Li-Cycle Stock: A Risky Play on Lithium Battery Recycling

Table of contents

Scarcity is the name of the latest game toying with the global economy. It’s why people are sawing off catalytic converters from the underbelly of vehicles and why Britons are stuck in long lines waiting to fill up their cars with petrol (as they say in merry old England). But the biggest headline in the automotive industry this year has been the scarcity of semiconductor chips, which is why one of our MBAs still drives a car with a tape deck. The shortage is expected to cost the industry north of $200 billion in lost revenue. But, of course, an even bigger crisis looms: More than 18 million electric vehicles will never be built between 2022 and 2029 because of an impending shortage of battery cells.

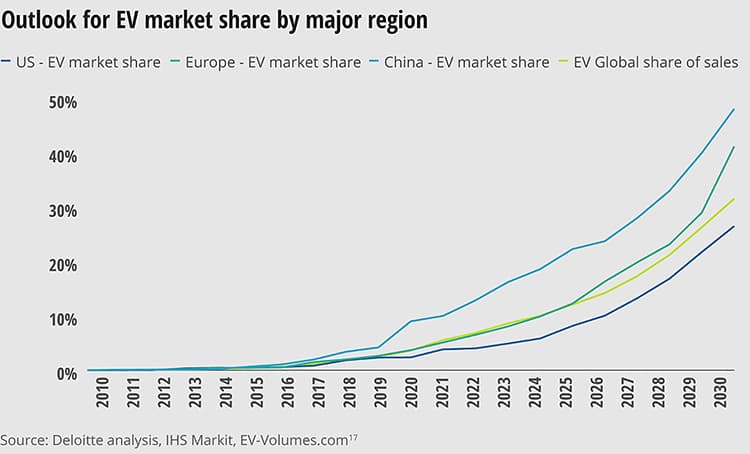

The dominant battery today is lithium ion, but the metals, minerals, and other materials that go into their manufacture are generally not easy or cheap to source, process, or manufacture. That’s why we’ve largely avoided the whole theme of investing in lithium, a volatile and dirty commodity filled with far too much risk. On the other hand, pretty much every market report being cranked out in sweatshops around the world projects electric vehicle sales will accelerate significantly over the next decade. From one of the more reliable sources (Deloitte), EVs will account for 32% of all new car sales by 2030. That means the demand for lithium and the other materials necessary to produce lithium-ion batteries will also increase, even as the battery technology becomes more efficient.

Until we start mining asteroids for precious metals, we’ll need to figure out a way to stretch out our Earth-bound supply. One way is to recycle lithium-ion batteries and extract valuable materials like lithium, nickel, and cobalt for reuse in new batteries. That’s the business model of a pure-play lithium-ion battery recycling startup that just went public through a now completed merger with a special purpose acquisition company (SPAC) called Peridot Acquisition Corp.

About Li-Cycle Stock

Founded in 2016, Li-Cycle is a Canadian company that debuted on the New York Stock Exchange in August, with the somewhat unfortunate ticker name of LICY. Li-Cycle has started its new life as a publicly-traded company with a substantial war chest of $580 million, which included $315 million in additional private funding from the likes of Franklin Templeton (BEN) and Carnelian Energy Capital, the energy sector investment firm that backed the SPAC. And, just last month, a subsidiary of Koch Investments Group (one of many Koch Industries companies) made a $100 million investment in Li-Cycle through purchase of a convertible note.

Li-Cycle currently has a market cap of around $1.8 billion with shares currently trading at $11.18, an +11.18% premium over what the SPAC priced at. But it’s early, early days. Before we dive into the financials and market potential and pitfalls, let’s learn a bit more about recycling lithium-ion batteries and what allegedly makes Li-Cycle’s process better than the rest.

