How Technology Will Affect Big Insurance Companies

Table of contents

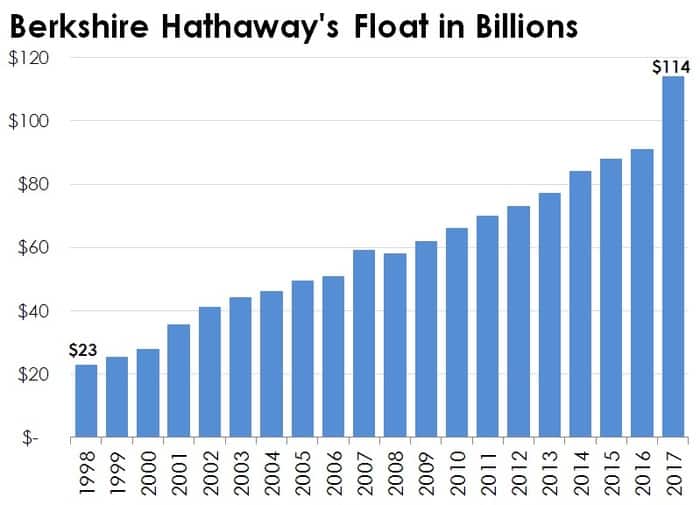

We’re all familiar with how insurance works because we are all forced by law to purchase insurance for various assets that we don’t own. Depending on how risky you are, depends on how much you pay each month in the form of “premiums”. Those premiums then go into a bank account, a giant bank account, where everyone else who pays premiums also sends their money to be stored. What you end up with is a massive pile of cash called a “float” that insurance companies can then invest. When it comes time to pay a claim, easy enough to sell some investments and pay the claim. That’s the foundation of Warren Buffet’s admiration of the insurance industry, and it’s why his company, Berkshire Hathaway, had over $100 billion in float last year:

Of course, that’s how things used to work. Today, technology is transforming the insurance industry in ways we wouldn’t have imagined. Warren Buffet himself has talked about how autonomous driving will dramatically affect the auto industry. Why? Because when all cars drive perfectly using AI algorithms, there are no wrecks. The cost of insuring a self-driving car will plummet, and all those “premiums” the insurance companies used to create these massive “floats” will dwindle. If you’re holding an insurance company in your portfolio, this ought to concern you. We’ve been holding Chubb (CB) for a while now, and we’re concerned for sure.

A Big Insurance Company Called Chubb

With a market cap of over $60 billion, Chubb is the world’s largest publicly traded property and casualty insurer, with a globally diversified portfolio of delicious income streams. We like Chubb because they’re a dividend champion. That means they have a track record of not just paying us cash four times a year, but also increasing those cash flows – every damn year – for 25 years. In the past ten years, that increase averaged just over 10% every year. Here’s how that income stream would look if you had $10,000 invested in Chubb at today’s yield of 2.26%:

| Year 1 | $ 10,000 | 2.26% | $ 226 |

| Year 2 | $ 10,000 | 2.49% | $ 249 |

| Year 3 | $ 10,000 | 2.73% | $ 273 |

| Year 4 | $ 10,000 | 3.01% | $ 301 |

| Year 5 | $ 10,000 | 3.31% | $ 331 |

| Year 6 | $ 10,000 | 3.64% | $ 364 |

| Year 7 | $ 10,000 | 4.00% | $ 400 |

| Year 8 | $ 10,000 | 4.40% | $ 440 |

| Year 9 | $ 10,000 | 4.84% | $ 484 |

| Year 10 | $ 10,000 | 5.33% | $ 533 |

In ten years, the income from this asset has doubled. You don’t get that sort of income growth with bonds, that’s for sure. Chubb knows that quite well because that’s all they invest in with their massive float. Remember how earlier we talked about insurance companies investing their premiums? Here’s where Chubb invests their money.

Of course, when self-driving becomes a thing, those insurance premiums may dry up. When that happens, how will Chubb be able to keep giving us those nice raises every year? To answer that question, we need to look at the exposure Chubb has to “self-driving risk”.

