Robo-Advisors, AI, and Asset Allocation

Table of contents

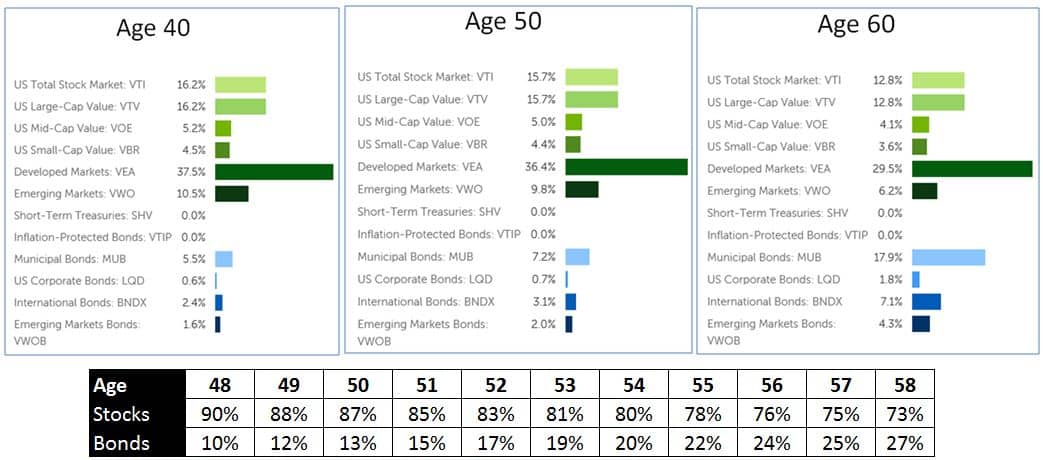

We’ve talked about robo-advisors before and concluded that these are just the same tools that private wealth managers use for their clients except now they’ve been sent up to live in “the cloud“. If we take a step back though and look at the actual service being rendered here by both a robo-advisor and a human financial advisor, it’s basically what people in finance call “asset allocation”. This is simply determining how much of your money should be in bonds/stocks/cash, usually based on your risk profile and age. That’s it. In the case of robo-advisors, they break this out a bit more into types of equities (international vs. domestic / size) and different types of bonds (municipal/corporate/varying duration), all of which charge ridiculously low fees:

Now that we understand that the primary service offered by a robo-advisor is asset allocation, let’s dispel another myth that seems to be permeating financial media. Just take a look at yesterday’s article in the Financial News:

This needs a caveat which is that the majority of robo-advisors today do not employ artificial intelligence despite the name “robo” making them sound like they do. Startups like Betterment that manage your money will use linear asset allocation algorithms to change your portfolio over time as seen below:

Before we go any further, here’s a key question. How do we benchmark Betterment’s performance? In other words, how do we know if their asset allocation formula is better than anyone else’s?

Benchmarking Robo-Advisors

We’ve talked before about how “passive management” is where a portfolio manager tracks a benchmark – like MSCI ACWI – which tracks all global stocks (ACWI stands for All Country World Index). On the other hand, “active management” is where a portfolio manager charges you extra fees so that he can use everything they learned in their MBA to outperform the market, and 86% of the time, their MBA lets them down. That’s a horrible track record, so how can you tell if your active asset manager falls into that 86% of under-performers? You compare their performance to a benchmark (after subtracting fees of course).

So what sort of benchmarks can we use for robo-advisory offerings? Well in our experiences, firms will use what’s called a “reference portfolio” which is simply a weighted mix of a stock index and a bond index. If you wanted to match the robo-advisor more closely, you could even rebalance the mix every so often using the same weighting schedule like the one seen above. The problem is that you would need to do that for each individual case. Few retail investors will take the time to do this. Why is this not a bigger issue? Mainly, it’s much less of a concern because these robo-advisors are charging you next to nothing for the service. Bringing on the staff needed to make more “active” asset allocation decisions beyond a linear algorithm will result in higher costs and it then becomes important to see if those added fees come with a performance increase.

Artificial Intelligence and Asset Allocation

Now that we have an idea of how to benchmark robo-advisors, we can now start to think about how artificial intelligence can be applied to asset allocation. Since all a robo-advisor does is allocate your dollars across a mix of cash bonds and stocks, the AI would presumably allocate differently based on some delicious “big data” you’re feeding it. One startup that is using artificial intelligence for asset allocation decisions is Responsive. As the name implies, Responsive will re-balance your asset allocation based on market events like the 2008 Great Recession:

In hindsight, it’s pretty easy to see that this would have been a good allocation switch to make, but just because you stress tested your AI strategy and it made sense historically, it doesn’t mean you can provide any assurance that it will perform optimally going forward. Let’s put it this way. People are stress testing strategies and implementing them all the time and they still manage to under-perform 86% of the time. Our ideal artificial intelligence algorithms are always praised by “how human” they are so let’s hope in this case these AI algorithms don’t act human. Seems like rules based is the whole point of asset allocation as it removes bias, but who are we to say. This is ARTIFICIAL INTELLIGENCE man and it’s finally here! Response charges 80 basis points (.80%) for anything under $200,000 USD so that’s about as expensive as an actively managed mutual fund. Let’s hope they can show better returns than most actively managed mutual funds.

Conclusion

As the hype behind artificial intelligence continues to grow, it’s important we stay grounded when it comes to our expectations of what AI brings to the table. Here are some key takeaways from our research:

- The performance of robo-advisors cannot be benchmarked easily and is unique to each individual situation (based on your age)

- Asset allocation decisions are a form of active management and active managers have a track record of really sucking at what they do

- Artificial intelligence used for asset allocation in robo-advisors is not common today even though the media would lead you to believe otherwise

- We should see an explosion of AI-powered robo-advisors which is nothing more than active management at a higher level

- The extent to which AI contributes to performance will be difficult to tell by listening to the marketing spiels of robo-advisors

The big question here is what value can artificial intelligence bring to the asset allocation decisions made by robo-advisory firms? Just because you hire a few cognitive researchers and have them tweak your linear asset allocation model doesn’t mean that you “use artificial intelligence”. The whole appeal of robo-advisors right now is the low fees. Just how much are you going to charge in additional fees to accommodate the use of AI in your robo? More importantly, how will you show that using AI (and the added fees that came with that) can benefit retail investors over the long run and in a meaningful manner?

Sign up to our newsletter to get more of our great research delivered straight to your inbox!

Nanalyze Weekly includes useful insights written by our team of underpaid MBAs, research on new disruptive technology stocks flying under the radar, and summaries of our recent research. Always 100% free.