A List of 7 Proteomics Stocks For Investing in Proteins

Table of contents

Table of contents

- Seer - The Proteograph Product Suite

- Quanterix - Digital Biomarker Detection

- Codexis - Protein Engineering to Create Biocatalysts

- Olink - Protein Biomarker Discovery

- SomaLogic - The Leading Proteomics Platform?

- Nautilus Biotechnology - Sequencing the Proteome

- Quantum-Si - Digital Protein Sequencing

- To Buy or Not to Buy

- Conclusion

We recently had the chance to present our take on nanotechnology investing to The Nanotechnology Industries Association, and it wasn’t the most compelling topic, at least when it comes to the success of nanomaterials. One attendee joked that the word “nano” is Greek for “we need funding.” It’s a reflection on how nanotechnology didn’t really live up to its promises, at least how it has been traditionally defined. However, if you consider nanotechnology to include synthetic biology and gene editing, then it’s fair to say that nano is now one of the most exciting investment themes ever.

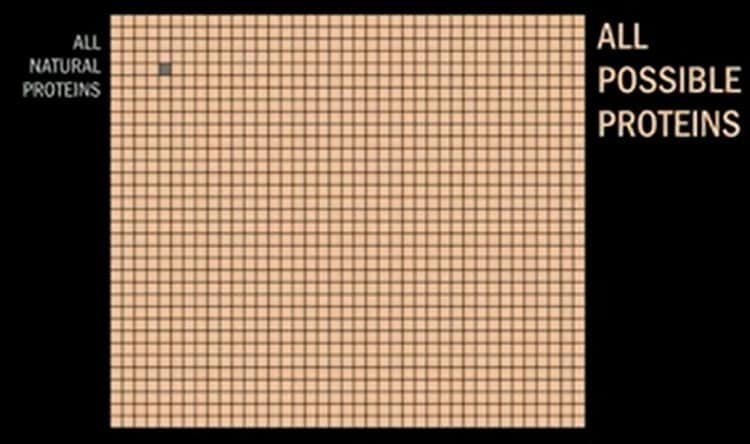

Proteins are little molecular machines that form from unique combinations of 20 different amino acids. Not only are we able to create unique proteins from what exists in nature, but we can also create proteins that don’t. On the surface, these never-before-seen molecular machines would appear no different than what Drexler proposed in his 1986 book on engines of creation. In last summer’s piece on Designing Proteins to be Molecular Machines, we found it remarkable how many different types of proteins can be created using amino acids, and how few exist in nature today.

The potential for proteins to provide transformative solutions for everything from manufacturing to healthcare is remarkable. As investors, we’re interested to know how we can get some exposure to proteins as an investment theme. So today, we’ll look at seven stocks that are a pure play on proteomics, the study of proteins.

Seer – The Proteograph Product Suite

At the top of our list is Seer – A Pure-Play Stock for Investing in Proteomics, but one without meaningful revenues yet. Their Proteograph Product Suite is an integrated solution that is comprised of consumables, an automation instrument, and software. The purpose of the platform is to analyze any one of the million or so known protein variants using custom nanoparticles that are engineered to attract proteins, and it’s being rolled out rather slowly.

- Now – An initial collaboration phase with key opinion leaders

- 2021 – Sell to select sites performing large-scale proteomics or genomics research

- Early 2022 – Broad commercial availability

We’re likely to check back when systems start selling, something that helps validate the platform’s economic viability. In the meantime, there are plenty of other proteomics platforms that are generating revenues – like Quanterix.

Quanterix – Digital Biomarker Detection

One way to find the leaders that occupy an existing domain is to look for those companies that have monetized their platforms across a broad base of customers. Then, you can see who the leaders say the competition is in order to get a full list of names. This graphic came from SomaLogic, a company we’ll talk about shortly.

It’s rather daunting to understand what Quanterix does, but one look at their revenue growth makes us want to.

ELISA technology has been the industry standard for protein detection for over 40 years. Then along came Quanterix with “the most sensitive commercially available multiplex protein detection platform” called Simoa which consists of instruments and consumables (around 30% of 2020 revenues). Healthcare researchers often want to see if proteins exist in samples by searching for “protein biomarkers.” So, two key metrics we can look at for Quanterix are “installed instruments” which show us adoption progress and “biomarkers” which shows us how many proteins they can detect with their platform.

