Calyxt IPO – TALEN Gene Editing in Agriculture

Table of contents

Table of contents

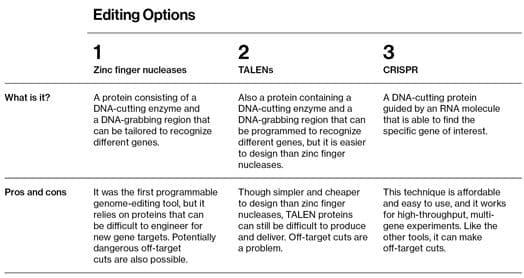

It’s only been a week since we published our article on “GMO vs Gene Editing vs Genetic Engineering“, and we were pleasantly surprised to see that there is now a gene-editing IPO planned that is specifically focused on gene editing in agriculture. We’ve looked at various agriculture startups that keep you fed and even robots that are getting into farming, but an agtech company we haven’t discussed before called Calyxt has now filed for an IPO which means we need to dig in and see what this is all about.

About Calyxt

Members of the Cellectis management team actually invented TALEN, and the company has all the intellectual property wrapped up even going so far as to trademark the name “TALEN”. Even with all the promises of gene editing, investors haven’t been too excited about the potential of TALEN. Since their IPO in April 2015, shares of CLLS have lost -27% of their value. Now Cellectis is looking to spin out the agricultural applications of TALEN into their proposed IPO, Calyxt, which has a product development pipeline that looks like this:

The consumer-centric products seen above will try and appeal to people’s desire to be healthier, especially in the face of the obesity epidemic facing America. The farmer-centric products will focus on increasing crop yields. Through this IPO, Calyxt is looking to raise $50 million in order to execute on this product pipeline. Their first product candidate, a high oleic soybean designed to produce a healthier oil, has zero trans fats and reduced saturated fats, and is expected to be commercialized by the end of 2018.

As you would expect, Calyxt hasn’t generated any meaningful revenues yet. So far they have successfully edited more than 20 unique genes in 6 plant species since they began in 2010. They simultaneously deactivated all six copies of a gene within a single wheat plant with the purpose of increasing fiber content. Their technology which focuses on five core crops—soybean, wheat, canola, potato, and alfalfa – is protected by 81 issued patents and 170 pending patent applications.

What we found interesting about Calyxt is that they’re not planning on an “Intel inside” licensing model but instead they want to get deeply involved in the entire farming life cycle. Their strategy is to partner with farmers to grow premium products and then buy these from the farmers. They will then contract with processors to create specialty food ingredients which they will market directly to food manufacturers. This is their second year of multi-location field trials in Minnesota and South Dakota and in 2016, 45,000 bushels of soybean seeds were produced by their farmers resulting in established supply chain partnerships. This vertically integrated business model for their soybean product presents three potential revenue opportunities:

- Seed sales to farmers

- Oil sales to food companies

- Meal sales to animal feed companies

While the argument for having a vertical business model is that you can achieve better margins, it just seems like a whole lot of work which comes with lots of additional risk. Are they a gene-editing company that dabbles in agriculture or an agriculture outfit that dabbles in gene editing? Looking at the leadership team, the CEO has a 20-year career in the ag biotech and seeds industry including experience at Monsanto while the Chief Science Officer was one of the people who invented TALEN. Calyxt clearly believes that they can do both equally well.

In addition to the regulatory and public perception risks that all GMO food companies face, Calyxt also faces competitive risks. Just yesterday, SynBioBeta published an article about DuPont continuing to license CRISPR gene-editing technology for all agricultural uses:

DuPont Pioneer (DuPont) and ERS Genomics (ERS) announced a technology license agreement whereby DuPont gains exclusive rights to the ERS patent portfolio covering CRISPR-Cas genome editing technology for all agricultural uses and applications in plants. ERS was formed to commercialize the foundational intellectual property (IP) of the CRISPR-Cas technology from co-inventor and co-owner Emmanuelle Charpentier, Ph.D. The licensing agreement with ERS complements DuPont’s previously announced CRISPR-Cas licensing and collaboration agreements with Caribou Biosciences and Vilnius University.

The most basic need we all have is for food and water, and with the earth close to capacity and no signs of a slowdown in population growth, the only way we can feed all these people is by becoming more efficient.

Conclusion

The “investing in food” thesis is compelling but this particular play on food seems to have lots of moving parts and lots of risks. For a play on agriculture, our portfolio contains Archer Daniels Midland (NYSE:ADM), a company that’s been paying a dividend and increasing it every single year for 42 years straight now. ADM’s yield is just over 3% right now and that sort of stable income is an opportunity cost that needs to be taken into consideration when looking at buying shares of Calyxt should the IPO go through.

Sign up to our newsletter to get more of our great research delivered straight to your inbox!

Nanalyze Weekly includes useful insights written by our team of underpaid MBAs, research on new disruptive technology stocks flying under the radar, and summaries of our recent research. Always 100% free.

Analysts see upside +142%.

Path to profitability in 2023.

I opened a small position today as the stock looks attractive.

Analysts see lots of things and most of it is just white noise.

It’s great to see Calyxt has revenues coming in! At a market cap of under $200 million, we’ll need to see that go up 5X before we consider investing in it. You’re a bigger risk taker than we are. Hope that position does well for you man!