Trading The Crackdown on Opioid Companies

Table of contents

Back in August 2017, we published an article on How to Make Money off America’s Opioid Epidemic which looked at the major players in legal opioids. At least a few of them were selling legal Fentanyl – you know, that extremely dangerous drug you keep hearing about on the news these days. In our article, we cited speculation about a coming DEA crackdown and proposed two parts to a possible investment thesis.

- Investing long in those stocks that benefit from selling drugs that help people overcome their addictions

- Selling short those providers of opioid pain killers.

Here’s what we had to say about a company called Insys Therapeutics (INSYQ):

Given that Insys sells nothing but fentanyl at the moment, they’re probably the best option of the bunch for shorting based on the “DEA crackdown thesis”.

Turns out it was way worse than we could have imagined. A few days ago, shares of Insys fell -74% in a single trading session as “the company warned that it may seek bankruptcy protection after bleeding tens of millions of dollars on legal settlements and defending former executives convicted of bribing doctors to prescribe a powerful opioid.” That’s according to an article by Bloomberg which stated that Insys Therapeutics “may not be able to complete a $150 million settlement with the U.S. Justice Department over illegal marketing of its Subsys drug.”

Shares of Insys traded at $9.25 a share at the time our last article was published and now trade at just $1.20 a share. That’s an -87% loss since we identified Insys as a possible short candidate – but of course, we didn’t take our own advice because we never short stocks. Let’s use Insys as an example of why we don’t short stocks. (If you know how painful shorting a stock can be, just skip this next section).

Shorting Insys – Two Possible Scenarios

First, we need to open a margin account (that’s an account that allows you to short stocks) and deposit some cash. We’ll deposit $10,000 cash to be used for this example.

Let’s say we shorted 1,000 shares of Insys at $9.25 a share. That means we would borrow 1,000 shares of Insys and sell them on the market to receive $9,250 cash in our trading account (our brokerage firm loans us the 1,000 shares). We now owe our broker 1,000 shares of Insys and hold $19,250 in cash. If the company goes bankrupt, the shares are worth nothing so we owe nothing. We would make $9,250, a +100% return and the maximum amount of money we could make on this trade. However, the company has not gone bankrupt and the shares are presently selling for $1.50 a share. If we want to close our short position today, we go buy 1,000 shares on the market. The closing price for those shares on the last day of trading was $1.50 each so we would pay $1500 to get the 1,000 shares back. That means we would make $7,750 on the trade ($9,250 – $940 = $7,750), a return of about +84%. That’s what a successful short trade looks like. Now, let’s look at what a painful short trade looks like.

Let’s say we shorted 1,000 shares of Insys at $9.25 a share. Same trade as last time. We now owe our broker 1,000 shares of Insys. Now, let’s say that some “unconfirmed rumors” were published the next day that said a major pharmaceutical company was looking to acquire Insys and shares doubled to $18.25 a share. That means we now need $18,250 to close our position. At the moment, the cash we have can still cover this trade ($9,250 + $10,000 = $19,250). But we’re getting very close to losing all our money on this two-day trade. Then, let’s say shares are up another 20% on the same rumors the following day. The moment those shares hit $19.25, our broker would immediately sell that position and our account balance would be zero. We would have lost $10,000 in two days, a return of -108%. (In other words, we lost more than we originally committed to the trade.) If we had more cash in our margin account, we may have lost that too. In theory, there’s no limit to how much you can lose on a short position – and it can all happen very quickly.

That’s why we don’t ever short stocks, but we do know some of our readers were short Insys so congratulations on your newly found wealth. There were four more companies listed alongside Insys as being responsible for the “top five opioid product sales in 2015.” These companies were Purdue Pharma, Johnson & Johnson, Mylan, and Depomed. We also uncovered four additional stocks that have had exposure to opioids – Teva, Pernix Therapeutics, Endo International, and Allergan. Let’s see what’s happened to each of these companies since our last article.

Purdue Pharma Settles for $270 Million

If you’ve been watching the news, you would know that a crackdown is indeed in effect. Attorney General Mike Hunter and The Oklahoma Commission on Opioid Abuse are behind a multi-billion dollar lawsuit filed against opioid manufacturers which is expected to go to trial on May 28. One company that won’t be there is Purdue Pharma, a privately held company. Last month, Purdue Pharma settled for $270 million. The company responsible for OxyContin has paid their fine and the focus is being switched elsewhere.

Investors in the companies we’re going to talk about next have raised a great deal of concern about the May 28th trial that’s resulted from roughly 2,000 lawsuits filed in federal and state courts against Purdue and other drug makers. Some companies need to be more concerned than others. Johnson & Johnson probably falls under the “doesn’t really need to be concerned at all” category.

