Hexo Corp Stock – What You Need to Know

Table of contents

“‘Mispriced’ Pot Stock Hexo Looks to New York to Boost Profile,” read the title of an article by Bloomberg just a few weeks ago. What this really means is that the stakeholders over at Hexo aren’t too happy that Hexo Corp stock hasn’t achieved the sky-high valuations that their competitors have. If indeed there is “value” to be had here for today’s cannabis investor, it merits a closer look using our favorite comparative metric. It’s one simple question: How much marijuana are you selling?

The Bloomberg article presents the below chart which is rather upsetting to look at considering that Bloomberg should know better than this:

Simply comparing market caps tells us absolutely nothing about the underlying businesses and how they compare. A simple method of comparison is to look at how much weed is being sold by these companies. Here’s a comparison with slightly more color:

In the above charts, we see how Hexo’s revenues and “kilos sold” is proportional to Bloomberg’s market cap chart we looked at earlier. If you’re not selling as much weed as your competitors, don’t expect to have the same valuations as your competitors. Of course, this is a gross oversimplification that ignores other key metrics like profitability, future growth plans, etc. (For example, one metric Hexo Corp uses to show how undervalued they are compared to their peers is price-to-book.) If you happen to be undervalued compared to your peers who all happen to be grossly over-valued, then you’re just valued appropriately. Let’s test that theory by looking at Molson Coors (TAP).

Marijuana Stocks and Molson Coors

If you don’t know what Coors is, it’s a watered-down beer that Americans drink which has absolutely no flavor but if you drink 12 you’ll catch a buzz. Maybe. The company that makes Coors, Molson Coors, is the world’s third largest brewer with a market cap of nearly $14 billion. Since we’re all about comparing companies using market cap, let’s throw Molson onto our comparison chart of weed companies just for fun:

Since we’re interested in whether or not Hexo is undervalued, we need to think about whether or not all other marijuana stocks are overvalued. Using Molson Coors as a comparative benchmark isn’t that far out when you consider all these companies are in the business of selling stuff that gets you messed up when you’re feeling happy or sad. They’re all “sin stocks”. In the case of Molson Coors, you have a profitable business that pays a dividend. In the case of these marijuana stocks, they’re burning through loads of cash and selling paltry amounts of product while losing money – Aphria being the exception to the rule. In the case of Hexo, their yearly losses nearly doubled from $12 million to $23.3 million from 2017 to 2018. They happen to be in good company when it comes to losing money:

But just as in the case of pharma companies that light money on fire for years while producing zero revenues, it’s all a matter of future growth potential. One of the reasons that people have been getting so excited about marijuana stocks is because the world’s biggest brewers have shown interest in cannabis drinks, even Molson Coors, who recently announced prominently on their homepage that they’ve entered into a partnership with none other than Hexo.

Hexo Corp and Molson Coors

In August of this year, Molson Coors and Hexo announced a joint venture to “pursue opportunities to develop non-alcoholic, cannabis-infused beverages for the Canadian market following legalization. The joint venture, Truss, will be led by former Molson Coors executive, Brett Vye, in the role of Chief Executive Officer.” Truss is a standalone company with Molson holding a 57.5% controlling interest with HEXO holding the remaining 42.5%. Having a member of Molson’s senior leadership team running the show is a great vote of confidence for Hexo’s future growth capabilities. There is no way a company like Molson would get into bed with a small Canadian marijuana grower without making sure they could scale as needed. With Canada now being the second country in the world where cannabis is legal, Molson needs to move extremely fast to dominate the cannabis drinks market. So how much weed can Hexo be expected to grow?

