Bluechiip: The $5.6 Million MEMS Company

Table of contents

Table of contents

In a past article, we discussed Micro Electro Mechanical Systems or MEMS and how commonly used these devices are for a variety of purposes. If you own a smartphone, then you would be using many of these devices every day. The MEMS market is growing rapidly and reached over $12 billion in 2013 with projections of yearly CAGR of +12% going into 2018. One application of MEMS is to provide temperature and identification tracking solutions for biosamples which are particularly sensitive to their environment. An Australian company called Bluechiip (BCT) claims to be the only company that produces a MEMS technology-based smart chip which provides temperature plus location for biosamples without the need for a battery and under extreme conditions.

About Bluechiip

Bluechiip Limited (ASX:BCT) is an Australia-based company that has developed a new MEMS wireless tracking solution. The technology offers many benefits not attainable with existing tracking technologies and is particularly suited for biobanking applications. Bluechiip trades on the ASX and has lost -64% of its value since it first started trading in 2011. The Company has a minuscule current market cap of $5.6 million and an accumulated deficit of just under $19 million.

What is Biobanking?

Biobanks collect, process, store, and distribute biospecimens which can be any kind of tissue or body fluid. According to a Helmsec research report published this year on Bluechiip, total sales for the biobanking market are predicted to reach $19.13bn in 2015, $31.50bn in 2020 and $44.59bn by 2025. Currently, there are over 2 billion biospecimen samples stored in Biobanks globally, a number which is growing by approximately 200 million samples a year. The existing tracking systems used in Biobanks typically utilize labels and barcodes for tracking. In addition to the need for tracking, many biospecimens can be temperature sensitive and require monitoring.

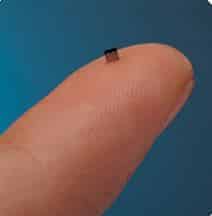

Bluechiip has developed a MEMS-based temperature and identification tracking solution for biosamples which does not require a power source. The device known as a “smart chiip” contains resonators that when stimulated by a frequency, will return a signal that indicates the unique identification and temperature of each “smart chiip”. The profile of the “smart chiip” is extremely small:

Bluechiip claims that unlike its competitors, their “smart chiips” are unaffected by extreme cold or gamma irradiation making them extremely durable. Traditional tracking methods such as labels, barcodes, and also (RFID) systems can experience issues in such environments. The below table shows a breakdown of attribute for the “smart chiip” along with competing solutions:

Many cold storage systems require temperatures below -80 at which RFID solutions cease functioning. Bluechiip is hoping that this durability advantage along with instantaneous wireless reading of location, ID, and temperature will be enough to displace competing solutions. The Company has a partnership in place with STMicroelectronics to manufacture its “smart chiips”, no debt, and enough cash on hand to last until mid next year. The only thing missing is the sales. In Bluechiip’s annual report for the year ended June 30th, 2014, the below statement was made:

Towards the end of 2013 it became increasingly apparent, predominantly through the lack of sales, that the significant sales, marketing, and business development resources being committed by the company needed urgent review.

The company then brought in two consultants who said Bluechiip needed a “revised commercialization strategy” and “significant cost management”. Just a few months after this, the CEO resigned with the CTO, Jason Chaffey, appointed to “acting CEO”. In July of this year, Chaffey was appointed the CEO position until several weeks ago when he too resigned. Two CEOs in less than two years shows that the Company may be having some major problems internally. In a quarterly update a few weeks ago, Bluechiip announced a successful share placement to raise just under $900,000 along with validation sales from about 6 customers.

While Bluechiip’s current market cap of just $5.6 million may seem low, the company’s valuation reached an all-time low of $2.6 million this summer then the stock hit its 52-week low of 3.3 cents. One could argue that if Bluechiip’s technology was so unique, why were they not acquired at such a low valuation? On the other hand, the application may be so niche that it has been generally overlooked. Based on current burn rate, the company claims to have enough cash to last well into the first half of next year. Only an increase in revenues will show that Bluechiip’s senior management has been able to put the back on company on track. A continued lack of sales for Bluechiip (ASX:BCT) could also hint at the dire fact that there is no current demand for this technology solution at an economically viable price point.

Sign up to our newsletter to get more of our great research delivered straight to your inbox!

Nanalyze Weekly includes useful insights written by our team of underpaid MBAs, research on new disruptive technology stocks flying under the radar, and summaries of our recent research. Always 100% free.