Artificial Intelligence and Industry Classifications

Table of contents

Table of contents

In the world of stock investing, we can look at all the world’s stocks as a big basket or universe of all available stocks to choose from. We can then start to slice and dice the basket into categories like country, industry, and size. Finance people call these “factors”, and what investors have noticed since as far back as the 1930s is that stocks that fall within a particular factor tend to behave similarly. You may have noticed examples of this happening before, such as when Intel (NASDAQ:INTC) reports strong earnings and all the other chipmakers see a bump in their stock prices as a result. The key takeaway here is that stocks within a particular industry tend to behave similarly. So how can we tell which stocks fall within which industries? It turns out that there are particular industry classifications that a designated authority ascribes to stocks. Perhaps the most popular classification method is known as GICS (Global Industry Classification Standard).

GICS is quite a useful concept to understand for retail investors. It simply consists of a hierarchy that starts at the top with sectors we’re probably all familiar with like Utilities, Consumer Discretionary, or Energy:

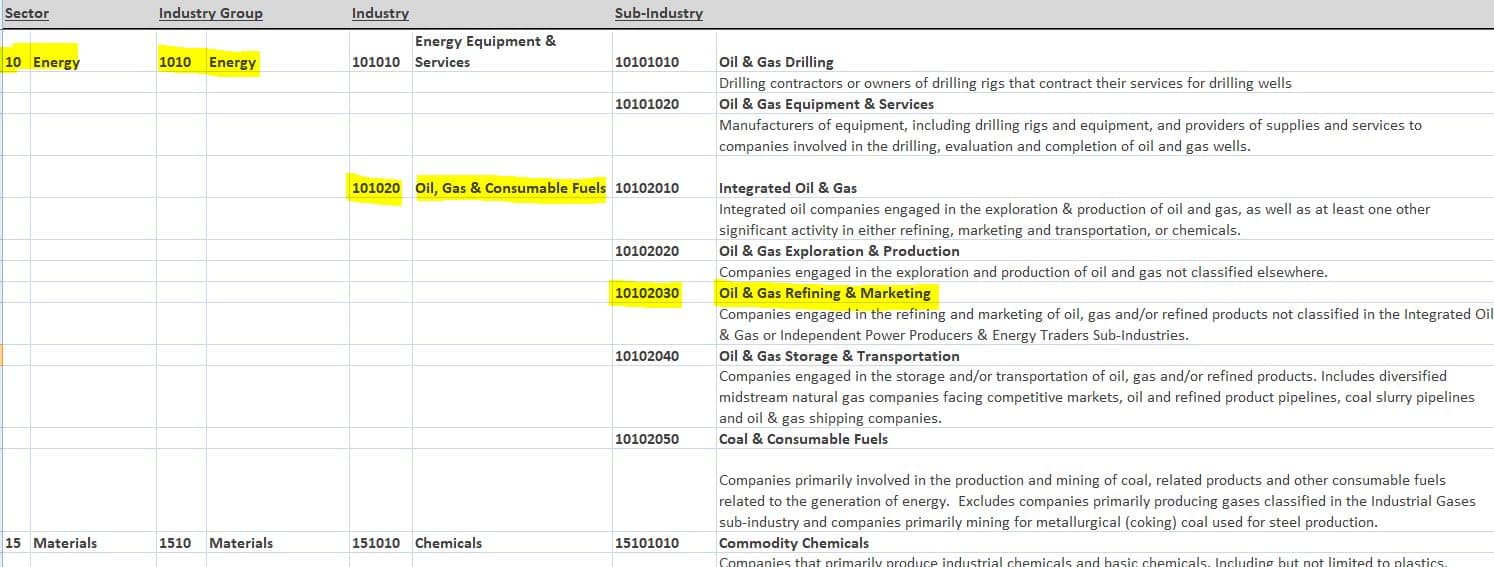

Under each industry are further classifications at increasing levels of granularity. At the very bottom is the “sub-industry” and it makes sense that each stock will belong to a single “sub-industry”. Since each level is designated by a two-digit code, when you get the bottom, you have an eight-digit code that represents “Sector/Industry Group/Industry/Sub-Industry” as seen in the below example:

Quite clever, right? The question now becomes, how do we determine which companies fall within which classifications? This happens through a manual process that looks at fundamental data (essentially all that stuff in a company’s SEC filings) to determine where a company’s revenues are coming from. Historically, the authority behind these classifications (MSCI and S&P Global) have used quarterly earnings reports (10-Q filings in other words) to determine which GICS sub-industry a company falls under by looking at revenue breakdowns in earnings reports. We do this all the time here at Nanalyze. For example, when we were looking at Japanese robot stocks, we wanted to understand the contributions to revenues made by robotics and not some other activity like selling widgets. In the same way, a bunch of John-in-Mumbai types pore through the quarterly earnings reports of all the world’s companies in order to see where they fall within this standard industry classification. Whenever we hear about people doing manual tasks like that, we know that the space is ripe for disruption by AI.