Hexo Corp’s Future Plans

Even though the amounts of marijuana that Hexo sells today pale in comparison to their bigger competitors, Hexo is still paying attention to the numbers so they have a benchmark to hit as they scale. The company’s cash cost to grow is around 67 cents USD per gram and they’re selling at $7.02 USD per gram making for some healthy margins. While they only sold 539 kilos in 2018, they claim to have a 25,000-kilo production capacity, a number which they expect to quadruple by the end of this year:

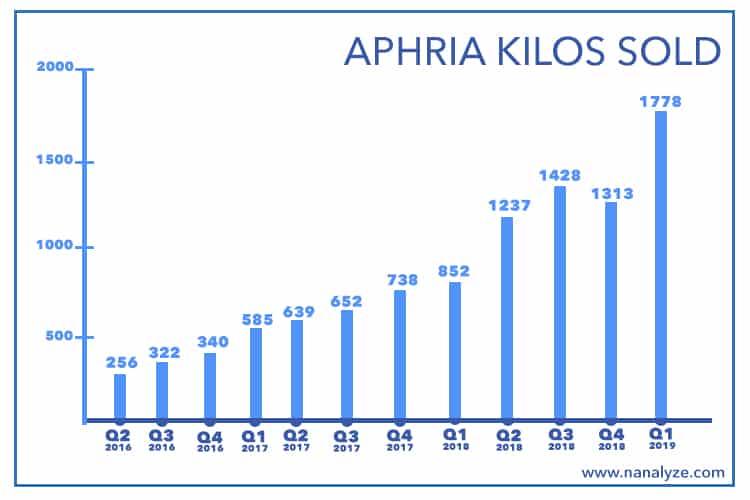

Every single one of these marijuana growers has some master plan which involves million-square-foot warehouses and thousand-ton projections of how much weed they plan to grow and sell. The truth is, this stuff happens slowly over time, not all of a sudden. Take for example the below chart we put together which shows Aphria’s slow-and-steady growth over time which is what we would expect to see as a company scales:

In order for Hexo to move from selling 539 kilos in 2018 to 25,000 kilos in 2019, it will take some time for them to scale. (To put that 25,000-kilo-number in perspective, Canopy Growth, Aphria, and Aurora collectively produced and sold just under 20,000 kilos in 2018.) In case you’re wondering how the company plans to sell all that “dried flower”, Hexo has announced a five-year supply agreement with the government of Quebec which is defined as follows:

Hexo Corp is pleased to announce that it has entered into a commercial agreement with the Société des alcools du Québec (SAQ) to be the preferred supplier of cannabis products for the Quebec market for the first five years post-legalization, with an option to extend the term for an additional year. Under the agreement, Hexo will supply 20,000 kg of products in the first year of the agreement and is expected to supply 35,000 kg in the second year and 45,000 kg in the third. The volumes for the final two years of the agreement will be established at a later date based on the sales generated in the first three years.

That means we need to see 20,000 kilos sold next year else Hexo is leaving money on the table. In order to measure Hexo’s progress, it’s very simple. Continue charting their production growth every quarter. Given the amount of money investors are throwing at the marijuana industry right now, they shouldn’t have any problem raising the money needed to scale. Management should pay less attention to their stock being “undervalued” and more attention to making sure they can produce 25,000 kilos of marijuana next year that they have a buyer for. We’re marking our calendars to check back in a year or so to see how fast they were actually able to scale. Let’s hope we’re all pleasantly surprised.

Conclusion

If you wasted several years of your life studying for your CFA in the evenings instead of having a life, you would know that there are dozens of ways you can show how undervalued or overvalued any given company is. That’s why we like to keep things as simple as possible for our simple minds. A $12 billion company that has yearly revenues of $60 million selling commodity products is not something you’ll see very often. This leads one to believe that the future potential of marijuana stocks is already priced in at today’s lofty valuations. From where we’re sitting, Hexo appears no different when you look at marijuana being sold today. Hexo Corp stock is expected to begin trading on a major U.S. exchange at an undetermined point of time in the future.

Sign up to our newsletter to get more of our great research delivered straight to your inbox!

Nanalyze Weekly includes useful insights written by our team of underpaid MBAs, research on new disruptive technology stocks flying under the radar, and summaries of our recent research. Always 100% free.