5 Pure-Play Stocks for the B2B Payments Thesis

Table of contents

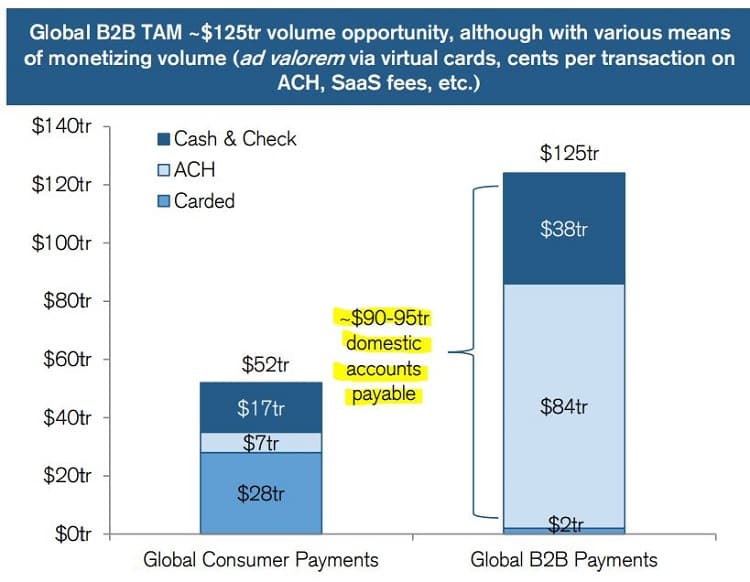

Our recent piece on AvidXchange talks about how small to mid-sized businesses (SMBs) in the United States represent a $20 billion opportunity for B2B payments automation. Alongside that opportunity is an additional $20 billion from offering supply chain financing products. A $40 billion total addressable market (TAM) is sizable, but pales in comparison to the global “domestic accounts payable” opportunity which is somewhere in the range of $90 trillion.

Many throw around the number “one trillion,” but few comprehend just how enormous it actually is. If one million seconds is about 11.5 days, then one billion seconds is about 32 years. One trillion seconds is equal to 32,000 years. When we’re assessing investment opportunities, a trillion-dollar opportunity is massive, but a $125 trillion opportunity is nearly impossible to comprehend. If you can capture half a percent – just 50 basis points – on a $125 trillion dollar market, you’ll have $625 billion in annual revenues.

A $125 Trillion Opportunity

The notion of KISS (keep it simple stupid) is quickly disregarded when you start working at an investment bank where lengthy reports are worn as a badge of honor. Look no further than the 261-page fintech report – Payments, Processors, & FinTech – produced by four analysts over at Credit Suisse who no doubt spent many sleepless weekends on this monstrosity of insights.

While almost several years old, the report can help us better understand the B2B payments opportunity, starting with the below chart which breaks down the $125 trillion opportunity into various components. One of these is the $90 trillion opportunity in “domestic accounts payable” which is what it says on the tin – payments that businesses make to other businesses within the same country.

If we want exposure to the “domestic accounts payable” opportunity, we could buy stock in AvidXchange (AVDX), a pure-play B2B payments company focused solely on domestic accounts payable with a solution that’s tailored to SMBs in the United States. We like AvidXchange, but are there other B2B payments stocks we should be considering? Turns out there’s a whole load of companies dabbling in B2B payments, but not many that are pure-play opportunities. In the Credit Suisse report, they list five publicly traded stocks under the category of “B2B Payments /Other.”

The black sheep of the list is Verra Mobility (VRRM) which clearly falls into the “Other” classification with their smart transportation offering which is a play on smart cities and IoT (and one we may cover in a future piece). The other four companies on the list can be classified into two types of B2B spending: employee spending and company spending.

- Company Spending – B2B payments for expenditures related to the normal process of doing business

- Employee Spending – B2B payments related to travel and expense (T&E), a budget item that’s often reduced in times of economic turmoil

FLEETCOR (FLT) and WEX (WEX) are pure-play B2B payments stocks that largely fall into the employee spending category seen above.

