Symbotic Stock: A Pure Play on Warehouse Automation

Table of contents

Billionaires have big dreams and even bigger egos. Elon Musk and Jeff Bezos want to go to outer space. Bill Gates either wants to vaccinate the world or enslave humanity to the lizard people. Mark Zuckerberg wants to build the metaverse and enslave humanity. And then there’s Richard Cohen who … oh, never heard of the guy? He happens to be the sole owner of C&S Wholesale Grocers, the largest wholesale grocery distributor in the United States, based on revenue of $25 billion in 2021. That’s good enough to earn the No. 8 spot on Forbes’ list of most valuable private companies in the country.

A few years ago, Mr. Cohen “retired” as CEO of the family-owned, third-generation business to focus on his more down-to-Earth version of the billionaire dream – a little warehouse automation startup called Symbotic. We never heard of the company, despite all the articles we’ve written about warehouse robotics over the years, until last month when Symbotic announced it would go public by merging with SVF Investment Corp. 3 (SVFC), a special purpose acquisition company (SPAC) affiliated with SoftBank.

Regular readers know that we’ve been keen to invest in a warehouse robotics solution, because we think it’s a viable technology with a total addressable market (TAM) estimated to be in the $250 billion neighborhood. The recent labor shortages, supply chain problems, and lack of allowable pee breaks only underscore the fact that warehouse automation is long overdue. Ocado Group (OCDO.L), was looking to be an emerging technology stock on the warehouse robotics theme, but at the end of the day, it’s just a piece of the UK grocery business. Then there’s AutoStore (AUTO.OL), a pure-play warehouse automation company out of Norway. But a legal spat between Ocado and AutoStore raised some red flags, so we’ve put AutoStore on ice.

Could Symbotic Inc be the answer?

About Symbotic Stock

Founded about 15 years ago as CasePick Systems by a guy named John Lert (who went on to found a startup called Alert Innovation for retail automation), Symbotic has mostly been a stealth project for C&S to develop its own in-house warehouse automation system. Cohen has reportedly sunk “hundreds of millions” of dollars into the company in his life’s quest to create the world’s most efficient warehouse. It’s not like going to Mars, but probably a lot more useful and profitable.

Apparently, some other deep-pocketed people feel the same way. The deal with SVFC could net Symbotic as much as $725 million with a valuation of about $5.5 billion. That includes $320 million of cash in trust from SVFC, $205 million in additional private equity ($150 million of which is coming from Walmart Inc), and what’s being called a “$200 million forward purchase of common equity at $10.00 per share by an affiliate of SoftBank Vision Fund 2.” And outside of all that, Symbotic expects to receive an additional $174 million in cash from Walmart.

The world’s biggest brick-and-mortar retailer has been pushing hard into AI and robotics in recent years, even working with Alert Innovation on a pilot warehouse automation project, as well as testing out various autonomous delivery services. At some point, Walmart was (is?) also working with Berkshire Grey (BGRY), another pure play on warehouse robotics that went public this year through a SPAC. Symbotic and Walmart have worked together since 2017 to implement an AI-powered robotics system at a distribution center in Florida. Earlier this year, the two companies announced the high-tech system would be installed in 25 of the company’s 42 regional distribution centers.

Of course, Walmart will be much more than a customer if the SPAC deal goes through, owning 9% of Symbotic. Mr. Cohen, who is subject to a one-year lock-up period post-closing (meaning he can’t sell any stock for the first 12 months and run away to the Cayman Islands), will retain 76% ownership, with the 15% in scraps going to other institutional and retail investors.

