The Top 12 Venture Capital Firms You Should Know About

Table of contents

Table of contents

An expert knowledge of finance isn’t a prerequisite to writing good content about investing. Sure, it helps to know some of the terminology like what the “efficient market hypothesis” is but when all is said and done, we’re here because we want to identify the most exciting emerging technologies out there that have a high likelihood of commercial success and then figure out how we can invest in them ourselves, whether through buying pre-IPO shares or by investing in the few exciting publicly traded companies out there like Illumina (Genomics) or Nvidia (AI/VR).

The fact remains though that the majority of exciting emerging technology companies today are startups. Take artificial intelligence (AI) for example. Some estimates put the number of AI startups at well over 1,500. How can we possibly determine which of these 1,500 companies will succeed? The three metrics we look at first are:

- Who is backing the company?

- What are the founder’s credentials?

- How much money have they taken in?

The most important of these 3 metrics is the first one. If a high-profile venture capital (VC) firm invests in a startup, you can bet your azz they grilled that founder and vetted them far beyond what we’re capable of doing from our stiff-backed office chairs. These VCs would laugh at any founder who doesn’t show them every single detail about the startup they plan to put their investors’ money in. You know how much of those financial details a startup would give us if we asked? Eff all.

When looking at which VCs our writers should be paying special attention to, we wanted to come up with a list of the top-10 venture capital firms out there. Why 10? Because it’s easy enough for our writers to get accustomed to 10 names, but it’s not realistic to have them memorize the VC 100. We looked around awhile for a top-10 VC list and then decided that the only way forward was to build one ourselves. We wanted to use some meaningful measures such as:

- How many successful exits they’ve had

- How much assets under management (AUM) they have

- What’s the popular opinion among VCs about them

- What’s the pedigree of their partners

The first thing we did was take a look at the top 100 venture capitalists out there according to the bright minds over at CB Insights. “Venture capitalists” are the guys and gals who work at “venture capital firms” so this is essentially just identifying the star employees. Since employees should be your greatest asset, we selected all firms with 3 or more star employees:

- Accel Partners – 5

- Sequoia Capital – 5

- Kleiner Perkins Caufield & Byers – 5

- Benchmark Capital – 4

- Bessemer Venture Partners – 4

- Lightspeed Venture Partners – 4

- New Enterprise Associates – 4

- Index Ventures – 3

- Khosla Ventures – 3

- Meritech Capital Partners – 3

Next, we came across a list of top-20 VC firms from CB Insights based on what general partners in 70 VC firms thought in response to a peer ranking survey conducted by CB Insights. Among these venture capital firms there are most likely lots of behind-the-scenes politics going on, and some of these partners have massive egos for well-deserved reasons. When this survey was run, Anand over at CB Insights actually found out that one of the VCs participating had created a script to “fake votes”. That’s how serious these guys and gals take this. When all the votes were tallied and the cheaters chastised, here’s the resulting top-10 VCs according to a group of 70 venture capital firms:

- Sequoia

- Benchmark Capital

- Accel Partners

- Greylock Partners

- Andreessen Horowitz

- Union Square Ventures

- First Round

- Bessemer Venture Partners

- Kleiner Perkins Caufield & Byers

- New Enterprise Associates

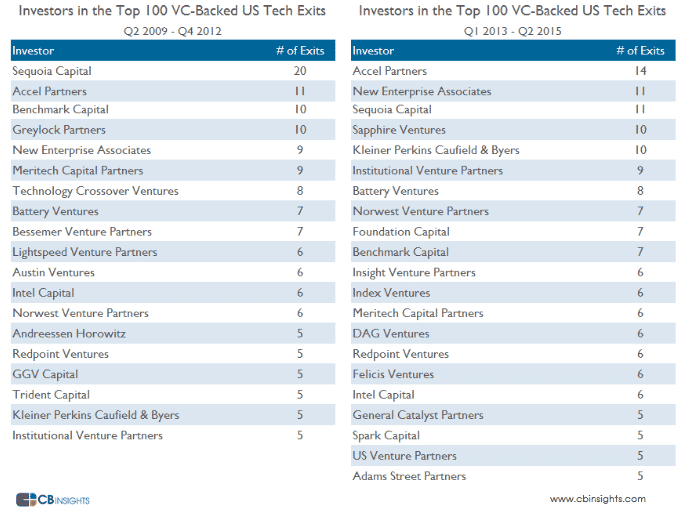

The firms above in green text were also found on our first list. Next, let’s look at CB Insights data on the largest successful tech exits for two periods of time over a recent 6-year timeframe:

