Why Has the Guggenheim Solar ETF (TAN) Underperformed?

Table of contents

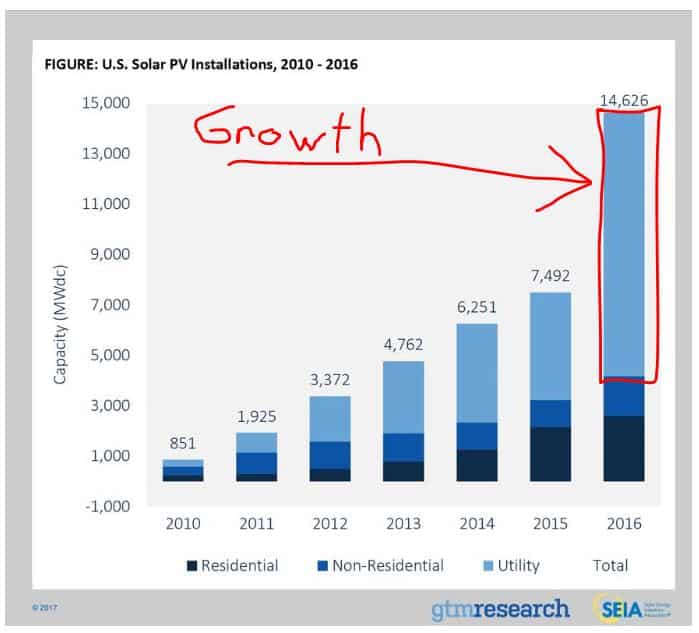

In a recent article, we were raving about the incredible growth of the US solar industry over the past year. With a +95% growth in installations mainly driven by photovoltaics (PV), last year was truly record-breaking for solar energy. For those of you unfamiliar with the term, PV is what usually comes to mind when thinking about solar power – panels that directly convert sunlight into electricity. If we add the rest of the world, global capacity growth still remains above a whopping +50% with the U.S. first and China second. The U.S. is clearly leading the growth charge as seen below:

Given the fact we’ve been invested in the Guggenheim Solar ETF (NYSEARCA:TAN) for the past 5 years, we happily started eyeing yacht catalogs and booking trips to over-priced all-inclusive resorts in the Bahamas. Checking on our investments though, we found TAN had a dismal -26% performance. Now, before we start chastising ourselves for making such poor investment decisions, we need to know how the overall market performed. It’s actually way worse than we originally thought:

- If we held a NASDAQ tracker ETF for the last year, we would have made +26% compared to a -26% loss by holding TAN

- If we held a NASDAQ tracker ETF for the last 5 years, we would have made +97% compared to a -21% loss by holding TAN

- If we held a NASDAQ tracker ETF since April of 2008, (when TAN started trading) we would have made +151% but instead, we lost -93%

With such growth in the industry, this is puzzling to say the least. Looking a bit more closely, there are some worrying details to this picture.

While installations soared, solar prices dropped -29% over the course of 2016. This had a compounded effect on manufacturers, who are running big factories and are not able to adjust their cost structures quickly (if at all). Their margins suffered a major blow because of this, and the financial effect of the price drop was postponed as installations of previous contracts (negotiated at higher prices) were still rolling out in 2016.

Industry outlook for 2017 is also looking grim. Government incentives for solar investments are being cut or axed. The UK has already started to do so in 2015, and China, a leading global market has reduced feed-in tariffs in 2016 (feed-in tariffs are paid by the electricity utility to the PV electricity producer under a multiyear contract, and are set by the government). In addition, there are widespread expectations that the U.S. will cut investment tax credits for solar, which is currently a major incentive representing somewhere around a 30% discount.