AI Warehouse Automation Platform

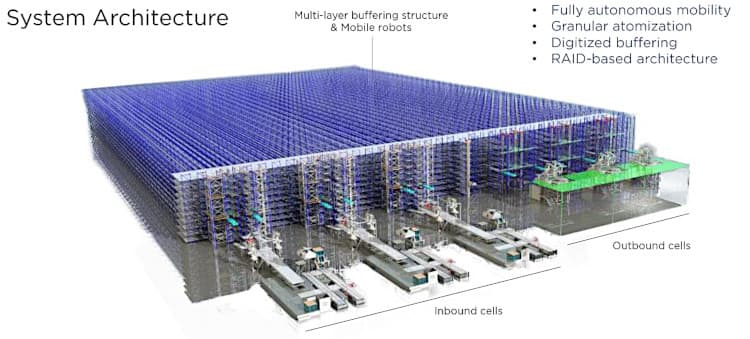

The system from Symbiotic relies on a hive-mind of intelligent, mobile robots that receive, store and retrieve a virtually unlimited number of products. These fully autonomous fleets of Symbots move products at speeds up to 25 mph with 99.99% accuracy to and from random access storage structures. As products first enter and then exit the system, robotic arms use computer vision to sort and manage cases, totes, and packages. The actual warehousing system uses a horizontal architecture that allows the Symbots to move in three dimensions, and it can be retrofitted to virtually any existing distribution center to increase warehouse capacity by several orders of magnitude. For example, a traditional warehouse with 10,000 individual items could theoretically pack up to 300,000 products in less space.

In effect, the warehouse is turned into a digital twin, where each individual case is digitized, and the system knows its size and handling attributes. That means the operation doesn’t need labels or trays, which gives it an advantage in terms of density, speed, and the number of different SKUs it can handle. Nor does it really need humans: Once a pallet of merchandise is inducted into the system’s inbound cells, as illustrated above, no one touches a case on that pallet until it is ready for delivery to a store.

A typical warehouse automation platform features a fleet of 400 autonomous Symbots, shipping one million cases per week with less than one error per million. Of course, the whole thing is modular and scalable for operations that are a third the size or three times as big. The system is also industry agnostic, meaning it can be deployed in various markets, from retail to food – and Symbotic is even developing an arctic version that can work in freezers.

Should You Buy Symbotic Stock?

We never tell you where to invest your money, but we do try to give you some of the pertinent facts and things to consider to make your own decisions. As with all SPACs, the picture with Symbotic is incomplete, but let’s see what we can piece together.

The company claims that an average system, with 400 bots zooming around a warehouse, costs about $50 million for the initial installation. That’s quite a wad of cash, but Symbotic argues that the return on investment (ROI) can be recovered in as little as a year. Some of its customers, for instance, “plan to save up-front capital costs by reducing their inventory in their supply chain, allowing the system to pay for itself in the first year.” Other ROI includes “improved labor efficiency” (ie, fewer workers needing pee breaks), less real estate needs, and better inventory management. The company also claims an average system typically reduces operating expenses by more than $10 million per year. Presumably, these aren’t just theoretical numbers: Symbotic already operates systems that service more than 1,400 stores in 16 states and eight Canadian provinces, with plans to expand eventually in Europe and Asia.

Symbotic makes money in three ways. First, there’s the up-front sale of the physical system, which the customer owns. Second, there’s recurring revenue through a software and support package, which enjoys much higher gross margins than the hardware: The company expects the lifetime gross margin of an install to expand by more than 60% relative to the first year. Finally, and the smallest piece, customers pay for system operation services and maintenance parts.

In 2021, the company projected revenues of $211 million, though the final number is likely to come in between $240 million and $250 million. Next year, the forecast is to essentially double revenue. Of course, that all sounds great, but we’d like to know more about the recurring revenue piece. More detail about the customer portfolio would also be helpful. In other words, how well diversified is Symbotic? If Walmart pulled out tomorrow, would the company collapse? How much of the business is reliant on C&S Wholesale itself as a customer? We won’t get any of these answers until the deal closes sometime later this year when it may be worthwhile to revisit Symbotic stock.

Conclusion

While we haven’t found the right company yet, we’re pretty convinced that warehouse automation is a good investment thesis. The jury is still out on AutoStore, which is projecting revenue for 2021 and 2022 that is just slightly higher than Symbotic. Berkshire Grey remains a smaller player, with annualized revenues of about $75 million from six customers according to the most recent third-quarter results. Like many SPACs, Berkshire hasn’t been kind to early adopters of the stock, dropping nearly half its value in about six months – another reason to sit tight and wait for the dust to settle with Symbotic.

If the deal does go through as planned, Symbotic will trade on the Nasdaq under the ticker symbol SYM by sometime in the first half of this year.

Sign up to our newsletter to get more of our great research delivered straight to your inbox!

Nanalyze Weekly includes useful insights written by our team of underpaid MBAs, research on new disruptive technology stocks flying under the radar, and summaries of our recent research. Always 100% free.

Probably some robot manufacturers that could also design warehouses to best use their products without going through these middlemen.

Thanks for commenting. That is certainly applicable for new builds, but for 85% of existing warehouses with zero automation, then this sort of retrofit probably makes a lot of sense, especially if the ROI is close to what Symbotic claims.