Investing in Drones With a Drone IPO From MOTA Group

Table of contents

Table of contents

Drones are becoming more common place because of advances in lithium battery technology, HD video, stronger/lighter materials, and a general awareness of just how fun they can be to play with. Investors are being attracted to this space because of the tremendous rates of growth that are forecasted for consumer and commercial drones. The fact is though, there aren’t that many pure play stocks for retail investors to participate in. Here are a few we’ve talked about in the past:

- AgEagle Aerial Systems (NASDAQ:UAVS) – These guys filed for an IPO that didn’t generate much attention and it appears that they didn’t attract enough interest since the company is still private.

- AeroVironment, Inc. (NASDAQ:AVAV) – This is a “small” $534 million company that sells military drones. As we pointed out in our article on AVAV, military drones are not on the same growth trajectory as consumer/commercial drones.

- Parrot SA (EPA:PARRO) – This is a small pure-play drone stock (mainly consumer drones) but they’ve lost -78% of their share price value in the past year which tells us something is wrong.

We also wrote about a few OTC drone companies here and here that you are better off just ignoring altogether since as we all know, the majority of OTC companies will lose your money. There are also many privately held drone companies doing exciting things like Airobotics that we recently profiled, a company that wants to make almost continuous drone flight a reality. Perhaps the most successful of all drone startups is DJI Innovations which has a valuation of $10 billion making them the 14th most valuable startup there is today (tied with Dropbox). With limited options available for retail investors, we’re always happy to see a drone-related IPO. A company we’ve never heard about called MOTA Group just filed for an IPO with a focus on not only drones but also virtual reality / augmented reality hardware. Let’s take a closer look at MOTA Group which is looking to raise $23 million.

About MOTA Group

Founded in 2003, the MOTA Group has taken in an undisclosed amount of funding to develop electronics products that are divided into two different business areas:

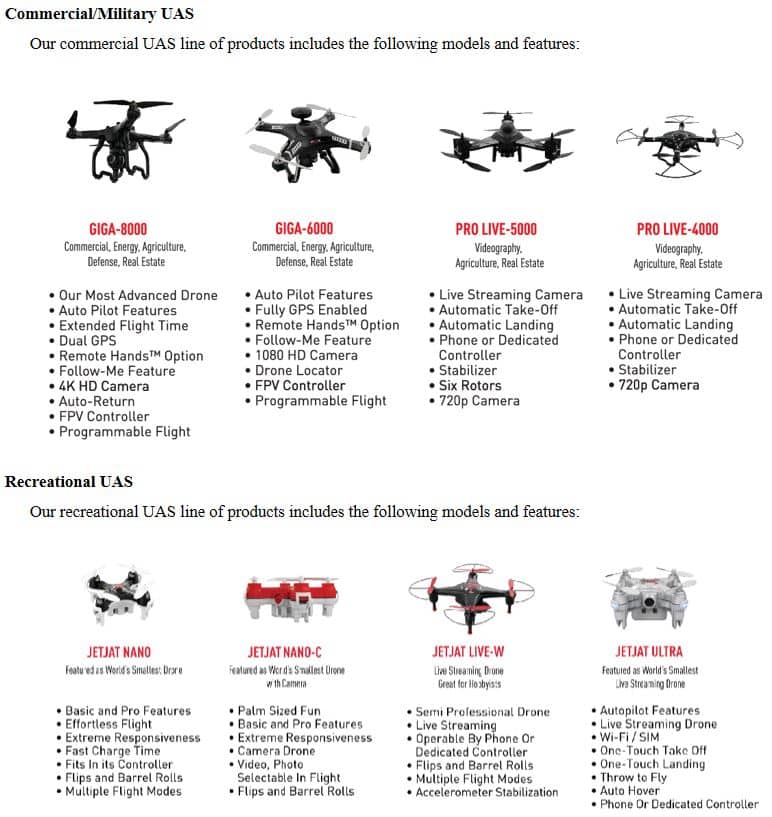

- MOTA – Consumer drones (under the JETJAT brand) and Commercial drones (under the Pro Live and GIGA brands).

- TOMA – Stylish wearables, virtual reality products, portable power products, and mobile accessories

We’re not sure what either of these acronyms stand for except that we recall MOTA from our college days as Spanish slang for “that green stuff“. There’s nothing green about this startup though. Since 2012, the MOTA Group claims to have sold and shipped over 1.7 million units of their products to consumers worldwide. The thing is we just don’t know which products those are because their IPO filing doesn’t provide a breakdown of their revenues. What we do know is that in 2015, the MOTA Group pivoted away from low-margin, low-cost products that are volume-based, such as plastic phone cases, low priced-toys, and most of the portable power accessories, to focus on higher-margin drone products instead. Their commercial and consumer drone product lines can be seen below:

The question is just how many of these drones are available for purchase? Out of the consumer drones listed above, on Amazon.com we found the JETJAT Nano ($24.99), the JETJAT ULTRA ($104.56), and the JETJAT Live-W ($53.55). Out of the commercial drones, we only found the JETJAT Pro Live-4000 ($190.57). MOTA Group gives us some indication of how many drones they have sold with the following statement made in their S-1 filing:

The JETJAT family of drones was released in November 2015, and approximately 12,000 units were sold through June 30, 2016. It currently consists of four drones from very basic to hobbyist and they have an average of 4.5 Amazon star rating.

Current retail prices for their commercial drones range from $200 to $1,000 so pretty much all the drones they sell are at very economical price points. Here’s a look at MOTA Group’s finances over the past 3 years:

MOTA Group vs. 3D Robotics vs. DJI Innovations

One important measure of the potential for any company is the leadership and financial backing. In this case, we don’t see any notable venture capitalists behind this startup. The 35-year-old CEO/President/CFO, Michael Faro, has prior experience at Intel and Siemens. The 35-year-old Chief Product Officer, Lily Ju, used to be the VP of Human Resources and before that ran a consulting firm and even a modeling agency at one point in time. Those are the only two C-Level appointments at MOTA Group.

Conclusion

Why are we so concerned about leadership? The reason is because this is a viciously competitive business environment to be operating in. 3D Robotics took in over $126 million in funding from investors that include Qualcomm and Sandisk. If an article by Forbes last week titled “Behind The Crash Of 3D Robotics, North America’s Most Promising Drone Company” is any indication, then it appears that 3D Robotics is getting the isht kicked out of them by DJI. We’d also suspect that DJI’s dominance helped contribute to PARRO shares tanking over the past year as well. 3DR had strong backing, a lot of money, and almost certainly was better connected. MOTA Group is going to have their work cut out for them. If the MOTA Group drone IPO goes through, you can trade it under the symbol MOTA.

Sign up to our newsletter to get more of our great research delivered straight to your inbox!

Nanalyze Weekly includes useful insights written by our team of underpaid MBAs, research on new disruptive technology stocks flying under the radar, and summaries of our recent research. Always 100% free.