JNJ’s Liabilities

We’ve held shares of Johnson & Johnson (JNJ) for over a decade as part of a Dividend Growth Investing (DGI) strategy. In a world of volatile biotech stocks, JNJ stands out as a well-managed company with a diversified collection of businesses that has not only paid a dividend but increased it for 57 years in a row. This is a company with $18 billion in cash right now, and the likelihood that this whole opioid debacle will affect our income stream seems highly unlikely. And it’s totally ethical to hold this stock because the ESG analysts say they’re an “ESG leader.”

Alison Frankel at Reuters published an excellent piece on this topic a few weeks ago titled “J&J makes last, best case to head off Oklahoma opioids trial.” As investors, we just want to know what JNJ needs to pay for this to go away. The answer seems to be “not very much.”

Purdue Pharma’s Oxycontin drug generated $35 billion in sales from 1996 to 2017 and they just settled for $270 million. (They also paid $634.5 million in penalties back in 2007 for misbranding.) Even if JNJ was required to pay $1 billion, that’s a small chunk of change for a company that brought in more than $80 billion in revenues last year. Perhaps the most compelling piece of information in the article regarding JNJ’s liability is the following:

As a factual matter, J&J’s brief argued, its opioid products – a fentanyl patch and two versions of a pill called Nucynta – occupied less than half of one percent of the market for prescription opioids in Oklahoma. Neither, the company said, was widely abused. (Oklahoma’s suit also cites two J&J subsidiaries that produce active ingredients for opiates but Johnson & Johnson argues that it cannot be liable for the government-regulated production of ingredients used in drugs it did not make or sell.)

J&J stopped marketing the fentanyl patch in 2007 and ceased all marketing of opioids in 2015, when it sold the Nucynta franchise.

J&J sold their Nucynta franchise to Depomed and it quickly turned into a game of hot potato.

Depomed Becomes Assertio Therapeutics

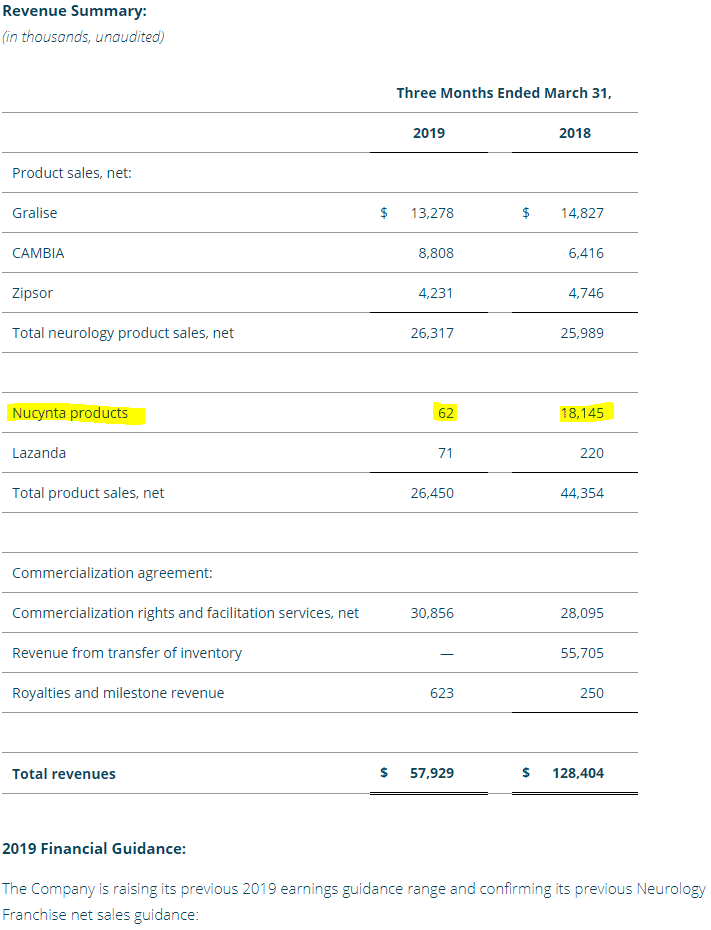

People spend too much time bashing CEOs and not enough time appreciating the impressive feats they manage to pull off at times. Take Depomed as an example. They’re no longer known as Depomed but instead have re-branded as Assertio Therapeutics. Opioids have all but vanished from their product mix. In Q1 2018, Depomed sold $18 million worth of Nucynta products (the Fentanyl spray). Exactly one year later, and that number has fallen to $62,000 worth of product in Q1 2019. While the company’s total revenues have fallen sharply as a result of dropping opioids, the company leaves their last earnings report on a positive note:

Not only that, but Assertio managed to show a profit for their investors last year and avoided getting creamed too bad by the opioid debacle. Since our article, the overall market cap of the company has fallen from $398 million to $256 million, a drop of about -36%. That’s not bad, all things considered. Assertio’s management team did a tremendous job pivoting the company away from opioids while minimizing fallout.