So after looking at these 3 metrics from CB Insights (popularity, tech exits, and super stat employees), we’re now able to create a chart that shows the top VC firms based on these metrics:

| Star Employees | VC Peer Rankings | Exits A | Exits B | Total Points | |

| Accel Partners | X | X | X | X | 4 |

| Sequoia Capital | X | X | X | X | 4 |

| Kleiner Perkins Caufield & Byers | X | X | X | X | 4 |

| Benchmark capital | X | X | X | X | 4 |

| Bessemer Venture Partners | X | X | X | 3 | |

| New Enterprise Associates | X | X | X | X | 4 |

| Index Ventures | X | X | 2 | ||

| Khosla Ventures | X | 1 | |||

| Meritech Capital Partners | X | X | X | 3 | |

| Lightspeed Venture Partners | X | X | 2 | ||

| Greylock Partners | X | X | 2 | ||

| Andreessen Horowitz | X | X | 2 | ||

| Union Square Ventures | X | X | 2 | ||

| First Round | X | 1 |

If we remove the two firms that only received 1 point, we’re left with 12 VC firms. If you familiarize yourself with these firms, you can avoid any embarrassment should you find yourself in a hipster bar in Silicon Valley at some point in your life:

| VC Firm | Founded | Fun Facts | Visits |

| Accel Partners | 1983 | Funded more than 300 companies including Facebook, Spotify, DJI, Jet.com | 54K |

| Sequoia Capital | 1972 | Backed companies that represent $1.4 trillion in stock market value (22% of NASDAQ) | 174K |

| Kleiner Perkins Caufield & Byers | 1972 | 500 ventures backed like Google, Amazon, Genentech, AOL, Electronic Arts, Sun Micro | 77K |

| Benchmark Capital | 1995 | Extremely focused “maverick” 5-partner fund – last decade returns of 1,000% net of fees | 62K |

| Bessemer Venture Partners | 1911 | Oldest VC in the U.S., over 100 IPOs, funded LinkedIn, Yelp, Pinterest | 56K |

| New Enterprise Associates | 1977 | World’s largest VC ($18 billion AUM), invested in 650 companies, 500 liquidity events | 35K |

| Index Ventures | 1996 | 160 companies funded like Dropbox, Etsy, Supercell, Squarespace | 37K |

| Meritech Capital Partners | 1999 | Invests in late stage investments, funded Facebook, Cloudera, Salesforce.com | 5K |

| Lightspeed Venture Partners | 2000 | Backed 200 companies like Doubleclick, Informatica, Snapchat, Solazyme | 19K |

| Greylock Partners | 1965 | Early-stage focus, funded Facebook, LinkedIn, Airbnb, Instagram, Workday | 112K |

| Andreessen Horowitz | 2009 | Young VC firm, funded Facebook, Groupon, Twitter, Zynga, Skype, Instagram, Oculus VR | 205K |

| Union Square Ventures | 2003 | One of the top returning VC funds globally, $1 billion exit every year since 2011 | 25K |

Conclusion

While we were originally looking for the top-10 venture capital firms, the top-12 is close enough. While everyone seems to be familiar with big corporate emerging technology investors like Google, Intel, or IBM, it’s equally important that we all know which venture capital firms are pouring fuel on the fire of invention and bringing us the next Apple or as it were “the next Microsoft”. It’s a good idea to familiarize yourself with this list if you have the slightest interest in staying on top of new emerging technologies. These firms are thought leaders and you can follow the money to see what trends they see will dominate.

Sign up to our newsletter to get more of our great research delivered straight to your inbox!

Nanalyze Weekly includes useful insights written by our team of underpaid MBAs, research on new disruptive technology stocks flying under the radar, and summaries of our recent research. Always 100% free.

![A Review of Netcapital and a Look at [REDACTED]](https://www.nanalyze.com/app/themes/wp-nanalyze/assets/img/placeholder.png)

Thank you for sharing list, you should visit Lightbox as well, because i had a great experience with them.

http://www.lightbox.vc/

There is one majot flaw in this analysis. By the time one of these top 12 VCs are invested, it is too late for any other investor to get a seat that the table.

Ai Real Estate Market opportunity size in USD a industry disruptor (Ai-Realtor)

Statistics for the 2022 Residential Real Estate in the United States market size. The residential real estate market in the United States is valued at USD 2.48 Billion in the current year 2022 and is expected to register a CAGR of over 2.10% during the forecast period.

Total current 2022 residential real estate agent commissions

$2,480,000,000 / 6% = $148,800,000

(Ai-Realtor) capabilities: replace the current human-to-human transaction with (Ai-Realtor) computer-to-human real estate. Eliminating the realtor from the transaction process being much cheaper, faster, smarter, more accurate, more efficient, works 24/7. Would have the ability to research, list and market properties, arrange property showings (via third party host (ie door opener) or self-service showings), answer questions, trained and customized to analyze provide info, arrange buyer inspections mortgage appraisal, make offers and conduct negotiations and sign contracts.

Eliminating the human-to-human realtors from the process & eliminating the high 6% commission cost and commission-splits between listing and selling agents by selling residential real estate properties directly to the home buyers.

Agree. Realtors never added much value anyway.