In addition to the manual labor required to actually classify the stocks each quarter, there is also a problem with how subjective these descriptions can be. Two different people might interpret the same description in two different ways. Not only that, but it is very difficult to keep the descriptions up to date. The way that methodology changes have been applied in the past has been nothing short of painful. First, a notice is sent out to all the stakeholders with the proposed change and then a “consultation” takes place where everyone throws in their two cents during a bunch of boring meetings where people exchange business cards and canned platitudes all the while wishing they were anywhere but in said meetings. It takes a lot of time and it wastes a lot of time. Now we may have a different way to approach this.

We’ve talked before about platforms like Alphasense where you can literally ask an AI algorithm natural questions about a company and it will answer them in seconds, questions like “what has management said about capex recently” or “what has anyone said about my company in the earnings call before last“. It only makes sense that we begin using artificial intelligence to allocate stocks within this framework.

Just today, the world’s largest asset manager which oversees nearly $6 trillion in funds, Blackrock (NYSE:BLK), announced that they’re going to start using AI to determine which “buckets” to place stocks in. An article by Reuters today said the following about the announcement:

The actively managed “iShares Evolved” funds will target major industry groupings: financials, healthcare, media, consumer staples, consumer discretionary and, of course, technology. Investors often rely on sector definitions determined by index companies like S&P Dow Jones Indices and MSCI Inc (NYSE:MSCI), who control the Global Industry Classification Standard. Amazon.com Inc (NASDAQ:AMZN) is not considered an information technology company, but is listed alongside auto parts sellers and other retailers as a consumer discretionary stock. Tobacco companies are considered a consumer staple.

The article goes on to say how in today’s world, business models can change very quickly or even be multidimensional. The Blackrock approach will allow for companies to be allocated across multiple sub-industries as well. The announcement is timely considering that GICS is undergoing quite an overhaul to accommodate for the fact that a key sector like “Telecommunications” no longer make sense. They plan to change that sector to “Communications Services”, and it’s probably where they will categorize the world’s biggest distraction platform, Facebook.

The ability for AI to allocate companies according to a pre-determined classification also opens the door to creating entirely new classifications as well. We see such a classification with the increasingly popular Robotics & Automation Index ETF (NASDAQ:ROBO) which now has $1.8 billion in assets (though we don’t believe they’re using AI for stock selection – yet). There are certain “themes” we cover here on Nanalyze that are too granular and complicated to merit their own sub-industry, themes like synthetic biology or the “internet-of-things”. However at least one startup is working on this, one we covered before called Kensho which is using AI to build “21st Century Sectors”:

Of course we arrive at the question we’re all wondering which is, in what industry do we classify artificial intelligence itself?

Which Industry is Artificial Intelligence?

When it comes to “artificial intelligence stocks“, they are far and few between. If you believe the standard line from the talking heads, just invest in Google and you’ve invested in every emerging technology under the sun. Now you can see how silly that statement is in the context of looking at revenues. If we were to pick a “picks-and-shovels AI stock” like NVIDIA, we would see that they are classified under “Semiconductors” which is what we would expect. It hardly makes sense to come up with a new GICS category for artificial intelligence because we’re already at a point where AI is pervasive. If you’re not thinking about using AI in your business, then you’re going to be able to compete. AI is the new electricity, the new oil, the new black, the new everything really.

Of course there is a pitfall when it comes to looking at where revenues come from today, versus where they may come from tomorrow. We learned this lesson when we initially dismissed the top-3 lithium producers as having non-meaningful contributions from lithium to their revenues. Fast forward a few years later and we now see very meaningful revenues contributions from lithium for these top-3 producers. “Skate to where the puck will be” as a famous hockey player once said. (Hockey, along with rugby, are some of the last great sports played by real men who beat the isht out of each other over perceived injustices then go for a beer afterwards.)

Conclusion

In the past, investors were constrained by a lack of data and resources to cleanse the data. Index providers like MSCI and S&P 500 have been able to effectively dictate to the investing community which companies belong in which industries. Now that AI algorithms are able to analyze and SEC filing in seconds while answering natural questions about the contents, it is feasible and economical for investors to start creating their own classifications and indices. Platforms like Addepar further democratize the process, enabling high net worth individuals with the tools they need to operate independently of any single authority. We talked before about how the “smart beta” of tomorrow will simple be an AI algorithm, and it appears that direction is precisely where we’re heading.

Sign up to our newsletter to get more of our great research delivered straight to your inbox!

Nanalyze Weekly includes useful insights written by our team of underpaid MBAs, research on new disruptive technology stocks flying under the radar, and summaries of our recent research. Always 100% free.