Their verbose 53-page Q4 and Fiscal Year 2020 Earnings deck is so daunting that we’re inclined to pass on the stock simply because we don’t have enough time and resources to understand the value proposition. If we can keep things simple – it’s a company that sells instruments and consumables related to proteomics – then we might be able to see past all the noise. We’ll add this stock to our research queue and see if their SEC filings provide more clarity than their investor decks. (Read more: Quanterix Stock: A Way to Play the Proteomics Boom.)

Codexis – Protein Engineering to Create Biocatalysts

Last summer was the last time we checked in with Codexis, A Pure-Play Protein Engineering Stock, that’s a leader in the field of protein engineering to create novel biocatalysts. At that time, we expressed concerns about their revenue concentration risk – about 66% of revenues came from three customers in 2019. Their 2020 10-K shows that number has dropped to 56% in 2020, but it’s still too high for our tastes. Having more than 10% of your revenues coming from any single customer creates too much volatility, something that’s reflected in their share price over time. Revenues for 2020 stalled due to The Rona, another concern we had, though their growth appears to be resuming.

We arrive at the same conclusion we did in our last piece. As risk-averse investors, we see a few meaningful risks we’re not willing to take:

- An overreliance on large pharma companies that have all the leverage in the relationship.

- Uncertain cash flows that make for an extremely volatile share price. We like to sleep well at night.

We’re more interested in business models where hundreds of customers each contribute a small fraction of total revenues. That seems to be the modus operandi of our next company.

Olink – Protein Biomarker Discovery

Founded in 2016, Sweden’s Olink (OLK) recently began trading in the United States while raising $353 million in the process. Shares traded up nearly double the offering price of $20 per share, settling at $37 per share and giving the company a $4.4 billion market cap. Simply put, Olink offers “high-quality protein biomarker discovery based on a flexible and scalable technology platform.” These come in the form of assays, what Wikipedia describes as “qualitatively assessing or quantitatively measuring the presence, amount, or functional activity of a target entity.” You can rapidly measure up to 1,536 proteins simultaneously using a Next-Generation Sequencing (NGS) machine – up to 1.3 million protein measurements per week, per NGS instrument. So, their revenues can be broken down into two segments, Kit and Service.

- Kit revenues refer to the sale of our panels directly to customers that run the kit and analysis in their own labs.

- Service revenues refer to the sale of our panels through our fee-for-service lab, where we run the analysis on our products on behalf of our customers.

Here’s the breakdown for the last two years which is all the historical revenue information we’re given in the F-1 filing that accompanied their U.S. debut.

They’re looking to move away from the Service model and drive their “revenue and business towards a distributed kit model.” The company has around 630 customer accounts in over 40 countries including 30 of the world’s largest 40 biopharmaceutical companies by 2019 revenue. Original customer accounts obtained in 2016 have grown at an average annual growth rate of 25% now accounting for around 30% of 2020 revenues. Getting your customers to stick around and spend more is critical for sustaining revenue growth.

The CEO of Blue Prism was recently lamenting that shares of his company were undervalued in light of the coming UiPath IPO which is valued 2-5X richer. While comparative valuations usually mean little because there are so many ways to measure them, his point is valid. As long-term investors, we would much rather own assets that are valued at a discount. Given ARK Invest’s stated intention to focus on U.S. stocks, foreign stocks also provide some diversification protection from “the ARK effect.” In that context, we find Olink to be attractive as it could be flying under the radar of proteomics investors. (Read more: Olink Stock (OLK) – A Lesser Known Play on Proteomics)

Contrast that to the multiple proteomics startups that have chosen to go public using special purpose acquisition companies (SPACs).

SomaLogic – The Leading Proteomics Platform?

We recently talked about how SPACs are forming cliques – LiDAR and metal 3D printing being a few good examples. You can now add proteomics to that mix, as three companies dabbling in the same space have decided to throw the best interests of their long-term investors aside and go public via SPACs.

