Is IBM Ready to Dominate Radiology With AI?

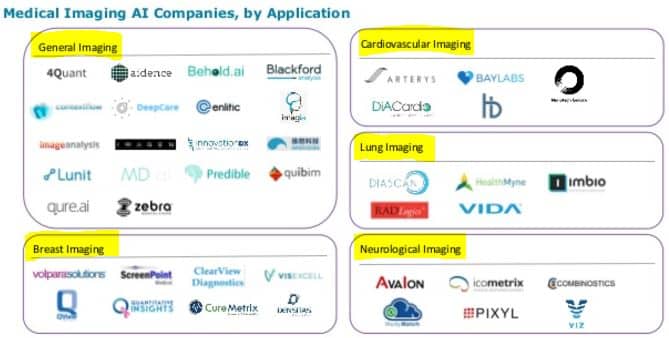

Advances in artificial intelligence (AI) are moving so fast that our team of MBAs can barely keep up. Everywhere you turn, startups are burning through venture capital funds in a mad rush to land grab as much “big data” as possible which will be used to produce the best artificial intelligence algorithms possible. Back in February of this year, we were all proud of ourselves for putting together what we thought at the time was a comprehensive list of “9 Artificial Intelligence Startups in Medical Imaging“. Just 7 months later, we see that there are now more than 40 medical imaging startups developing AI algorithms for use in radiology:

That slide from Signify Research shows how we are already seeing the AI algorithms beginning to specialize in particular areas. We’ve written before about some of the more well funded companies in the list, and now we want to start looking at the rest of them. Before doing that though, we wanted to think about what a winning company in the AI medical imaging space might look like. One thing we know for sure is that the best AI algorithms will be the ones with the best data. This means that each of these startups should have exclusive access to certain “big data” that will distinguish them from their 39 other competitors. The best startups will be spending money to secure access to data, and one good example of that comes not from a startup, but from a beaten-down value stock that pays a nice +4.29% yield.

“You’ll never get fired for buying IBM” as the old saying goes, except over time IBM (NYSE:IBM) has lost their mojo. In an attempt to reinvent themselves, they came up with some “strategic imperatives” which include things like cloud computing and cognitive computing in the form of IBM Watson. While best known for playing Jeopardy, Watson has applications across many industries including healthcare. “Watson Health Imaging” is a key part of Watson Health, and something which has been built over the years with some very strategic acquisitions of medical data. In fact, more than $4 billion was spent on acquiring health-related technology and data providers in just a year’s time.

The biggest of these was the acquisition of Merge for $1 billion in October of 2015, a company that had over 30 billion medical images at the time which came from 7,500 medical institutions (distribution channels) in the U.S. that they’ve had been working with over the past 25 years (relationships in place). Those 7,500 channels can now be used to offer “IBM Watson Imaging Clinical Review” which is IBM’s AI-powered radiology tool that just became available 4 months ago for the very first time. When Merge was acquired, the Watson Health Cloud had 315 billion data points including lab results, electronic health records, genomic tests, clinical studies and other health-related data sources that are now being used to help improve their AI medical imaging algorithms over time.

Just prior to that, IBM picked up two startups called Phytel and Explorys which gave them at least 50 million “live” patients which represent the medical data records for that many unique humans. Then, in February of last year, IBM acquired a company called Truven Health which gave them more than 4X that number of data records at 200 million live records. If we assume that there was minimal overlap, then that means IBM has 77% of the U.S. population covered (excluding those poor souls who died since then). All that data combined has been used to train some mean AI medical imaging algorithms which have been recently made available for commercial use. IBM also decided to form a collective which shares images known as the “Watson Health medical imaging collaborative” which is described by IBM as follows:

In 2016, IBM created the Watson Health medical imaging collaborative, a global initiative comprised of more than fifteen leading health systems, academic medical centers, ambulatory radiology providers and imaging technology companies. The collaborative aims to bring cognitive imaging into daily practice to help doctors address breast, lung, and other cancers; diabetes; eye health; brain disease; and heart disease and related conditions, such as stroke.