Recycling Lithium-ion Batteries

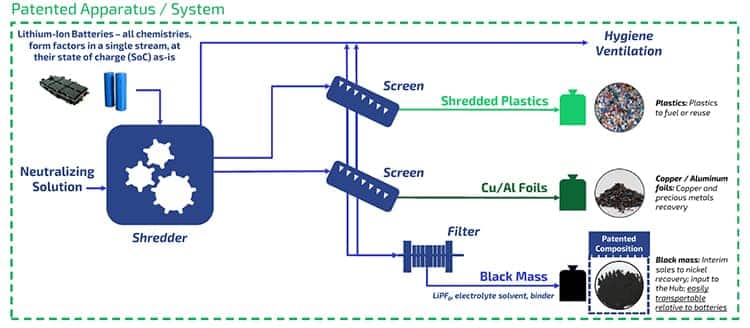

There are basically two ways to recycle lithium batteries today. The most common, because it’s cheaper and simpler, is known as pyrometallurgy. This process applies heat to extract the precious metals. But it’s also more energy-intensive (not to mention combustible) and less efficient, with a reported recovery rate of about 50%. Li-Cycle uses a method based on hydrometallurgy, which first involves shredding the batteries before extracting end products such as lithium, nickel, and cobalt from a water-based solution.

The company divides the process into two separate facilities in what’s called a spoke and hub model. Dead batteries and battery-related waste are first shipped to spoke locations where the material is shredded, screened, and filtered. It recovers plastics, copper, and aluminum that can be recycled into other products. But the real gold here is black – cathode and anode material that is known as “black mass” (not to be confused with the Satanic ritual of the same name).

Black mass is powder that contains lithium, cobalt, nickel, and other valuable materials. Black mass is shipped from spokes to central hubs where the hydrometallurgical hocus pocus takes place, transforming it back into battery-grade materials. Li-Cycle claims its proprietary process recovers up to 95% of the valuable material.

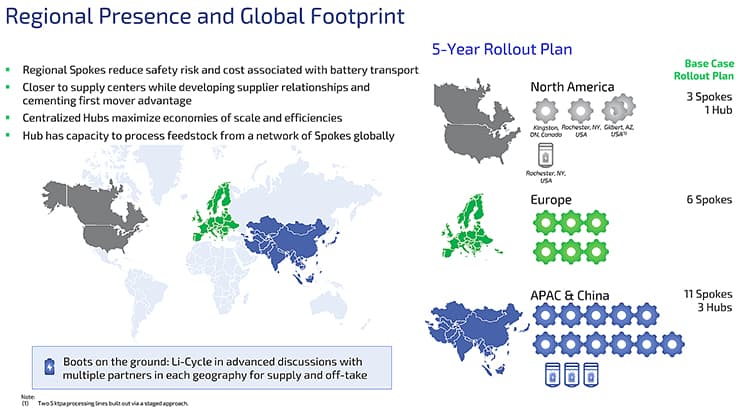

Spoke and Hub Facilities

The basic concept behind the spoke and hub model, as the name implies, is that you operate multiple spokes for each hub. The idea is to locate the former in places close to where batteries are going to end up, which cuts down on costs around collection and transportation. Li-Cycle currently has two operational spokes in Kingston, Ontario and Rochester, New York. A third is under construction in Gilbert, Arizona, while the company announced just last month plans for a fourth battery recycling facility in Tuscaloosa, Alabama. Total capacity of the four locations is estimated at 25,000 tons per year, which Li-Cycle claims would make it the leading lithium battery recycler in North America based on tonnage.

The company’s first revenue-generating hub will also be located in Rochester, with the capacity to process 25,000 tons of black mass annually, which is equivalent to about 60,000 tons of lithium-ion battery feed. Construction of the $175 million facility (plus or minus 30%) is expected to begin before the end of the year and be operational in 2023.

Li-Cycle Revenues and Customers

Let’s briefly talk about the company’s revenues, which should be easy because it’s a pretty brief history.

- 2019: $48,000

- 2020: $792,000

- First three quarters of 2021: $2,984,000

The company expects about $12 million in revenue this year, which means the fourth quarter numbers must be a doozy. Following the massive fourth quarter the company expects to finish out 2021 with, they’re making some pretty optimistic projections for the next several years, especially after its Rochester hub becomes operational.