Founded in 1999, Denver’s own SomaLogic raised a whopping $581 million in funding from names that include Novartis, Amgen, T. Rowe Price, Quest Diagnostics, and a Chinese AI unicorn with great aspirations, iCarbonX. Around $200 million of that funding came in the form of a $202 million Series A that closed in late 2020.

SomaLogic has actual revenues – $55 million in 2020 – from more than 300 customers. Revenue history is unfortunately missing, something all too common with SPACs, however, their glossy SPAC deck does a good job of telling their story. SomaLogic claims to have the leading proteomics platform on the market with “a significant first mover advantage.” They can measure over 7,000 proteins in a single sample, far more than any other competitor.

They have loads of data that has a value of its own, and they’re not afraid to start analyzing it using machine learning. Their big data alone makes them stand out from the rest, and we can’t wait until they provide some proper regulatory filings so we can do a deep dive.

Just days ago, SomaLogic announced their intention to go public using a SPAC called CM Life Sciences II (CMIIU). Provided the deal goes through as planned, shares of SomaLogic will trade under the ticker SLGC. We’ll wait for the dust to settle following the transaction and take another look because we like what we’ve seen so far – which isn’t a whole lot because it’s a SPAC.

Nautilus Biotechnology – Sequencing the Proteome

Founded in 2016, San Francisco’s Nautilus Biotechnology has taken in over $100 million in funding with the last round – a $76 million Series B – closing about a year ago. Nautilus was co-founded by Sujal Patel, founder and CEO of Isilon Systems, a publicly traded company that sold to EMC in 2010 for $2.6 billion. When you have a track record of successfully exiting something you created for billions of dollars, investors are more likely to back your next venture.

Among Nautilus’ investor list are names like Paul Allen, Jeff Bezos, and Andreessen Horowitz. They all believe that Nautilus is targeting a valuable niche in proteomics – the ability to describe a proteome in much the same way you can now sequence an entire genome. (A proteome is “the entire complement of proteins that is or can be expressed by a cell, tissue, or organism.”) Currently, proteome analysis is time-consuming, incomplete, and expensive. Since approximately 95% of FDA-approved drug targets are proteins, this is clearly a platform with many use cases.

Nautilus has decided now is the time to go public, and they’re using a SPAC called Arya Sciences Acquisition Corp III (ARYA) to do it. Revenues will start trickling in around 2022 when $4 million is expected, and that’s when we’ll check back in to see how things are going.

Quantum-Si – Digital Protein Sequencing

Founded in 2013, New England startup Quantum-Si (QSI) has taken in around $180 million in funding. The founder, Jonathan Rothberg, is a prolific entrepreneur who founded more than ten companies including one that also went the SPAC route – Butterfly Network. The basic value proposition is that they’ve built the first semiconductor chip for single-molecule proteomics and protein sequencing. Here’s how they position their offering relative to others we’ve talked about including Nautilus which is trying to do the same thing.

Quantum-Si is starting with protein identification, quantitation & sequencing in 2021, and scaling to whole proteomes in 2022-2023. The first revenues for the company are expected to begin in 2022 with $17 million coming from an install base of 534 instruments. Over time, an increasing amount of total revenues will come from high-margin consumables, similar to what we saw with Illumina.

To Buy or Not to Buy

The big question is obvious. Which of these proteomics platforms is the best way forward for investors who want exposure to the exciting future of proteomics? Like Warren Buffet, we only want to invest in what we understand, and we understand very little of the technical details on display from most of these companies. Investor relations teams should be rewarded based on their ability to explain their value proposition simply. Asking the experts to interpret things for us is a can of worms, because then we’re relying on someone else to make our investment decisions. And we know how well that’s worked out in the past, so we’re approaching the problem like this.

Our tech investing methodology usually always avoids companies without meaningful revenues, no matter how compelling their founder’s track record might be (Quantum-Si), or how grand a master plan they have (Seer). Companies which derive revenues from a concentrated number of customers are an avoid as well (Codexis). As for the three SPACs, two are trading at premiums we don’t think you ought to be paying (SomaLogic and Quantum-Si), while you might be able to justify paying 6% more than retail investors did for Nautilus, a pre-revenue company which we’re also avoiding for that reason.