Employee B2B Spending

With FLEETCOR, we see a company that’s targeting niche applications such as expense management solutions (fuel, tolls, and lodging) that provide customers with “greater control and visibility of employee spending.” With WEX, there’s a similar focus on employee spending. Both companies have a heavy focus on fuel cards which isn’t nearly as compelling as the accounts receivable-payable automation technologies on offer from companies like AvidXchange. The report affirms that both FLEETCOR and WEX are trying to pivot into full accounts payable automation:

Beyond their core fuel card businesses (also a form of B2B payments), both FLEETCOR and WEX have corporate payments businesses aiming to shift businesses more toward full-AP automation.

Credit Suisse

These companies are leaders in “virtual cards” with a fraction of revenues coming from the sort of accounts payable automation exposure we’re ideally looking for – FLEETCOR (20%) and WEX (10%). The rest of the exposure comes from T&E-type expenditures which are often among the first budget items that are frozen when times get tough, hiring being another.

That leaves us with two stocks – Bill.com (BILL) and Bottomline Technologies (EPAY) – both of which are largely involved with company spending activities as opposed to employee spending activities. Let’s start with Bill.com.

Company B2B Spending

About one page into the SEC filing and it’s hard not to start seeing some major similarities between Bill.com and AvidXchange. Both companies are using AI to do some cool automation stuff, both are purpose-built for the SMB niche, and both are acquiring companies like mad. But before we start looking into Bill.com too deeply, we’re throwing up a showstopper.

Bill.com better be the highest potential growth opportunity based on how expensive their future growth is being priced. Here’s a comparative valuation of all five B2B payments stocks using our simple valuation ratio:

| Company Name / Ticker | Market Cap | Annualized Revenues | Rev. Data | Ratio |

| Bill.com Holdings (BILL) | $29,241 | $312 | 2Q-2021 | 93.7 |

| AvidXchange Holdings (AVDX) | $4,309 | $235 | 2Q-2021 | 18.3 |

| FLEETCOR Technologies (FLT) | $22,908 | $2668 | 2Q-2021 | 8.6 |

| WEX (WEX) | $8,723 | $1836 | 2Q-2021 | 4.8 |

| Bottomline Technologies (EPAY) | $2,128 | $488 | 2Q-2021 | 4.4 |

For now, we can move past Bill.com because it’s extremely overpriced. To achieve a simple valuation ratio of 40, shares of Bill.com would need to trade for around $172 a share. If that ever happens, we’ll do an in-depth dive on the company. We can wait for that to happen, or we can consider investing in AvidXchange or Bottomline, the latter of which we haven’t talked about yet.

Subscription Revenues vs. Transaction Revenues

We always drone on about how great software-as-a-service (SaaS) business models are because they provide revenue consistency and predictability which lowers risk. For the B2B payments thesis, that may not neccessarily be the case because we prefer a company that has a taste of that $125 trillion in the form of volume-based fees. That’s one appeal of the whole payments opportunity. As the volume of money increases, costs largely stay the same while margins expand thanks to an increase in volume-based fees.

Both Bill.com and AvidXchange have revenue streams from subscription and transaction fees, something that’s well explained in this slide by Bill.com:

As for Bottomline, they’re largely focused on becoming a SaaS business with 82% of revenues being recurring and growing.

A look at their product offering shows they’re targeting a broader set of applications, each of which has its own list of competitors. These areas include payment platforms, banking solutions, legal spend management solutions, and financial crime solutions.

To understand why it’s important to get a taste of transaction revenues, we can compare the growth of revenues for AvidXchange and Bottomline over the last ten quarters.

Bottomline grew revenues +15% over that time frame while AvidXchange managed +75% growth. Without transaction revenues being part of the mix, we may not be able to realize the full potential of the B2B payments opportunity. Bottomline isn’t a pure play for our B2B payments thesis because they’re also dabbling in other areas. Combine that with their focus on moving solely towards subscription revenues and it’s not a stock that gives us the exposure we’re looking for.