Self Driving Cars and Insurance Premiums

At some point, self-driving cars will move from killing people to saving lives. They promise to be infinitely safer than human drivers, something that startups like Zendrive are betting on with tools that let us monitor human driver behavior. This means that car insurance premiums could dry up, so we’re interested to know what exposure Chubb has to auto insurance premiums. When we look at Chubb’s premium distribution by product, it looks like we don’t have that much to worry about:

The “personal lines” segment seen in the above pie represents the sorts of insurance policies that consumers might purchase for their homes or automobiles. We looked at Chubb’s latest 10-K report and found that just 25% of that segment is auto insurance. This means that the “self-driving risk” for Chubb is about 5% of their entire portfolio. Sure, that’s a rudimentary way to assess this risk, but when it comes to technology and big insurance companies, we’re less concerned about “risk” and more concerned about “opportunity”. Based on what we’ve seen in the insurtech space, using AI in an industry where everything is about forecasting risk happens to be a really great application.

Artificial Intelligence and InsurTech

Often referred to as “InsurTech”, the transformation of the insurance industry by technology is something we’ve touched on before in articles like “9 Insurance Startups Improving Underwriting” and “10 Artificial Intelligence Startups in Insurance“. In one example we came across, AI was used to reduce false claims by over 90%. Think about that for a second. It’s not even the money saved from not having to pay false claims, it’s the fact that you don’t need a team of John-in-Mumbai types to process all your claims and try to determine which ones are false using some hard-to-understand flowchart that’s already outdated. No, we’ll let AI sort that out. Reducing false claims by 90% should help Chubb cover any losses from autonomous cars, but only if Chubb is “out there looking” for these new types of technologies.

“One of our strategic focus areas is to transform ourselves to thrive in a digital age,” says Chubb’s latest yearly report. It’s something that their CEO rambled on about in a report by CB Insights on “insurance earnings calls” in July of last year, but nothing was said about how Chubb plans to get there. If we look at the overall insurance industry to see which companies are most actively investing in tech startups, Chubb barely merits a mention with the exception of their investment in Coverhound. Then we came across this statement in a recent article by Digital Insurance:

Chubb is now working with startups across the world, especially in Israel, to solve some of the shortcomings related to data for cognitive computing. The insurer has no established structure, such as an innovation lab or accelerator, to communicate with startups. Instead, it opts to work with and invest in industry newcomers on an ad hoc basis.

In that same article, the SVP of Digital Analytics at Chubb talks about how one hurdle to technology adoption in the insurance industry is the quality of data available. After all, the best AI algorithms are the ones with the best data. Since everything is about data, it may be better to build than buy. That appears to be what another big insurer thinks as well. Again from CB Insights, we see a piece in April of this year titled “AXA & Allianz rethink venture units“. It goes on to say that in November of last year, Allianz said it would “discontinue its early-stage company building activities and focus on digital investment with strategic relevance for Allianz.”

When it comes to what Chubb is doing in-house with disruptive technologies, we see talk of drones, AI and blockchain. Using drones for damage assessment is pretty standard stuff now, and so is the use of satellite imagery to assess things like hail damage. Using AI for claims is something Chubb is well aware of based on an article we came across where two Chubb executives were preaching the merits of AI for claims processing. As for blockchain, there are all kinds of use cases you could find in the insurance industry but it’s probably not the low hanging fruit at the moment. Getting rid of all those archaic manual processes using robotic process automation and improving your forecasting using artificial intelligence for predictive analytics are probably where it’s at for big insurance companies like Chubb.

Conclusion

We’ve talked before about how artificial intelligence is such a commodity at this point that the question has changed from “who is using AI” to “who isn’t using AI”. Any stocks in your portfolio that have traditionally felt “safe” may not be adopting technologies like AI at the pace they need to in order to compete. It’s time to vet all your major holdings in boring industries like insurance to make sure they’re actively taking steps to compete. That’s what Walmart is doing at the moment as they try to take on Amazon using technologies like robotics. Like retail, insurance is an industry that stands to benefit immensely from a technology that excels in predicting things. Bad news for the 328,700 claims adjusters, appraisers, examiners, and investigators, who collectively represent over $21 billion in yearly labor costs, good news for our income portfolio.

Sign up to our newsletter to get more of our great research delivered straight to your inbox!

Nanalyze Weekly includes useful insights written by our team of underpaid MBAs, research on new disruptive technology stocks flying under the radar, and summaries of our recent research. Always 100% free.