Is Bitcoin Investment Trust (GBTC) a Bitcoin Stock?

Table of contents

Table of contents

If you’ve been watching the news lately, you’re probably sick and tired of hearing from all the armchair Uber CEOs who think that they know what’s best for the biggest startup on the entire planet. You’re probably also sick and tired of hearing about U.S. politics, North Korea’s saber rattling, and the growing list of people who claim everything is wrong with STEM but aren’t actually in STEM. If things keep going the way they are, it seems like you’ll be adding one more item to that list, bitcoins.

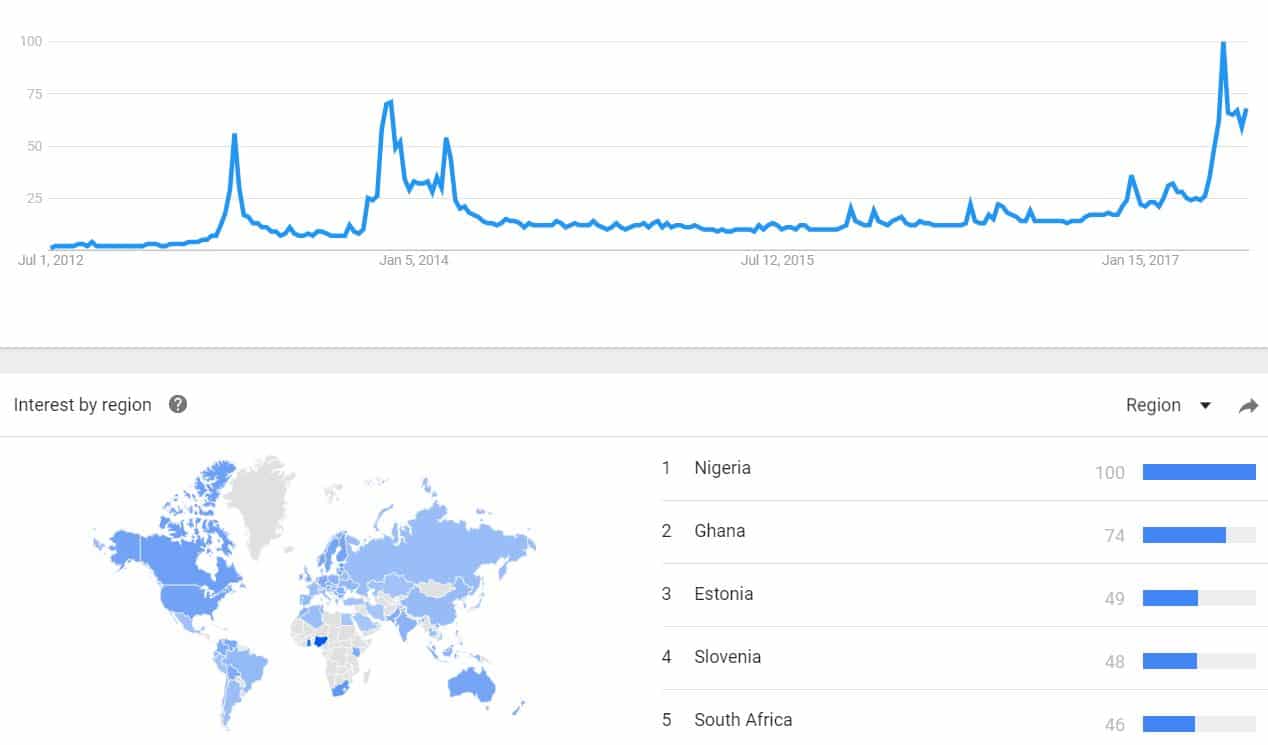

Now the first thing we found alarming with the above picture was which countries are most interested in bitcoins. First in the list we see Nigeria. Most people probably don’t realize that Nigeria is a country of 182 million people. That makes Nigeria 7th in the world by population, and the largest in Africa (there are 54 in total). As with every country, you will find some bad apples. The problem with bad Nigerian apples is that they’re incredibly good at what they do.

Next in the list is Ghana. Have you ever ever heard of the Sakawa boys?

These guys actually use “magic” to scam people. They drive Range Rovers and live like total ballers because they’re good at what they do – and because they use magic. And what about Estonia? Well, you may have heard that country’s name mentioned before in the context of hacking. Again, not all Estonians are hackers but they do seem to have a bit of a reputation.

While the list of undesirables who are interested in bitcoin probably goes on and on, the message here is very clear. Bitcoins can be risky business and criminals smell easy money. This is why we put together a “A Basic Intro to Cryptocurrencies for Dummies” for our lovely readers. While researching that article, we had a few additional realizations as follows:

- Many of the people who are buying this stuff up are not experienced investors and will be subject to the emotional roller coaster best described in the book “Reminiscences of a Stock Operator“. This means that we should expect extreme volatility.

- These same inexperienced investors are likely to panic very easily causing the market to fall out from under this thing in a hurry

- There are tons of cryptocurrencies out there and no barriers to entry for creating new ones

- There is nobody to sue or hold accountable if the technology blows up

- Certain allocations of bitcoin have disappeared forever and can never be recovered. With an infinite horizon, bitcoin should disappear entirely.