Currently, the drop in prices and margins as well as the outlook for 2017 suggest short term challenges for solar players, and may result in some industry consolidation ahead. With solar being a viable alternative to more traditional sources of energy, this space remains very interesting to us as investors. The problem is, we can’t figure out how to invest in solar. Let’s take a look at how the stocks in the TAN ETF performed versus their financials.

| Name | Weight | 1 Year Performance | Revenue Change | Operating Profit Change |

| TERRAFORM GLOBAL INC | 1.42% | +83.59% | 218% | -1393% |

| TERRAFORM POWER INC | 4.42% | +27.83% | 43% | -115% |

| ATLANTICA YIELD PLC | 5.46% | +21.85% | 23% | 17% |

| CHINA SINGYES SOLAR TECH | 1.61% | +11.90% | 25% | 15% |

| HANNON ARMSTRONG SUSTAINABLE | 4.48% | +7.76% | 15% | 42% |

| SCATEC SOLAR ASA | 3.10% | +7.66% | 23% | -49% |

| GCL NEW ENERGY HOLDINGS LTD | 3.79% | +6.33% | 226% | 217% |

| DAQO NEW ENERGY CORP-ADR | 1.79% | +5.91% | 26% | 237% |

| VIVINT SOLAR INC | 1.01% | -0.66% | 111% | 38% |

| HANWHA Q CELLS CO LTD – ADR | 1.74% | -7.71% | 133% | 500% |

| CAPITAL STAGE AG | 2.98% | -11.33% | 26% | -12% |

| XINYI SOLAR HOLDINGS LTD | 9.37% | -13.49% | 55% | 96% |

| JINKOSOLAR HOLDING CO-ADR | 3.84% | -15.47% | 61% | 41% |

| GCL-POLY ENERGY HOLDINGS LTD | 9.78% | -17.03% | 29% | 138% |

| 8POINT3 ENERGY PARTNERS LP | 3.51% | -17.26% | 426% | 275% |

| SUNRUN INC | 3.67% | -17.92% | 49% | 2% |

| CANADIAN SOLAR INC | 5.32% | -24.01% | -18% | -62% |

| SOLAREDGE TECHNOLOGIES INC | 4.73% | -34.53% | -13% | -30% |

| JA SOLAR HOLDINGS CO LTD-ADR | 3.16% | -36.14% | 20% | 31% |

| SMA SOLAR TECHNOLOGY AG | 2.48% | -47.59% | -4% | 107% |

| REC SILICON ASA | 2.69% | -51.74% | -18% | -153% |

| FIRST SOLAR INC | 8.63% | -53.86% | -49% | -439% |

| SHUNFENG INTERNATIONAL | 2.49% | -62.67% | 31% | -78% |

| SUNPOWER CORP | 4.04% | -66.98% | 62% | -124% |

| MEYER BURGER TECHNOLOGY AG | 4.50% | -77.09% | 40% | 42% |

There are a few things to note in this table. The squeeze on margins is evident with 6 companies posting increasing revenues but decreasing profits. Sunpower and First Solar are implementing costly and hopefully productive restructuring initiatives. Terraform Global has been acquired by Brookfield Asset Management with a 50% premium over their 16 September 2016 share price along with Terraform Power’s controlling stake, so movement in the market is evident. It is puzzling to see 9 companies with seemingly sound financials, increasing revenues and operating profits, but with dropping share prices. Could these be driven by higher costs due to increased capacity? Is it because of the market outlook? Let’s investigate the top-3 and bottom-3 performing ETF constituents further.

Top-3 Performers for TAN

Terraform Global (NASDAQ:GLBL)

TerraForm Global was founded and partly owned by SunEdison, the troubled clean energy giant. It was established to buy and operate the parent’s clean energy power plants and saw an IPO in July 2015. SunEdison went bankrupt due to cash flow issues ending their acquisition spree in April 2016, and GLBL was then taken over by Brookfield Asset Management on 7 March 2017 as we mentioned earlier. GLBL has a portfolio of 31 wind and solar power plants totaling 952 MW of capacity spread across high-growth emerging markets.

GLBL says their business strategy is to own and operate a portfolio of renewable energy power plants and to pay cash dividends to their stockholders. They have paid dividends twice so far, in November 2015 ($0.1704) and March 2016 ($ 0.275). Current share price stands at $4.75, with performance since inception a dismal -66.07%. GLBL posted major losses in 2015 and their 2016 annual report is not published yet. We can’t help thinking that the Brookfields acquisition premium helped their stock performance greatly.

So what about investing in Brookfield? They’re a giant Canadian firm with assets as follows:

As we can see, Brookfield is hardly a pure play on solar.

