Investing in 5 Manufacturing on Demand Stocks

Table of contents

Studies show that investors feel the pain of a loss twice as hard as they feel the joy of a gain. Another psychological phenomenon is feeling strong emotions before any gain or loss has been realized. Until you sell a position to realize profits or losses, you really shouldn’t feel anything. But we all know that’s not how these things work.

Yesterday, shares of Protolabs (PRLB) hit a 52-week low off the back of their Q2-2021 earnings call during which management noted “several emerging companies that offer online access to manufacturing have entered or announced plans to enter the public markets.” Today, we’re going to review and compare all publicly traded – or soon-to-be publicly traded “manufacturing on demand” stocks, a list that’s grown well beyond just Protolabs.

| Company | Ticker | SPAC | SPAC Finalized |

| Protolabs | PRLB | No | |

| Shapeways | GLEO | Yes | No |

| Xometry | XMTR | No | |

| Fathom | ATMR | Yes | No |

| Fast Radius | ENNV | Yes | No |

We chose the label “manufacturing on demand” because it most appropriately describes what these companies do, but this term is also synonymous with other labels including:

- On-Demand Manufacturing

- Distributed Manufacturing

- Manufacturing-as-a-Service

- Digital Manufacturing

- Cloud Manufacturing

- Contract Manufacturing

- Etc, etc, etc.

Let’s start with three companies that are planning to use special purpose acquisition companies (SPACs) to go public, none of which have actually finalized their mergers. (We’ve written about why we don’t invest in SPACs before the mergers are finalized.) One of these SPACs we recently wrote about in a piece titled Why We’re Long Protolabs Stock But Not Shapeways Stock, where we talked about how Protolabs already has the business model that Shapeways wants to have. Today, we’re going to look at two manufacturing-on-demand companies we haven’t talked about much – Fathom and Fast Radius.

About Fathom Stock

In all the research we’ve done surrounding manufacturing on demand, the first time we heard of Fathom was when their SPAC announcement was made. From what we can gather, a private equity firm called CORE Industrial Partners acquired five different companies, and the combined entity called Fathom is now merging with a SPAC called Altimar Acquisition II (ATMR). Here are the five companies that were acquired:

- GPI Prototype & Manufacturing Services – Illinois based metal 3D printing bureau with 25 employees (as of 2020)

- Midwest Composite Technologies – A Milwaukee-based 3D printing firm with (as of 2019) 45 additive manufacturing machines with capabilities in both metals and plastics – 65 employees

- Fathom – Oakland, California company doing advanced manufacturing and 3D printing since 2008

- ICOMold – A Ohio company specializing in plastic injection molding

- Summit Tooling – a provider of high-quality plastic injection mold design

Creating a company from scratch by rapidly acquiring five other companies in a short period of time is concerning in much the same way we were concerned with how Redwire was formed. Integrating companies is no easy task, and the Fathom glossy SPAC deck says that the $149 million in 2020 revenues “reflects various adjustments to give pro forma effect to acquisitions completed in 2020 and 2021 as though such transactions occurred on January 1, 2020.”

And that’s where we stopped reading. Once the acquisitions have been finalized, once all the books have been consolidated, once they figure out where all the bodies are buried, and once the SPAC merger is actually finalized and proper regulatory documents are filed, then we’ll spend the time needed to investigate how viable an investment this stock might be.

About Fast Radius

We first came across Chicago-based Fast Radius back in January of last year when we wrote about Ten 3D Printing Startups That Took Funding in 2019. With nearly $68 million in disclosed funding from names like UPS and Alumni Ventures Group, Fast Radius is planning to go public using a SPAC called ECP Environmental Growth Opportunities Corp. (ENNV). While scrolling through their 80-page glossy monstrosity of a SPAC deck, we were somehow hoping they had accomplished more than just $14 million in revenues for 2020, especially for a company with a planned market cap of $1.4 billion.

Buried in their investor deck are some gems of useful information about the company. They offer the usual menu of manufacturing services which are served up from a network of 3rd party manufacturers along with the company’s own collection of micro-factories (more on this hybrid approach in a bit).

They’ve printed 11 million parts so far for 2,000 different unique customers, and about a third of their revenues come from startups. There’s a $360 billion total addressable market to be claimed, which means there’s plenty of room for more than one company to operate. And one company that brought in 31X as much revenue in 2020 as Fast Radius at less than twice the size is Protolabs.

An Update From Protolabs

In April of this year, we wrote the following about Protolabs:

The company grew revenues at a compound annual growth rate of +19% for the period of 2013-2019, a major reason why we went long the stock. Now, they need to get back to that happy place ASAP.

Credit: Nanalyze

Since that article, both Q1-2021 and Q2-2021 results have shown that revenue growth is resuming. Yesterday, Protolabs announced record quarterly revenues of $123 million.