With so many technical pitfalls that people can encounter, it’s no surprise that some would look for an investment vehicle that gives them assurance in their cryptocurrency investments – a “bitcoin stock”. When people start looking for a bitcoin stock, they will likely come across the “Grayscale Bitcoin Investment Trust (OTCMKTS:GBTC)”. You may notice that GBTC trades on the over-the-counter (OTC) market. If you’re a regular reader, you know how we feel about anything that trades on the OTC market (with some exceptions like ADRs). That’s why the first thing we need to do here is figure out who is behind GBTC.

About Grayscale

Now let’s move on to Grayscale Bitcoin Investment Trust (OTCMKTS:GBTC). This vehicle trades on the OTC market but we can be certain that the founder has a legitimate background, previous success stories, and has created a name for himself in the business. You’ll hardly ever see that with most OTC companies because someone of that caliber would not be involved in an OTC company. GBTC uses the OTC market to trade because regulations require it to. While there’s a 202-page document detailing the GBTC investment vehicle, the short story is that it is meant to reflect the price of bitcoin at any given time. It’s not a “bitcoin stock” but rather a “bitcoin fund”. Now here’s where you need to pay attention.

While GBTC is the first publicly traded bitcoin fund, it is not registered with the SEC and none of the fund’s annual reports are reviewed by regulators. The fund may transact with 3rd parties which is an added layer of risk. The fund needs to hold their own bitcoin wallets, which are subject to the same risks everyone faces (though to be fair, this guy would probably be the person who we’d feel most safe with, given his expertise). All those feelings of warmth and security are going to cost you 2%. Remember our recent article where we talked about robo advior fees? You’d be hard pressed to find anyone who doesn’t think an annual rate of 2% is pretty steep.

While the GBTC sales pitch is mainly that you can avoid the “challenges of buying, storing, and safekeeping bitcoins“, we’re not sold totally on that value proposition. Just 10 days ago we showed you how to easily buy bitcoin and get free bitcoins in the process. We’ve accumulated some bitcoins already using Coinbase and the whole thing couldn’t have been easier. While we know that some dudes with bad juju are looking for us, we’re pretty sure they wouldn’t be interested in such a small catch. In addition to mitigating this risk, “bitcoin stock” GBTC appeals to people who need the investment to be structured like a stock. For example, you can’t use the funds in your self-directed IRA to buy bitcoins on Coinbase, but you can buy GBTC. Just to be clear, you definitely shouldn’t be betting your retirement on bitcoins, even if the chart looks like this:

Another likely buyer of GBTC could be institutional funds that want exposure to the bitcoin theme. While many funds are restricted from buying OTC stocks, some exotic funds may find this to be the perfect solution for exposure to bitcoin. Catherine Wood of Ark Investments was talking a few weeks about how bitcoin is one of 7 disruptive technologies that could be worth trillions of dollars. Ark bought shares of GBTC as part of the Ark Innovation ETF (NYSEARCA:ARKK). Speaking of Ark, we looked at their 3D Printing ETF (BATS:PRNT) a while back and were skeptical about the composition but still, they have an entire firm dedicated to putting these funds together. All we have are some MBAs who can type 60 wpm and recite Porter’s 5 Forces in their sleep.

Sign up to our newsletter to get more of our great research delivered straight to your inbox!

Nanalyze Weekly includes useful insights written by our team of underpaid MBAs, research on new disruptive technology stocks flying under the radar, and summaries of our recent research. Always 100% free.

One feature of GBTC is the premium to NAV that it trades on which in past year has ranged from almost nothing to over 100% and has been close to that for a couple of weeks. There are data and a chart on the Grayscale home page.

Hi Gareth,

Thank you for bringing up a very important point Gareth.

You describe “NAV premium” as a “feature” when in fact we would say it is a negative thing in this context. If you immediately liquidated this fund based on the current price of bitcoin, you would expect the money received to be equal to the actual value of the fund. This is because the fund states that the purpose is to track bitcoin. If the fund trades as a premium to NAV, that’s a bad thing because you are paying more for bitcon than you would if you just bought bitcoin yourself. In this case it seems, a huge amount more.

Our understanding is that each share of the fund represents 1/10 of a bitcoin. If that’s the case, why is the fund priced at $396 when a tenth of a bitcoin is $240? Are we missing something here?

Hey guys! I’m an early adopter of bitcoins and I’m reading huge rewards! You may not afford to buy large quantities now, but still, there are lots of earning opportunities in the bitcoin ecosystem. One of them is bitcoin binary options trading. You simply analyze the market and “guess” whether the bitcoin price will go down or up and you earn money! Check out this unique binary options broker offering instant payments

Glad to hear you are “reading” huge rewards. Binary options trading is the equivalent of gambling. You’ll need to go peddle that garbage somewhere else Jessica.

I considered this as a heads up! GBTC not being registered in SEC? But anyhow, I have been in bitcoin trading and I’m learning and staying my bet low as possible. I need to take extra effort to believe that I can put a good bet. Again, I agree that its like gambling that’s why just hitting the right bet as possible and self-control at times.

Thanks for sharing this! It’s very informative.

You’re correct. If we wanted to gamble we’d head to Vegas and play some blackjack.