The collaboration has gotten much bigger since then, and the reason that’s important is because of the vast number of medical images being produced every year. You can’t just buy 30 billion images and be done with it, you then need a source of steady image flow. This collaboration should solve that. The below chart from IBM shows how medical imaging is growing by over 60 billion images a year:

IBM researchers are estimating that medical images make up more than 90% of all existing medical data available today, a number that is likely to grow based on the above estimates.

With IBM pushing their cognitive radiology assistant out into the healthcare industry, we wanted to get an idea of what roles might be impacted. In other words, where can we start to reduce headcount to save money that will be spent instead on IBM’s run rate which helps pay our quarterly dividends. The U.S. Bureau of Labor and Statistics contains some great info on two roles relating to medical imaging; “radiologic technologists” who help produce the images to a certain specification and “MRI technologists” who operate the scanners like the lovely young lady seen below:

If we assume the above growth rates hold true and then multiply that end number by a salary of $59,000 a year, we get a yearly run rate of $17.6 billion. However, when you read the job description for these two roles you realize that they will be minimally affected since they are required to operate the imaging equipment. While these types of jobs could eventually be replaced by humanoid robots, that’s not going to happen for a while. We want to look at who is actually interpreting these images because that’s where AI is going to dominate.

Since we know that the “technologists” won’t be replaced for a while, the role we want to look at is that of a radiologist, which CNN Money has listed as the 45th best job to have in America with just a tiny bit of stress:

Let’s now turn to the “Journal of the American College of Radiology” which performed a workplace survey in 2016 which found that there were 32,523 practicing radiologists with an estimate of between 1,713 and 2,223 new jobs in 2016 (a 16.2% increase from hiring in 2015). Using the low end of that estimate, we can calculate that the run rate for radiologists in America right now is $10.8 billion. When securing just 10% of that market would result in yearly revenues of $1 billion, it’s not hard to see why everyone’s throwing their hat into the ring.

It’s not just that AI can provide a substitute for a radiologist, it’s that AI can do things that a radiologist can’t even come close to doing. Sometimes trauma patients will require expensive “full body scans” in order to identify internal injuries and these types of scans can result in 1000s of images. This means that some days a radiologist may look at somewhere around 100,000 medical images. No human could ever be expected to process that many images without getting mentally exhausted over time. AI can do this 24 hours a day and it will only get better the longer it works. Plus, it’s not just the image that AI can evaluate in isolation, but rather AI algorithms can take into account a patient’s entire electronic health record. Your prior medical history can provide a wealth of information that the algorithm could begin to make associations with over time. Imagine a radiologist trying to digest all that data before sitting down to look at 100,000 images.

The real reason that radiologists need to be concerned here is that IBM isn’t trying to go after a business that brings in a $1 billion a year run rate. Watson is a strategic imperative which means they believe that it will meaningfully impact their present-day business that brings in nearly $80 billion in revenues a year. In order for their “cognitive radiology assistant” to move the needle, it needs to start seriously displacing the number of clinical radiologists that work in the 7,500 institutions that Merge operates in – or as IBM puts it, “empowering heroes”, heroes that will no doubt be “moving on to more value added activities” soon. While IBM begins pushing out their medical imaging solution, you can bet that the $11.6 billion in cash they have laying around could very easily be deployed to acquire any of those 40 imaging startups that are all trying to get a piece of the medical imaging pie.

If you want to help “empower some heroes”, then open up a brokerage account and pick up some shares of IBM which are right at a 52-week low. Who cares about Warren Buffet dumping his IBM shares not too long ago because Ginni Rometty is doing such a mediocre job. You’re a confident contrarian that knows a buying opportunity when you see one. You’re happy to get paid a +4.29% yield while you wait for IBM’s cognitive radiology tool to inevitably start impacting their bottom line. For all you millennials out there who can’t understand how interest rates work, this means you will get a monthly payment of $3.57 for every $1,000 you invest in IBM, generally speaking. It’s not much, but Rome wasn’t built in a day.

Sign up to our newsletter to get more of our great research delivered straight to your inbox!

Nanalyze Weekly includes useful insights written by our team of underpaid MBAs, research on new disruptive technology stocks flying under the radar, and summaries of our recent research. Always 100% free.