- SomaLogic – $13.45 = 34.45% premium

- Quantum-Si – $12.04 = 20.40% premium

- Nautilus Biotechnology – $10.66 = 6.6% premium

Just remember, we’re assuming that what institutional investors paid was a fair valuation, and that’s not necessarily the case. Paying the same as institutional investors should be the rule, not the exception. That said, if all three of these proteomics SPACs were trading at $10 a share, we’d consider going long SomaLogic only. They have revenues, a compelling value proposition, and an investor relations team that knows how to communicate it clearly.

That leaves us with two stocks – Quanterix and Olink – both of which we don’t know enough about to invest in. While Quanterix may provide sufficiently clear information in their SEC filings, Olink may have an information disadvantage given it’s a foreign stock. At any rate, we’ve added both these companies to our long list of stocks that need further research.

If you’re an institutional investor whose mandate is to invest in proteomics, you’re set. Just buy roughly equal amounts of all seven stocks in this article. For retail investors, you may want to stick with companies that have revenues today. We’ll revisit these names next year when all are expected to see some form of revenues. By then, the landscape may also have changed due to mergers and acquisitions as the space sees some consolidation.

Lastly, this is not a comprehensive list of all available proteomics stocks. It’s an attempt at identifying the leaders. If you think we missed your publicly traded sacred cow, drop us a note in the comments section and we’ll chastise the over-worked author for missing it.

Conclusion

We’re not eager to dive into another “emerging” investment thesis that’s early days. Just look at how long gene editing has been puttering about. There’s a lot of speculation about who will become “the Illumina of proteomics,” and there’s plenty of room for multiple leaders to emerge.

Some of these proteomics firms should look at how Illumina or SomaLogic present their value propositions – simply, so that anyone can understand them. Whenever a leader emerges, that’s what we expect to see. They’ll portray their value proposition in a way that’s easy for people to understand, which will attract more investors, which will result in more growth, which will attract more investors – the old flywheel effect.

Sign up to our newsletter to get more of our great research delivered straight to your inbox!

Nanalyze Weekly includes useful insights written by our team of underpaid MBAs, research on new disruptive technology stocks flying under the radar, and summaries of our recent research. Always 100% free.

I like Quantum-Si. What they propose makes a lot of sense. I like the fact:

1. The solution is based on a chip

2. The man behind it is Jonathan Rothberg.

I already have a small position.

On the other hand I was very disappointed when I looked at Nautilus Biotechnology web site. There is nothing there: no presentation, no product description. It is a joke: how they want to attract investors if they reveal nothing ..

https://www.nautilus.bio

So my analysis concludes as: Yes to Quantum-Si and No to Nautilus Biotechnology ..

Nautilus has a deck. It’s one of the many inputs we used to produce this article. As you know, we’re not keen on pre-revenue companies. We’re happy to wait until Quantum-Si starts selling some of those chips before we consider going long their stock.

The basic expectation of a good entry point would be the price institutional investors paid which is roughly $10 per share for whatever they received in exchange.

How much do you feel CM Life sciences shares will be diluted when they merge with Soma Logic

SPACs make these things quite convoluted. The glossy investor deck contains details around that – after the deal, SPAC public investors will own 14% of the company and – incredibly enough – the SPAC sponsor will own 4% which seems like quite the windfall. We’re definitely in the wrong line of work.

I think you meant UIPath not Upwork 🙂 Great stuff Nanalyze. This industry is so early, but there seems to be a lot of hype around proteomics from the ARK analysts and other bio experts. That this is worth watching closely. The next 5-10xer in bio might be from here. Have you seen Simon Barnett’s article on proteomics? I’m not from a bio background, this is kind of really hard to understand this space. It’s all about proteins I know, but trying to estimate it’s future potential is so difficult. Not as easy as electric cars, which I wish I’d have bet on 🙂

Cheers for that typo catch Deepak! Fixed.

Will take a look at what Simon Barnett has written. We read all the stuff coming out of ARK. The problem is – as you pointed out – the space is very hard to understand. That’s why we look to others for help and like to focus on something everyone understands – revenue growth.

Not only is it tough to discern tech themes that will take off, you then need to figure out when they will take off and which bets to make. Sometimes, you’ll lose a lot of money being early (synbio or solar are two good examples).