Mylan and Teva

Since our last article, shares of Mylan have fallen about -37% and continue to fall giving the company a present-day market cap of around $10 billion. Here’s their official response regarding the elephant in the room. And here’s some commentary published today on MarketWatch:

Shares of Mylan N.V. sank 2.7% in morning trade toward a 7 1/2-year low, after Fitch Ratings revised its outlook on the generic drug maker’s credit rating to negative from stable, putting the rating in danger of a downgrade to “junk” status.

It goes on to say:

Generic drug maker stocks have been under pressure in recent weeks and took another header on Monday after more than 40 state attorneys general filed suit against 20 makers of generic medications, alleging a conspiracy to artificially inflate prices and reduce competition. Shares of fellow generic drug maker Teva Pharmaceutical Industries Ltd. slid 6.1% in morning trade to a 1 1/2-year low.

In our last article, we said that Teva was “too big and diversified for any sort of crackdown to have an effect on their bottom line.” Looks like we were wrong.

The Rest

Here’s a quick update for each of the remaining three companies:

- Pernix Therapeutics (PTXTQ) could be affected by a crackdown though opioids only represent 18% of their revenues.

Pernix went bust and filed for bankruptcy just a few months ago citing “increased generic competition” – a return of +100% for anyone who shorted it into the ground. - Given that Endo International (ENDP) already lost -53% of their share price value year-to-date, the impact of an opioid crackdown may already be priced in.

The company’s market cap is about the same which represents two opposing forces – the potential blockbuster CCH for cellulite drug launch and the opioid overhang. An article on Seeking Alpha today covers this in more detail. - Allergan (AGN) is just too big and diversified to be affected by any crackdown.

Shares of Allergan have fallen -43% since our last article, something that’s being attributed to “increased generic competition.”

Conclusion

As investors, we’re supposed to balance our desire to make money with our desire to do what’s best for society. Finally, steps are being taken to address “the opioid epidemic” and the companies that were involved in the whole racket are trying to quickly distance themselves from the whole thing. It would be nice to say that ESG investing was responsible for stamping out the opioid problem but it seems to be more about a successful government crackdown. As Ms. Frankel stated in her article, “politics inevitably shapes litigation,” and it also shapes what societal issues are pushed to the forefront. Let’s just hope the opioid issue won’t be around for too much longer.

Sign up to our newsletter to get more of our great research delivered straight to your inbox!

Nanalyze Weekly includes useful insights written by our team of underpaid MBAs, research on new disruptive technology stocks flying under the radar, and summaries of our recent research. Always 100% free.

So what are people with chronic debilitating daily pain to do when the government has pretty much run all these opioid companies into the ground? As a pain patient myself, who was rx’d Zohydro. It was worked for my pain

Allergen is no longer making it thanks to this absolute LIE that there is still an opioid epidemic. It ended 10 yrs ago. Addicts are dying from heroin & China fentanyl, NOT rx opioids. Every G.D. generic opioid on the market today is absolute JUNK with barely a trace of active ingredient in them. The FDA does nothing abt this, thousands of ppl have complained. My daughter had a severe abscessed tooth & yrs ago one hydrocodone would have helped, she took 2 & NOTHING. She cried all night long & she had nvr taken a narcotic before. I have spondololthesis, scoliosis, spinal stenosis, arthritis & a fractured vertebra. My Dr rx’d 10mg hydrocodone. Every last generic maker is producing absolute junk that does NOT treat pain, just gives you a headache & terrible heartburn, oh and ringing in the ears. I see it’s all abt money in its stocks so I am SURE they are barely putting any active narcotic in them in fear of the damn gov suing them. Thanks to this farce many elderly ppl are spending their last yrs suffering with pain. Maybe do a story on this dilemma? Nobody seems to care bc its ALL abt the stocks, fear and money.

.

Hi Kimberly,

Thank you for the comment. We had to remove some of your other comments as we have to keep things concise around here for our readers. It’s not because of anything you said.

Yes, pain relief substitutes for opioids are being developed – like electroceuticals. We come across a fair number of companies working on pain relief, they just don’t fall under our remit. This piece we did many moons ago was more a one off article. Thank you for taking the time to comment as we did read them all but just kept the most concise one 🙂