How to Invest in Internet of Things (IoT) Sensors

Table of contents

Back in 2013, Science Daily wrote about how 98% of all data was created in the past two years alone. Who knows if that number still holds true today, but we do know that the sources of big data are increasing everywhere we look. This isn’t just because everybody plasters their lives all over social media now, this is because we’re now collecting lots more data around us using things like satellites, and smart sensors for the Internet of Things (IoT). It’s these smart IoT sensors we’re interested in taking a closer look at. When we say “smart sensors”, we’ll use this definition from WhatIs.com:

A smart sensor is a device that takes input from the physical environment and uses built-in compute resources to perform predefined functions upon detection of specific input and then process data before passing it on.

It’s pretty easy to see how these smart sensors fit into IoT. Here are 3 different estimates of market growth for smart sensors:

- Market Research Future – The smart sensors market is growing rapidly over 16% of CAGR and is expected to reach at USD 60 billion by 2022

- MarketsAndMarkets – The smart sensor market is expected to grow from USD 18.58 Billion in 2015 to USD 57.77 Billion by 2022, at a CAGR of 18.1% between 2016 and 2022

- Global Market Insights – Smart Sensor Market worth over USD 80 billion by 2024

All those people are wrong. We had our crack team of MBAs crunch the numbers to come up with our own estimate of USD 59.327 billion at market close on July 17, 2022. With that amount of growth, we want to know how we can invest as retail investors. The problem is that we now need to find out global market share for smart sensors which is a number compiled by the same muppets who produce these seemingly random forecasts of market growth (except us, our MBAs are different). We looked at 4 research firms to see who the biggest global players in smart sensors are today and here’s what we found:

| A | B | C | D | Score | |

| ABB Ltd (NYSE:ABB) | X | X | X | 3 | |

| NXP Semiconductors N.V (NASDAQ:NXPI) | X | X | X | X | 4 |

| Yokogawa Electric Corporation (TYO:6841) | X | 1 | |||

| Analog Devices Inc. (NASDAQ:ADI) | X | X | X | X | 4 |

| Siemens AG (ETR:SIE) | X | 1 | |||

| Eaton Corporation PLC (NYSE:ETN) | X | X | X | 3 | |

| Honeywell International Inc. (NYSE:HON) | X | X | X | 3 | |

| Emerson Electric Company (NYSE:EMR) | X | X | X | 3 | |

| Renesas Electronics Corporation (TYO:6723) | X | 1 | |||

| STMicroelectronics (NYSE:STM) | X | X | 2 | ||

| Infineon Technologies AG (ETR:IFX) | X | X | X | X | 4 |

| TE Connectivity (NYSE:TEL) | X | X | 2 | ||

| Atmel (NASDAQ:ATML) | X | X | 2 | ||

| Invensense (Acquired by TDK) | X | X | 2 | ||

| Robert Bosch (Private) | X | X | 2 | ||

| Sensiron (Private) | X | X | 2 | ||

| Customer Sensor & Technologies Inc. (Private) | X | 1 | |||

| General Electric (NYSE:GE) | X | 2 | |||

| Legrand (EPA:LR) | X | 2 | |||

| Smart Sensors Inc (Private) | X | 2 |

What a fcuking mess. Now at this point in time, we could create a motif and include all of the publicly traded companies listed above or we could take a closer look at any company that was mentioned by at least 3 of these top “research firms”. That would leave us with the following list of 7 companies.

ABB Ltd (NYSE:ABB)

We came across this company before when we were researching robot stocks (another area we’d like to be invested in) so we’re off to a good start here. This is a ginormous company with 2016 revenues of $33.8 billion, 180,000 employees, and a market cap of $54 billion. While browsing through their latest filing, we came across one of the most creative ways we’ve ever seen to announce layoffs:

We have announced our intention to reduce costs by approximately $1.3 billion in connection with our ongoing white-collar productivity savings program

HR people, you can have that one for free. We also came across this breakdown of their revenues by segment:

No, that isn’t backwards. ABB’s revenues have been declining which isn’t a good sign. In that same annual report, the word sensor was only mentioned 9 times. References were made to a recent launch of “ABB’s smart sensor solution for electric motors which can deliver downtime reductions of up to 70 percent, extend the lifetime of the motors by up to 30 percent, and reduce energy consumption by 10 percent“. They also talked about proximity and voltage sensors in the “Electrification Products” division and other sensors in paper and oil industries. We didn’t leave thinking that sensors were a meaningful part of ABB’s business.

NXP Semiconductors N.V (NASDAQ:NXPI)