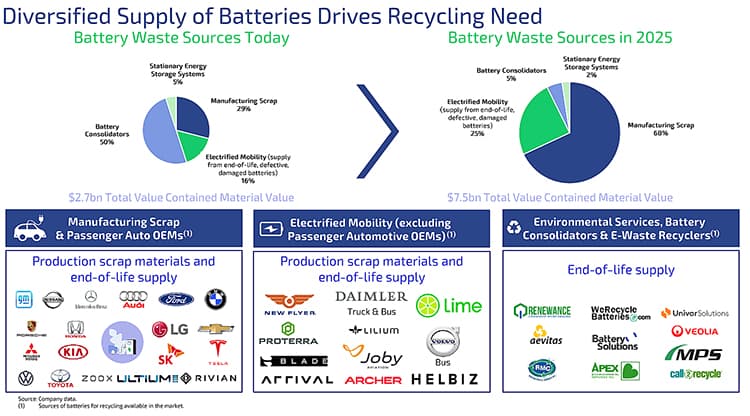

Li-Cycle currently claims to have 70 customers, but just one accounts for 70% of its current product revenues. Glencore is a multinational commodity trading and mining company that buys black mass at a discount because it must further process the material to extract the cobalt and nickel metals – a big reason why Li-Cycle is eager to get its hub facility up and running so that it can command premium prices for battery-grade products. The company expects to lean on Glencore for a significant portion of its revenues this year as well.

Beyond selling scrap metal to Glencore, Li-Cycle’s midterm future rests with Traxys, a company that provides financial and logistics solutions to the metals, mining, and energy industries. Traxys has agreed to buy 100% of Li-Cycle’s production of black mass until the intermediate material is integrated into the hub supply chain. Traxys has also signed a deal that will give it 100% of end products from Li-Cycle’s hubs, consisting of not just lithium, nickel, and cobalt, but also manganese carbonate and graphite concentrate. The seven-year agreement is expected to generate $300 million annually. Again, the Rochester hub needs to get online sooner than later. No pressure, guys.

Li-Cycle’s other big deal is with Ultium Cells, a joint venture between General Motors (GM) and LG Energy Solution, which consists of the battery business of LG Chem (051910.KS) and one of the world’s biggest lithium battery manufacturers. Li-Cycle will purchase and recycle up to 100% of the scrap generated by battery cell manufacturing at Ultium’s Lordstown, Ohio site. Maybe GM and LG will kick in all of the EV batteries from a massive recall earlier this year.

Should You Buy Li-Cycle Stock?

There seems to be some real long-term potential in lithium battery recycling, and considering that less than 5% of lithium batteries are recycled, according to enviro rag Grist, there’s plenty of market share to grab. However, the emphasis here is on the long-term, and by all accounts, we’re not going to see real traction until closer to 2030 than 2020. According to Li-Cycle’s own total addressable market (TAM) forecast, “based on a range of inputs from independent sources such as Benchmark Mineral Intelligence,” the lithium-ion battery recycling market in North America is expected to grow from $257 million in 2020 to $1.8 billion by 2025. That’s a pretty miniscule TAM, especially with hundreds of millions of dollars in capital expenditures planned during that time period, of which Li-Cycle claims to have captured 30% of:

We believe that Li-Cycle has approximately 30% of the North American market share, based on our internal estimates—comprising of lithium-ion batteries and lithium-ion battery materials that derive 18% from consumer electronics, 49% from manufacturing scrap, 28% from auto OEMs/transportation, and 5% from energy storage systems.

Credit: Li-Cycle F-1 Document

One company that may have also captured a large chunk of that TAM is Redwood Matrials.