We also need to be cognizant of private companies making traction in the B2B payments space that may soon go public or have already gone public.

B2B Payments Startups

In the lengthy report can be found a list of B2B payments startups that are dabbling in the AP / AR space. While AvidXchange has recently gone public, there are seven others on the list.

Billtrust (BTRS) went public using a SPAC whose glossy investment deck appears to show some similarities with AvidXchange. Now that the Billtrust SPAC merger has been complete, and some proper regulatory filing documents are available, we’ll take a closer look at this stock in a follow-up piece. A sneak peek at the IPO deck shows a focus on larger clients and a smaller offering than the other companies we’ve been discussing, like Bill.com.

As for the remaining six startups, here’s a quick look at how much funding each has raised along with comments (some taken from the report).

| Company | Founded | Funding | Comments |

| HighRadius | 2006 | $475 | Uses AI automation to gain insights and increase efficiency for order-to-cash and treasury systems. Used by 200+ Global 2000 companies |

| Mineraltree | 2010 | $119.7 | Focused on accounts payable automation. Emphasis on middle-market merchants. |

| Modulr | 2015 | $78.7 | An API payments infrastructure for efficiently automating and embedding payments. +100 customers. |

| PayFi | 2016 | $2.5 | Acquired by OV Loop |

| Paystand | 2013 | $98.3 | Using blockchain to create a more open financial system, starting with B2B payments. |

| Tipalti | 2010 | $295 | Provides accounts payable and receivable solutions and accounting software integrations. Works with both SMB and mid-market business |

Note that all the firms we’ve talked about today behave rather incestuously, using each other’s tools and products while often addressing similar customer bases. An MBA might postulate that the environment is so vast, the opportunity so expansive, that nobody really needs to compete yet. There’s plenty of room for everyone right now which helps explain why the market is so fragmented.

As the pace of consolidation accelerates, a leader will eventually emerge, but that may not happen for a while because (say it again with us) the opportunity is just so massive. In that respect, it may not matter that we can’t clearly see a leader emerging yet. It may be enough to put a dog in the race so we can keep a closer eye on this niche. If that happens, Nanalyze Premium annual subscribers will be the first to know.

Conclusion

We’re already holding one consumer payments stock – Adyen – and we wouldn’t mind placing a bet on the much bigger B2B payments opportunity. FLEETCOR and WEX are focused on employee spending, and aren’t appealing to us for that reason. As for company spending, we see several stocks we might like now – AvidXchange and Billtrust – and one we might like at a lower valuation – Bill.com.

The next step will be to do a deep dive on Billtrust now that their SPAC merger is done and dusted. However, we may not necessarily wait until that’s done to start building a position in one of the companies mentioned today.

Sign up to our newsletter to get more of our great research delivered straight to your inbox!

Nanalyze Weekly includes useful insights written by our team of underpaid MBAs, research on new disruptive technology stocks flying under the radar, and summaries of our recent research. Always 100% free.

Team,

I would be interested in an update on the above company.

You said you would consider buying when the stock would hit $172, that is when the simple ration would be 40. The stock price is now $75 and the simple ration is about 7.

Issues to consider:

SBC represent about 40% of the total revenues! What are the real operating margin and when would it be Gaap profitable? It appears well ahead of AVDX, although the latter looks cheaper.

65% of its revenues are transactions based

It is US centric and its sales originate from small and medium enterprises (how will the recession hit its revenues?)

But it is a truly market leader and Bill.com reduced its clients SG&A’s expenses.

I love this company at the current enterprise value. Do I get something wrong?

You stated ‘For now, we can move past Bill.com because it’s extremely overpriced. To achieve a simple valuation ratio of 40, shares of Bill.com would need to trade for around $172 a share. If that ever happens, we’ll do an in-depth dive on the company’.

Thanks

Fabio

This has been passed over to the editorial queue, thank you for the nudge!