Terraform Power (NASDAQ:TERP)

The sister company to GLBL, TERP is doing exactly the same but in developed markets. Their current portfolio has close to 3,000 MW capacity, made up of 48% solar and 52% wind power plants. TERP saw an IPO in July 2014 and performance has been -61.68% since inception. Brookfields Asset management acquired a 51% stake in them on 7 March as well.

TERP’s operating income has been stagnating since 2012, and increasing debt financing expenses have pushed the company further in the red in 2014 and 2015. We are interested to see how Brookfields will be able to manage the challenges facing TERP and GLBL, as their fundamentals point to financing issues and recent positive performance comes from a low base after share prices dropped significantly post IPO for both.

Atlantica Yield (NASDAQ:ABY)

With a market cap of $2 billion, ABY owns and manages a portfolio of contracted assets in the power and environment sectors. Their current portfolio is made up of 22 assets generating 1,442 MW of renewable energy, 300 MW of conventional power plus 1,099 miles of electric transmission lines and 10.5 Mft3 per day of water assets.

According to their 2016 annual report, revenues increased by 23% and adjusted EBITDA by 21% while they also decreased debt levels and successfully refinanced the remainder of their debt. Since ABY’s IPO in June 2014, the company has been paying quarterly dividends until November 2015 and restarted in August 2016 after a gap of 2 quarters. Performance since IPO has been -44.89% after their shares suffered a major drop in Q3 2015. Dividend amounts are sporadic and current dividend yield is 4.8%.

Bottom-3 Performers for TAN

Shunfeng International (HKG:1165)

According to their website, Shunfeng International is an integrated photovoltaic service provider engaging in solar power stations constructions and operations, solar products manufacturing as well as solar energy storage. Their interim 2016 report quotes impressive growth, +33% in both solar power generation and solar products sold to third parties. Shunfeng’s power generation capacity stands at 1,589 MW. While revenues and gross profit increased, so did cost of sales, administrative costs and costs attributed to research, resulting in a -68% drop in profits and a -3.7 percentage point drop in profit margin to a mere 1.2%.

Sunpower Corp (NASDAQ:SPWR)

SPWR has been around since 1985 and was listed in November 2005. They are a manufacturer of residential, commercial and utility-scale solar equipment and systems, and claim to provide cells with the highest conversion efficiency in the world. Their latest financials show recovering revenues: after dropping to half in 2015, SPWR posted a +62% increase in revenues in 2016 but gross margins dropped by -22%. Higher costs drove the company deeper into the red, generating -133% operating loss before tax. SPWR is another victim of lower prices and increasing costs, but their long history and strong value proposition may help them weather the storm.

Meyer Burger Technology (SWX:MBTN)

MBTN is a Swiss specialist in semiconductor technologies with a focus on photovoltaics. Their financials look better than their stock performance: sales increased +40%, EBITDA turned positive for the first time in 5 years and net losses decreased by +42%. While currently operating at a loss, if this trend continues MBTN will be able to generate profits shortly. The company is forging ahead with 10% of net sales reinvested in R&D, increasing focus on photovoltaics and consolidating their debt-to-equity position, so it’s worth keeping an eye out for developments in 2017.

Conclusion

So, Can We Invest in Solar? Some of our readers have asked us how they can invest in solar. We have that same question today. An ETF is the preferred investment vehicle because it offers diversification, but so far we’re getting hammered by holding TAN. Maybe now is the time to invest, but the macroeconomic outlook isn’t favorable. Can anyone shed any insights here as to what the way forward is for wannabe solar investors like ourselves? Stay tuned as we try and answer this question in coming articles.

The Invesco Solar ETF is the only available ETF for solar energy. Is it compelling enough to invest in? Find out in the “Nanalyze Disruptive Tech Portfolio Report,” a complete list of disruptive tech stocks and ETFs we’re holding. Now available for all Nanalyze Premium annual subscribers.

Sign up to our newsletter to get more of our great research delivered straight to your inbox!

Nanalyze Weekly includes useful insights written by our team of underpaid MBAs, research on new disruptive technology stocks flying under the radar, and summaries of our recent research. Always 100% free.