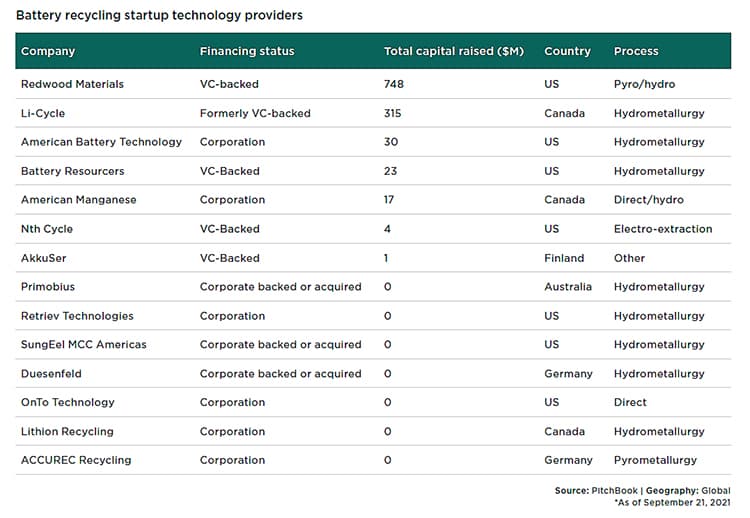

We like to bet on the biggest and baddest leader in a market category. Is Li-Cycle the clear champion? A pretty decent PitchBook analysis on the emerging electric vehicle battery recycling market came up with more than a dozen competitors, including a company called Redwood Materials out of Carson City, Nevada, that was founded in 2017 by J.B. Straubel, a former Tesla co-founder. Valued at $3 billion, the company has raised at least $792 million, including a massive $700 million Series C in July that happened to also include Franklin Templeton, along with T. Rowe Price, Goldman Sachs, and Breakthrough Ventures. Amazon is also an investor, while Ford (F) just kicked in $50 million last month and will partner with Redwood on recycling the automaker’s lithium battery packs. The company uses a combination of pyrometallurgy and hydrometallurgy that it claims recovers up to 98% of critical materials from lithium-ion batteries.

We don’t have much interest in the lithium battery recycling theme because the opportunity is just too small (the near-term North America TAM is also anemic at $1.8 billion), and we’re certainly not going to invest in a company with a revenue stream largely reliant on just a few customers. And by stream we mean trickle. Based on our simple valuation ratio, Li-Cycle stock is richly valued at 150 ($1.8 billion market cap divided by $12 million in annual revenues expected for 2021). We don’t invest in any company with a simple valuation ratio of more than 40.

Conclusion

ESG types will certainly be tempted to invest in Li-Cycle or the battery recycling theme, as one financially intangible upside is that less toxic stuff goes into landfills. Also, it’s worth keeping in mind that while we focused on EV lithium batteries, this technology applies to every type of lithium battery cell, from consumer electronics like smartphones to the renewable energy grid.

One thing we don’t have clarity on is the economic viability of lithium battery recycling, aside from the obvious upfront capital costs. PitchBook estimates, based on a UK feasibility study, that the value of recycled material obtained from battery cells “varies by chemistry but tends to range between around $4.50/kg to $11.00/kg. Meanwhile, the cost of recycling can range from $4.10 to $10.90 based on battery chemistry and health – with transportation comprising up to 75% of the cost of batteries with damage or unknown health status.” Similar to carbon capture, governments will probably need to step up if lithium battery recycling technology is to mature more rapidly. This is probably one of those green technologies worth revisiting in about three to five years. Until then, we’ll be sitting on the sidelines.

Sign up to our newsletter to get more of our great research delivered straight to your inbox!

Nanalyze Weekly includes useful insights written by our team of underpaid MBAs, research on new disruptive technology stocks flying under the radar, and summaries of our recent research. Always 100% free.

I just had a close look at that company.

March 26th 2022 – Blue Orca shorter report.

The stock fell 9% on the day of the report, but I don’t see a significant damage to share price from that report.

—-

On the positive side: May 5th 2022: Glencore makes $200M investment in battery recycler Li-Cycle.

—

Current share price: $7.48. Market cap: $1.3B.

Revenues are also seeing growth, but the small TAM is a concern. Would also like to see how gross margins look at scale.

We also need to be aware former Tesla co-founder JB Straubel has a battery rececling company called Redwood Materials.

JB Straubel has told a US Senate hearing that his company already receives approximately 6GWh of end-of-life lithium-ion batteries for recycling annually.

Investors in Redwood Materials’ $775M Series C include T. Rowe Price, Goldman Sachs, Baillie Gifford, Fidelity, Ford Motor Company and Amazon’s Climate Pledge Fund.

Redwood Materials had a valuation of $3.8 billion in September 2021, so a few times more than Li-Cycle.

Good point on a private competitor that needs to be considered when evaluating the Li-Cycle bull thesis.