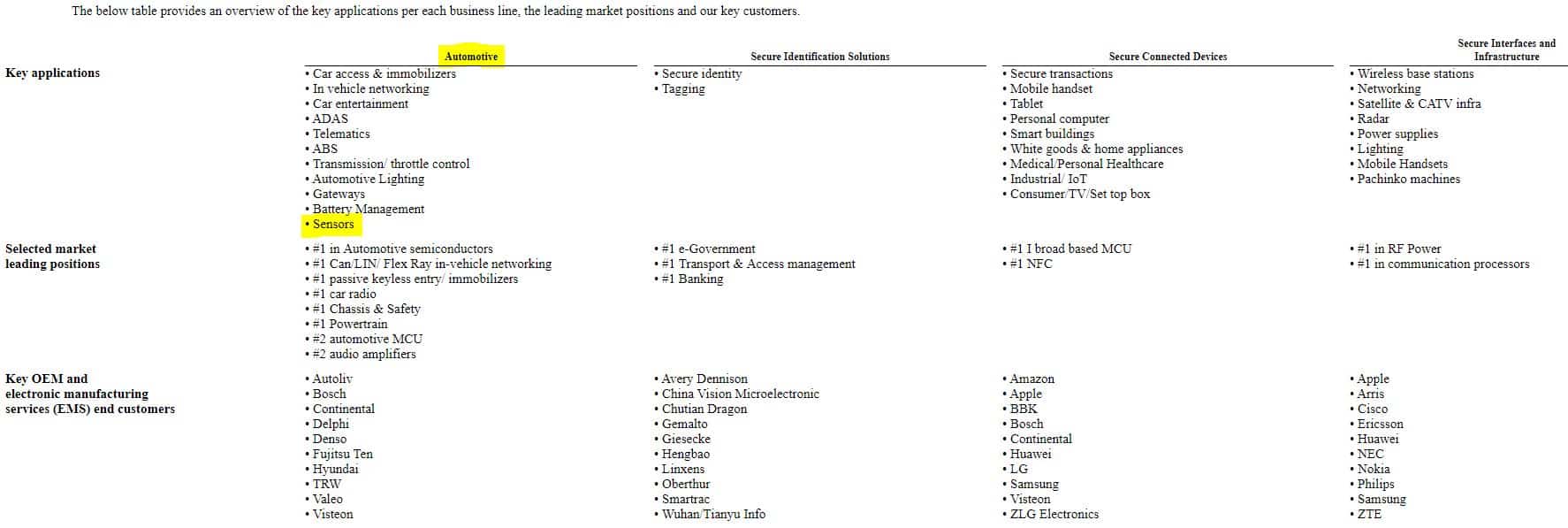

Looks like smartphone chipmaker Qualcomm is going to acquire NXPI for $38 billion. According to an article by Reuters, this is the biggest-ever deal in the semiconductor industry except that now it appears to be stalled due to regulatory approval that’s needed by the European Union. That decision isn’t expected until October at the earliest. Here’s a really cool table we found in their last annual report with one of the 11 mentions of sensors:

Those automotive sensors include inertial sensors for vehicle stability control and airbag crash detection along with pressure sensors in tire pressure monitoring, occupancy detection and engine control. It was nice to see that they’ve specifically called out the Internet of Things as a driver of business growth and specifically mentioned sensors as a key part of that. Sensors aren’t the only “picks and shovels” play on IoT. There’s also embedded microcontrollers and connectivity – short range RF and wireless technology – all of which are areas that NXP plays in as seen above.

Analog Devices Inc. (NASDAQ:ADI)

In looking at their last quarterly report, the word sensor isn’t mentioned once but that’s all just semantics. When we look at the Company’s “About Us” page, ADI says they offer a “broad portfolio of high performance analog, mixed-signal, and digital signal processing (DSP) integrated circuits (ICs) used in virtually all types of electronic equipment“. They go on to say “our signal processing products play a fundamental role in converting, conditioning, and processing real-world phenomena such as temperature, pressure, sound, light, speed, and motion into electrical signals to be used in a wide array of electronic devices“. That sounds like our agreed upon definition of smart sensors so we’re a big yes on including them in our IoT sensors portfolio.

Eaton Corporation PLC (NYSE:ETN)

This $35 billion company breaks down their business into two broad areas – Electrical (Power Management) and Industrial (Hydraulics, Aerospace, and Vehicles). Here’s a look at their revenue breakdown across these segments last quarter:

It appears that their exposure to “sensors” comes from the electrical segments but it’s unclear how meaningful of a contribution that actually is. In looking at their product pages, we can see they have quite a selection of sensors to choose from:

We just don’t know how many of those sensors they’re actually selling.

Honeywell International Inc. (NYSE:HON)

Honeywell is a conglomerate, which means they sell a little bit of everything. Trying to figure out just how much of their revenues come from sensors is an exercise in futility so we’ll just look at the segment level breakdown as follows:

The problem with conglomerates like this is that there are too many moving parts to consider any one area as a “pure play” on anything. The nature of these corporate structures is that they diversify away lots of industry specific risk which is good for investors but bad for those of us who want to find a pure play to invest in IoT sensors.

Emerson Electric Company (NYSE:EMR)

Here we have another conglomerate situation with revenues broken down as follows:

The segment referred to as “Process Control Systems and Solutions” is described as “digital plant architecture that controls plant processes by communicating with and adjusting the “intelligent” plant devices described above to provide precision measurement, control, monitoring, asset optimization, and plant safety” which is precisely where IoT sensors might come into play. The only problem is that segment doesn’t appear to be growing much.

Infineon Technologies AG (ETR:IFX)

This company came about when zee Germans over at Siemens decided to spin out their semiconductor operations into a separate company, which now trades under the name Infineon. The various divisions they operate in include Automotive, Industrial Power Control, Power Management & Multimarket, and Chip Card & Security. Here’s a cool slide which shows how that all breaks down:

Interestingly enough, they acquired a LiDAR company late last year and plan to make low-cost LiDAR a reality.

Sign up to our newsletter to get more of our great research delivered straight to your inbox!

Nanalyze Weekly includes useful insights written by our team of underpaid MBAs, research on new disruptive technology stocks flying under the radar, and summaries of our recent research. Always 100% free.