers which made loads of money through selling high-margin ink cartridges. The most relevant example today is Illumina (ILMN) and their 20,000 installed machines which generated $3 billion worth of consumables sales in 2021 – about 66% of total revenues.

When we look at life sciences companies developing hardware, we prefer those that place devices in the hands of customers, and then harvest consumables revenues over time. Contrast this to companies that choose a services model instead, or a hybrid model which combines both. One such company is Olink which generates revenue from two segments, Kit and Service. Kit revenues refer to the sale of their panels directly to customers that run the kit and analysis in their own labs. Service revenues involve Olink running the analysis on their products on behalf of their customers. Around 35% of Olink’s 2021 revenues come from Kits, up from 18% the year prior. The trend is going in the right direction.

Similar to Olink, the majority of SomaLogic’s revenues also come from offering services. That’s expected to change as the company prepares to re-launch kits on their upgraded platform. The advantage of performing all the work in-house is that SomaLogic collects lots of valuable big data, something that provides a foundation for their “first mover advantage” bull case.

A First-Mover Advantage

SomaLogic has built one of the largest proteomics databases worldwide because they can measure the most protein biomarkers in a sample – 7,000, or about 4.5X as many as their closest competitor. (That number jumps to 10,000 this year.) They believe their proteomics data set, and the AI algorithms used to make sense of it, give them 9X the total addressable market compared to other notable names in this space like Olink, Quanterix, and Seer.

Without doing the work in-house, SomaLogic wouldn’t have amassed the proteomics data they have today – 450,000 samples, 80% with 5,000 protein biomarkers measured, and 40% annotated with clinical data. Clients will pay to access this valuable data, and SomaLogic can simultaneously move forward with making their technology more widely available to the life sciences community. That’s what their partnership with Illumina is about.

Illumina’s stock soared today as everyone realized – yet again – that a pick-and-shovel genomics company will continue to benefit from the growth of genomics. Yesterday’s deck which triggered the action contained an interesting slide as follows:

SomaLogic’s technology will be made available on Ilumina’s platform in two years’ time, providing the lowest cost per sample, and addressing 10,000 protein targets. Maybe Illumina is hedging their bets in case that whole Grail thing falls through, or maybe it’s just another use case for next-generation sequencing that will help sell more machines. SomaLogic also talks about this strategy with the following buried in one of their recent investor presentations:

- The assay readout can be performed on alternative, less expensive arrays, or on NGS platforms (feasibility completed for both).

- Within ~24 mos. either of these could be a part of a more modular deployed assay solution, adding on-premise hardware and reagents sales to current, primarily service model.

- Either of these approaches will significantly lower assay COGS and increase margin on all products.

Sounds a whole lot like the work they’re doing with Illumina. We’ll check back in with the company in early 2023 unless something significant happens before then. In the meantime, let’s look at how valuations have been shaping up for proteomics stocks during the big tech crash of late 2021. (We’re joking of course, it’s been barely a blip so far.)

Investing in Proteomics Stocks

Proteomics is an emerging science that we want exposure to. In the absence of a clear leader emerging from the pack, we’ve put some chips on Quanterix, and consider that a placeholder which represents our capital allocated towards the proteomics theme. As growth stocks come crashing down, all proteomics stocks with revenues seem reasonably valued except for Seer.

| Company Name | Market Cap (USD millions) | Ticker | Annualized Revenues (USD millions) | Valuation Ratio |

| Seer | 1,284 | SEER | 8.6 | 149 |

| Quanterix | 1,288 | QTRX | 111 | 11.6 |

| Codexis | 1,720 | CDXS | 147 | 11.7 |

| Olink | 1,618 | OLK | 94.5 | 17 |

| SomaLogic | 1,888 | SLGC | 80 | 23.6 |

| Nautilus Biotechnology | 598 | NAUT | Nada | Nada |

| Quantum-Si | 865 | QSI | Nada | Nada |

Having a great deal of subject matter expertise in protein engineering won’t help us predict which company will eventually emerge as a leader. It doesn’t even have to be a company on the above list. The tell-tale sign of a platform that’s being adopted by the life sciences industry is one that customers are willing to pay for. That’s why we’re paying close attention to revenue growth going forward. With growth stocks undergoing a correction these days, we’re in no hurry to identify a leader in proteomics. We’ve put a reminder in the calendar for our research team to revisit this topic one year from now, or sooner if some corporate events take place.

Conclusion

About a year ago, artificial intelligence algorithms mastered the ability to fold proteins, something everyone quickly forgot about in favor of whatever political hot topic was being discussed on their preferred media echo chamber. The ability of AI to help us understand proteins has no doubt helped accelerate the field of proteomics. We’re particularly excited to see if Illumina makes something happen as we stand to benefit from that. Of course, that may cannibalize companies like Quanterix, something that will quickly become apparent in the form of declining revenues.

Sign up to our newsletter to get more of our great research delivered straight to your inbox!

Nanalyze Weekly includes useful insights written by our team of underpaid MBAs, research on new disruptive technology stocks flying under the radar, and summaries of our recent research. Always 100% free.

Thank you for the update. I remember you had looked at them last year before merger too. Somalogic has been on my watchlist for some time. It’s one of the few Spacs that has held up its price recently. On LinkedIn they have like 78 positions they’re trying to fill, so they’re quite active on the growth. Now that’s it’s back around 10 bucks I might buy slowly into a position, scaling into high single digits allocation of my Roth portfolio. And you’re right about Gillete, they suck.

You’re quite welcome. Probably the most exciting thing from where we’re sitting is the work they’re doing with Illumina. Of course, a lot can happen in two years.

Harry’s is a lot cheaper way to shave, and they don’t ignorantly presume that pissing off half their customer base by taking a political side is a smart thing to do. On the topic of shaving ads, nothing beats “Our Blades Are F***ing Great” by DollarShaveClub. Now that’s a clever shaving ad that works.

As to the valuation ratios, you used P/S ratios. Wouldn’t it be better to use EV/S since SLGC has much more cash on hand compared to OLK, and it’ll make a big difference, especially after another week’s sell off.

A number of people have raised this. We don’t use enterprise value because we want everything to be extremely simple. Going to Yahoo Finance and pulling the market cap, then one more click to get the latest quarter revenues, is far easier for retail investors who haven’t a clue what enterprise value is. Simplicity is paramount here at Nanalyze. What’s most important is to have a consistent ratio being calculated so that each investor can set their own cutoff and use it for relative comparisons. We totally hear what you’re saying but always want to adhere to the ‘ol KISS principle 🙂

Here’s a piece we did on the ratio: https://nanalyze.com/2021/06/simple-valuation-ratio-tech-stocks/

SomaLogic is down 80% since it started trading in 2021. Its 2022 revenue was $96M, net loss $109M. Current market cap: $513M, cash $540M – sa cash is larger than market cap ! ARK has a small position: $32M.

One great news: they expect to reduce cash burn by 50% by year end.

SomaLogic looks to me like a potential buy now.

Cash being larger than market cap is quite wild! Doesn’t make it a potential buy though. Our last piece said, “our conclusion is the same as we reached earlier this year – we’ll check back in early 2023 unless something significant happens before then.” Given our increased focus on “likes” and “loves,” we’ll see if this merits a follow up.