7 AI Enterprise Solutions Getting Funding in 2018

Table of contents

We write an awful lot about artificial intelligence. Sometimes it might seem like so much hype that the AI bubble is primed to burst any day now. Our perspective is that AI and its related technologies – machine learning, deep learning, neural networks, natural language processing, and computer vision – is the new electricity. Pretty much every technology company on the planet will someday use algorithms to power all sorts of solutions, from finding the best airfares and transcribing text to understanding medical images and doing basic research. In fact, a casual search on Crunchbase finds that nearly 10,000 companies claim to use some form of AI. We recently discussed how unreliable that data can be when it’s simply crowdsourced and you don’t sanity check it against a human and then let some algorithms go to work on the data, as the startup Hive does with AI for enterprise.

In that article we made a distinction between companies like Noodle.ai that build AI enterprise solutions that help clients make sense of big datasets in order to guide business decisions and AI for enterprises that customers can use to tackle specific tasks or problems. An example of the latter is startups that use AI for automating back-office processes, also known as Robotic Process Automation (RPA). As we already noted, there are thousands of startups coming on the tech scene, often falling into one or both categories. We come across these young companies daily, as new rounds of funding are announced, and thought we would write about some of the AI enterprise solutions getting funding in 2018. The first is the aforementioned Noodle.ai which took in a $15 million funding round in June of this year, along with six new names we haven’t written about before.

Closing the Deal with AI

Founded in 2016, San Francisco-based People.ai just closed a $30 million Series B in October that brought total disclosed funding up to $37 million. It’s got an impressive roster of investors, beginning with premiere VC firm Andreessen Horowitz, which also led the recent Series B. One area where companies are applying artificial intelligence is in Customer Relationship Management (CRM), a sort of catch-all term to describe a company’s data and activities surrounding its services and sales regarding its clients. It’s a topic we’ve covered before here and here with lists of startups, as well as a few other articles. So, People.ai enters a pretty crowded marketplace but brings to the table a good network through backers like Andreessen Horowitz, GGV Capital, Lightspeed Venture Partners, and Y Combinator, which is probably the premier Silicon Valley incubator for startups.

People.ai is particularly focused on using AI to improve a company’s enterprise sales division. Its platform ingests data from 96 sources – including email, calendaring systems, audio and video conferencing services, and telephone systems – and then the machine-learning algorithms go to work, populating a company’s CRM records, but also analyzing the sales process and seeing where there may be concerns or problems. So, People.ai isn’t just a fancy way to keep your digital contacts up to date, but to figure out what works and what doesn’t by identifying actionable patterns in the dealmaking. You could see where this would be helpful, especially for game show contestants on Let’s Make a Deal. People.ai customers include Lyft and dozens of others, including a company called Cogniance that claims the platform improved sales by 33 percent.

Update 05/21/2019: People.ai has raised $60 million in new funding to continue growing the business and building partnerships with new channels, such as system integrators to target bigger enterprises. This brings the company’s total funding to $100 million to date.

Breaking Enterprise Silos

VentureBeat reports that r4 Technologies is currently applying its technology to inventory shortages in brick-and-mortar stores and that the startup claims more than 20 Fortune 500 companies and organizations as clients. r4 also claims to have increased revenue by up to 20 percent, improved forecast accuracy by 200 percent, and reduced the cost of delivery and inventory management by more than 20 percent for its customers, according to VentureBeat. They provide absolutely no context with these improvement numbers so don’t ask questions and just be impressed, ok?

AI as the Brains of the Operation

In one case study, Peak helped a car tech company called Regit increase sales by 27 percent. Regit generates revenues in various ways, with 2.5 million members who use its services to manage their vehicle maintenance, among other things. It also leverages all that data to help other companies buy and sell automobiles. Regit was looking for a way to predict which members were likely to change cars using Peak’s AI platform. Regit also saved up to 35 percent in operational costs by staffing its call center at times when a sale is most likely to occur, as predicted by omniscient algorithms.