Proteome Sciences (PRM.L): ratio: market cap / revenue = 3.3 – very low ratio ..

It looks to me like a good value stock and profitable (P/E=50)

Also last month news:

Proteome Sciences stated that it now expects to report after-tax profits “materially higher” than announced at the time of its last update on 25 January, primarily due to higher than expected royalty receipts from Thermo Scientific for the final quarter of 2020.

Thank you for the heads up on PRM.L

Very, very small company with market cap under 50 million won’t be on our radar. They’ll need to start showing some serious growth before they merit a look.

Really fabulous analysis- ty! I started buying SEER a couple months ago and feel a bit burned. listened to their cll this evening, and like the management team, and strategy. It was great to read your report to better understand the space. A Stephen McBride report is referenced in the Yahoo Finance ‘conversation’ section on Quanterix. Is this report one in the same? ty again

Thank you for the feedback David. It’s positive responses like this that keep our team of overworked and underpaid MBAs motivated.

We’re not familiar with Stephen McBride. Like many, we’re keen on the proteomics value proposition, but unsure where to place our bets. Our research team has Quanterix and Olink in their queue, so hoping to see those articles out in the next month or so. We’re really apprehensive about taking on any new positions right now so we’ll need to have some real conviction before making a move. Thank you again for the encouraging feedback.

Quantum-Si now trading under ticker QSI (was CAPA earlier).

Thank you for that update Stan! Ticker has been updated in article.

ARK started buying Quantum-Si (QSI). So that is very likely to drive Quantum-Si price up in the near future.

This sort of short-term speculation should never come into play when you’re deciding whether or not to invest in a company for the long term.

FROM RISK HEDGE:

Chief Analyst Stephen McBride and I recently uncovered one such proteomics stock. It’s a BUY right now.

This company is a pioneer in the proteomics industry.

It’s spent the last seven years and close to $200 million developing its “proteomics on a chip” devices, which will allow scientists to sequence proteins faster and cheaper than ever before.

This stock is displaying major strength. We’re seeing relentless buying, likely from institutions and hedge funds. When these big-money movers zero in on a small stock like this one, it can propel the price higher for years.

I wonder which stock ? Anyone know ?

Sounds a bit like some promotion.

Stock Gumshoe covered that and it’s probably Nautilus. Since it’s a SPAC, we’d avoid, not to mention they’re not expecting revenues until next year to the tune of $4 million.

Sept. 01, 2021 SomaLogic, Inc., a leader in AI-data driven proteomics technology, today announced that it has completed its business combination with CM Life Sciences II, Inc. (CMII), a special purpose acquisition company sponsored by affiliates of leading healthcare and life sciences fund advisors Casdin Capital and Corvex Management. Following the transaction, the combined company was renamed SomaLogic, Inc., and its Class A common stock and warrants will begin trading on the Nasdaq Global Market (“Nasdaq”) on September 2, 2021 under the symbols “SLGC” and “SLGCW,” respectively.

I’ve placed my chips on Somalogic. They successfully closed the merger since this article and are only at a 2B market cap. They reported first half earnings of 38mm and raised 2021 revenue guidance to 100mm in revenue. Using your formula, 2B/.1 = 20. It might be the time to take a deep dive. In my opinion they’ll be the 500lb gorilla in the proteomics space.

You’re right, it’s time for an update on Somalogic. A cursory look shows they filed documents with the SEC for the first six months of 2021. There’s enough meat in there to do a piece on.

Also, we always annualize the last quarter of revenues when calculating our simple valuation ratio. For Somalogic, we have the first half of 2021 – $38.64 million – so we double that number to annualize it.

1,930 / 77.28 = 25

Still, it wouldn’t be considered overvalued based on our metric. We can also compare that number to Quanterix: 1,742 / 101.48 = 17

Quanterix quarterly revenue growth appears to have stalled so a lower valuation makes sense in that respect.

We added Somalogic to our editorial queue.

2.5 years later let’s check how these stocks performed. They are all in the red.

Best performers: OLK: -31%, QTRX: -52%.

Worst performers: SEER: -97%, CDXS: -90%, QSI: -85%, SLGC: -80%, NAUT: -78%.