In the same call, they talked about producing “record quarterly revenue in the third quarter in the range of $123 million to $133 million,” so they’re expecting that growth to continue.

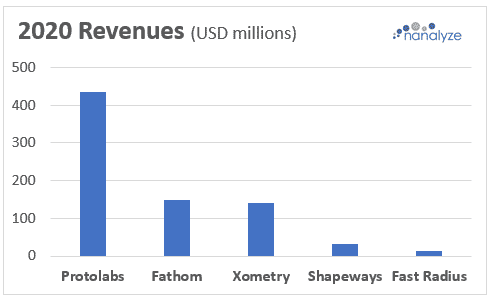

If we look at 2020 revenues across all five stocks we’ve talked about today, here’s how they compare.

Our focus is always on revenue growth because that’s a proxy for market share. Protolabs is the clear leader at the moment, though Xometry is growing at a much faster rate. It’s a good segue into talking about the two primary ways to approach manufacturing on demand.

Distributed vs. Centralized

Up until now, we’ve been thinking of two distinct business models for manufacturing on demand. The first would be distributed, where the company simply acts as a middleman – taking orders and then farming them out to manufacturing companies. Xometry is a good example of how this works, something we covered in our piece on Xometry Stock – An On-Demand Manufacturing Marketplace. The second business model involves doing all the manufacturing in-house, and up until recently, Protolabs was a good example of this. But perhaps the way forward lies in a hybrid model such as what Fast Radius is doing.

In looking over Protolabs’ latest investor deck, we see that they’re also moving towards a hybrid approach with their acquisition of 3D Hubs (now called Hubs) which gives them a network of manufacturing partners. We hadn’t actually considered that perhaps both a centralized and decentralized approach could be the way forward.

In the same investor deck, Protolabs talks about how they have a roadmap to hit $1 billion in revenues by 2026 – more than doubling revenues in five years’ time. This isn’t just some glossy SPAC promoter talking out of their ass. If Protolabs manages to hit the bottom range of their estimate for Q3-2021 at $123 million, then do the same in Q4-2021, that would put them at $485 million for 2021 – year-on-year growth of 11.75%. So, doubling revenues in five years would mean a compound annual growth rate (CAGR) of around 16% which would look something like this:

There’s every reason to believe that Protolabs can execute on their plan by growing organically and through acquisitions, and it’s something they absolutely have to do if they want to maintain their leadership position.

Simple Valuations

Another thing to consider here is our simple valuation ratio which gives us an example of how a company is valued relative to its peers. While we usually take the last available quarterly revenue number and annualize it, we’re dealing with SPACs that don’t provide that info, so we’ll just go with 2020 revenues. Here’s what we get:

- Protolabs (2.165 /0.434) = 5

- Fathom (1.423 /0.149) = 9.5

- Shapeways (0.605 /0.0318) = 19

- Xometry (3.394 /0.141) = 24

- Fast Radius (1.4 /0.0139) = 100

These numbers imply that Fast Radius is extremely overvalued (we consider anything 40 or higher to be overvalued), while Protolabs has the lowest valuation of the lot (or the lowest expectations of future growth, just depends on how you look at it).

Other Private Companies

SPACs of a feather flock together. First, we had the LiDAR lot, then the electric vehicle lot, and now we have the manufacturing on demand lot. If there was ever a time to raise cheap money by selling shares to a great number of greater fools, that time is now.

Last year, we looked at Six Manufacturing-as-a-Service Companies of which one, Fictiv, hasn’t announced any plans to go public. There may be other private companies that throw their hats into the ring, or any number of private equity companies that quickly cobble together a bunch of acquisitions with plans to use SPAC proceeds to pay for the whole thing. (Fathom actually has a $172 million loan due in April 2022, and they’re up schitt’s creek if the SPAC falls through.) Regardless of which companies may go public in the future, we’re confident placing our bets on Protolabs. The question is, do we buy more shares now that prices are hitting 52-week lows?

If you’re a Nanalyze Premium annual subscriber, we’ll send you an email alert should we decide to add some shares of any company we’ve discussed today.

Conclusion

Estimates vary, but the potential opportunity for manufacturing on demand is probably measured in hundreds of billions of dollars. It’s a compelling theme which grows even bigger when you consider the global opportunity set. Of the companies we’ve discussed today, one appears to have a solid lead when it comes to market share, and a roadmap to double revenues. Protolabs has committed to doing what needs to be done – resuming double-digit revenue growth. Now, they just need to execute like mad.

Sign up to our newsletter to get more of our great research delivered straight to your inbox!

Nanalyze Weekly includes useful insights written by our team of underpaid MBAs, research on new disruptive technology stocks flying under the radar, and summaries of our recent research. Always 100% free.