Using Blockchain for International Payments

Table of contents

When you spend your days producing insightful articles and giving them away for free, you need to conserve your costs so that you can make sure the MBAs who produce the stuff receive a fair wage. In other words, when you’re bootstrapping you need to count your pennies. The world is your oyster, so you go to where the talent is and pay them in their home currency. More than half our staff live abroad and get paid as they deliver work. This means we perform quite a few international payments every week. Everything seemed to be going well until something bad happened.

Chase and TransferWise

We were originally using PayPal for international transfers but had switched over to a firm called TransferWise. As many of you out there are aware, when you run a business you try and pay everyone using a credit card which then serves to fund your business travel via frequent flyer miles. We’ve been doing this for years and it seems to work well. Even though you pay higher fees to use a credit card, the flyer points offset the fees and it all works out. Unfortunately, that all changed. We logged into our business account recently and realized that Chase business credit card had started processing our credit card transactions with TransferWise as “cash advance.” Every transaction now incurs a $15 fee. We complained, Chase removed the fees for us, and we stopped using TransferWise. We then went to our fallback, PayPal.

PayPal and Spot Rates

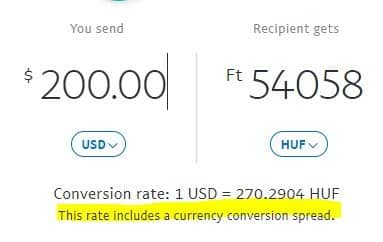

We’re not going to sit here and bash PayPal but the fees they charge are ridiculous, largely because they use a currency conversion spread that is (in our experience) complete rubbish. Nothing is more annoying than a business that touts how economical their offering is then rakes you on a forex spread that most people probably ignore. Here’s an example taken right now as we type:

They do state “this rate includes a currency conversion spread,” and we can use Xe.com to see that the amount our Hungarian MBA ought to receive is 56,543 HUF. That’s a difference of $8.79 right off the bat, and we haven’t even considered fees yet. Sure, there is variability here, but that’s the point. Can we not be told exactly how much we’re putting in their coffers every time we do a transaction or do we have to deal with all this smoke and mirrors bullisht every time we click “pay? The answer is no, because we won’t deal with firms that don’t – at least make an effort to provide spot foreign exchange rates – or charge a fee that’s fair.

An Ideal International Payment Provider

We then set out to look for the ideal international payment provider. Let’s list out our requirements:

- Spot rates, no spreads

- Clearly stated fees

- A fair fee-structure

- The ability to use a credit card

To make things absolutely clear for each transaction, we want to see the exact amount we’re charged, and the exact amount that’s being sent. With PayPal, they’ll actually deduct fees from the receiver, so we had to bump up our payments by 4.5% to cover people’s fees. Why can’t we choose who pays the fee? Who knows, but that’s another requirement. We want to choose who pays the fees or have the ability to make sure people who we pay are given the exact amount we send them. Ideally, we want to see exactly what we’re paying, exactly how much the receiver gets, and have both amounts displayed in their respective currencies.

Through our research, we haven’t been able to find a vendor that can promise low fees and let us still use our business credit card. It looks like if we want low fees, we have to connect our banking account directly. This means we lose out on frequent-flyer points which means we really need to see some low fees to offset that loss. In other words, we’re looking for an innovative fintech company that’s using technology to facilitate low-fee international payments. One firm we came across that uses blockchain technology for low-fee international payments is Veem.

Using Blockchain for International Payments

We signed up with Veem to try out their platform as an alternative to PayPal. As they state, signing up was pretty simple. You do need to upload documentation about your business so they can understand what you’re all about. That’s pretty much standard due diligence that you’d expect to see from a “business payments” solution. Their customer support team was responsive and overall things happened pretty quickly. By the end of the day, we already had a payment in progress to one of our MBAs in Hungry. After a few more payments, we’re now in a position to assess the economic viability of using blockchain for cross-border payments. Let’s go back to our original list of requirements to see if they’ve been met.

- Spot rates, no spreads – There is a spread but it’s not as bad as PayPal and they don’t charge any other fees

- Clearly stated fees – There are no fees, but there is an interest rate spread. We had to confirm this with their support as it wasn’t clear.

- A fair fee-structure – The fees are cheaper than we’ve seen so far – around 3% of the transaction in our experience

- The ability to use a credit card – They don’t support credit cards and you have to connect your checking account. Given the added hassle of dealing with credit cards, it seems highly unlikely we’ll ever see low fees and credit card support from any vendor out there. Veem seems to recognize this by offering a cash-back rewards program called Veem Rewards.

Overall, we’re content with Veem’s solution. They may take their money on a spread but the amount seems fair. The rate seems responsive to the actual movement of the underlying currency, and we observed rates change in minutes between transactions. We also like the ability to pay the exact amount owed specified in the receiver’s home currency. You can always see exactly how much you’re paying and how much the receiver is getting in their home currency. Here’s an example for a payment going out in Philippine pesos.

Alternatively, we can pay in USD and then the receiver takes on the currency risk. Either way, Veem seems very reasonable. In playing around with various currencies, we saw even better rates. In one instance where we transferred Philippine pesos, we saw a rate just over 2% based on spot rates according to Xe.com. However, there’s one thing that wasn’t on our initial list of requirements that needs to be considered here. The time it takes. In our short time using Veem, we have noticed that the transactions are measured in days, not hours. After we use the solution for a bit more, we’ll try to provide some additional color on what averages look like. Presently it seems rather long at 3-5 business days.

Conclusion

People often say that the best business ideas out there are the ones where the founder was so annoyed by a problem that they set out to solve it themselves. In this case, there must be loads of people who have the same problem we do. We’re mercenaries, so the first hint of a company that’s better than Veem and we’ll switch. There other vendors out there doing the same thing, some of which we may look at in future articles.

Veem’s fees seem reasonable, they seem to be reasonably transparent, but they don’t let us use a credit card. We could easily see a future where banks simply start treating all payment platform transactions using a credit card as “cash advances” and that’s not something the vendor can control. So, we’ll simply use a direct-connect bank account, but we want those fees to be as low as possible. Veem is backed by some very sophisticated investors, so we feel like they’re going to make the right decisions going forward. Keep it simple and keep it economical.

Sign up to our newsletter to get more of our great research delivered straight to your inbox!

Nanalyze Weekly includes useful insights written by our team of underpaid MBAs, research on new disruptive technology stocks flying under the radar, and summaries of our recent research. Always 100% free.