Update 02/17/2021: Peak AI has raised $21 million in Series B funding to continue expanding the functionality of its platform, adding offices in the U.S. and India, and growing its customer base. This brings the company’s total funding to $42.7 million to date.

Automating Industrial Enterprises with AI

Founded in 2016, Toronto-based Canvass Analytics raised a $5 million Seed round in August, led by Google’s AI-focused venture fund, Gradient Ventures. Total funding is $6.5 million, VentureBeat reported. We’re stretching the definition of enterprise here to include a company’s industrial plant operations – automating industrial processes the same as any other business process we’ve already discussed. The idea is that AI can help a plant’s operation run more smoothly and efficiently by literally analyzing millions of data points to do everything from predicting machine failures to optimizing an asset like a wind turbine to get the biggest charge for your buck. Last year, we introduced you to a similar concept with seven industrial Internet of Things startups using AI.

In one case, Canvass Analytics helped a global Fortune 1500 agriculture processing plant optimize its co-generation turbines, which led to a 13 percent improvement in fuel efficiency while reducing carbon emissions by more than 10 million pounds per year.

Speaking Your Language

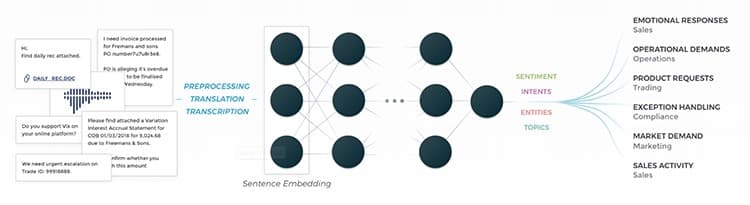

Customers include RPA firm Blue Prism (PRSM), which uses AI to automate the back-office drudgery. In the case of one investment bank, re:infer deployed its algorithms to crawl through 200 million conversations, discovering a host of problems: quality-of-service issues, information security risks, STP breaks, manual and redundant processes, coke deals, etc. The bank estimated it could save $135 million and 3,000,000 work hours per year. That’s some ROI.

Predicting the Future

Founded in 2016, Cognovi Labs is a Midwestern entrant on our list, based in Columbus, Ohio. It has raised $3.1 million, most of it from a Seed round back in January. One of the big advantages that AI promises is being able to predict the future, whether by forecasting product sales to improving inventory management or detecting consumer sentiment that might make or break a stock at any given moment. Cognovi is one of the many AI startups now leveraging social media – part of what we call data exhaust, the online fumes that we leave behind with every click – to make Nostradamus-like forecasts for how enterprises or other organizations should proactively operate.

For instance, Cognovi claims that it predicted (see graph above) the 20-percent drop in Facebook stock value on July 26 of this year – days before the social media giant released its second-quarter earnings – based on what it calls a Consumer Motivation score. The $120 billion in lost value was the biggest in history, with more than 40 analysts still pushing on a “buy” rating for the stock right before the plunge. In another case, Cognovi’s prediction platform identified weakness in McDonald’s all-in strategy to hype the Big Mac over other menu items, which the startup’s Consumer Motivation score suggested was the wrong direction. The fastfood restaurant announced layoffs this summer, following the March report from Cognovi. So, the question is: Did it predict that McDonald’s would hit an all-time high of $182.71 today? (Full disclosure: we hold Mickey D’s as part of our long-and-strong dividend growth investing strategy.)

Conclusion

Business is sort of like the Tour de France. Only the best of the best can compete, but sooner or later, some of the players are going to want to dope their balls off to gain an edge however they can. AI is that edge for business enterprises, from salesrooms to production floors. Those who don’t adopt it stand to be dropped from the pack.

Sign up to our newsletter to get more of our great research delivered straight to your inbox!

Nanalyze Weekly includes useful insights written by our team of underpaid MBAs, research on new disruptive technology stocks flying under the radar, and summaries of our recent research. Always 100% free.

I have successfully reverse engineered how the human brain performs intelligence and am seeking backing to build the first AGI Robot.