Is Smart Glass a Smart Investment Yet?

Table of contents

Does it seem like everything is becoming smarter? Soon even your toothbrush will have more computing power than the space shuttle. One smart technology that’s been around well before the term came into vogue is smart glass. But is it a smart investment yet?

Smart glass, also referred to as dynamic or switchable glass, is glass that can change tint and transparency manually or automatically, usually when electricity, heat or light is applied. It’s used in everything from construction to automobiles to aircraft. These days the technology has gotten even smarter, allowing users to change opacity with an app.

There are a number of smart glass technologies, but the three main electric-controlled ones include:

- Electrochromic (EC): Uses a small electrical charge to change the transparency of a medium capable of changing color.

- Suspended particle devices (SPD): Relies on nanoscale particles in a liquid that change alignment based on the amount of voltage applied, which changes the tint.

- Polymer dispersed liquid crystals (PDLC): Somewhat similar to SPD, PDLC uses liquid crystals encased in a polymer. An electrical charge changes the alignment of the crystals, allowing more light to pass through as the voltage increases.

A couple of years ago, we came across a startup called View Inc. and the publicly traded company Research Frontiers, which has apparently been around nearly as long as the Beatles. View was trying to work its way into the construction industry. Meanwhile, Research Frontiers’ business model involved licensing its SPD-SmartGlass technology to about 40 companies, mostly in the automotive industry.

At the time we found the technology engaging, noting that View was beginning to scale up, despite offering a product about 50 percent more expensive per square foot. View employs electrochromic technology, using multiple layers of transparent metal oxide film layered onto a normal window. A tiny electric charge causes ions to move between layers, changing its structure and tinting the glass.

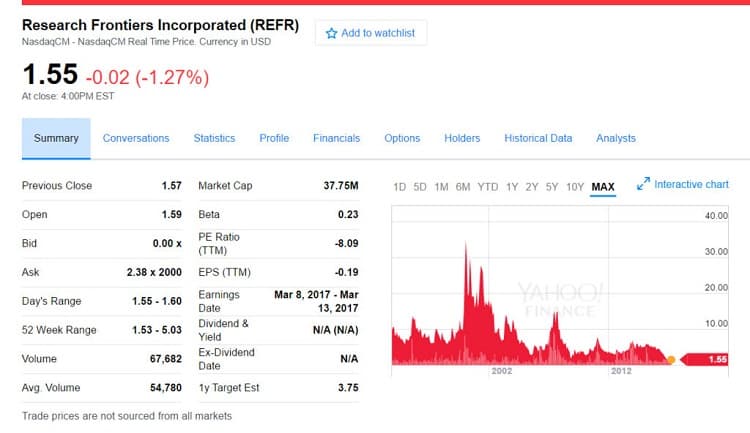

We thought Research Frontiers (NASDAQ:REFR), which debuted its IPO in 1986, had some promise with its SPD SmartGlass. It offered investors an opportunity to get some skin into the smart glass game, though we had some reservations about their stock performance and balance sheet. A quick check will show their stock price has fallen -68% since we first came across them in September of 2014. While they are selling their smart glass in the automotive sector to companies like Mercedes Benz, it’s just not enough revenue to move the needle. They need to either cut costs or increase revenues and neither seems to be happening. You would need some smart rose-colored glasses to see the bright side, though Westpark Capital issued a buy rating last month with a $6 target per share. Early retirement, here we come.

Smart Money is on the Glass

In our short series in 2014, we quoted MarketsandMarkets, saying the smart glass market was worth $1.5 billion in 2013. The research firm predicted a compound annual growth rate of 20 percent to 2020, putting a $5.8 billion price tag on the smart glass market by the end of the decade.

A more recent report from MarketsandMarkets shows the research firm is still bullish on the smart glass market, saying it will grow from $2.34 billion in 2015 to reach $8.13 billion by 2022, with a CAGR of 19.2 percent between 2016 and 2022. Grand View Research is only half as optimistic: It projects the smart glass market to reach $4.71 billion by 2022. Finally, n-tech Research, which refers to the smart windows market, currently values the industry at $1.8 billion but predicts a stratospheric rise to $8 billion by 2025.

The report from n-tech, which specializes in market analyses related to functional materials, says much of the “value added available to smart windows suppliers will flow from control systems, interfaces, and related electronics. Today smart windows are very much an Internet-of-Things (IoT) story.”

Review of View Smart Glass

That would seem to play into the View Inc. narrative. Its View Intelligence engine takes into account both exterior and interior parameters when determining optimal tinting settings. Parameters include time of year, time of day, predictive weather feeds and real-time sensors. It uses algorithms to calculate the theoretical energy of the sun, which helps it determine how much solar heat to block to stay below a specified temperature threshold. It can even adjust for glare based on the geometry of the incoming light. And the whole thing can be controlled by a mobile app.

View opened a $130 million manufacturing facility in 2012. At full capacity, it can produce five million square feet of glass per year, according to an in-depth profile on the company published by Silicon Valley Business Journal last year. View’s biggest coup to date was the installation of 37,000 square feet of smart glass for CenturyLink at its new “Center of Excellence” in Monroe, Louisiana. Even bigger things are on the horizon: Last May, Silicon Valley BJ reported, developer SteelWave announced it would use 100,000 square feet of View glass at a huge new office complex called America Center II in San Jose.

Smart Glass Market Still Fractured

Other parts of the n-tech report that seem to favor startups like View:

- EC technology will account for 75 percent of revenues in the smart glass space by 2021, double the share it had in 2016.

- Smart windows are penetrating the construction market at a “brisk rate” and will contribute more than $1.3 billion in revenues by 2021 compared with just $105 million in 2016.

- The report also says that the bulk of investment dollars are flowing into EC startups.

That would seem to be the case with Kinestral Technologies, a San Francisco-based startup that earlier this year closed a $65 million Series C led by Japanese glass manufacturer AGC, which is also one of its key strategic partners. Total investments are now at $160 million, so the latest infusion of cash was a big deal. Kinestral claims its system, called Halio, is capable of uniformly darkening itself within minutes, implying that it’s probably based on EC technology. It plans to roll out Halio, which can reputedly reduce energy costs between 20 and 40 percent, in 2018 for both commercial and residential use. Check out the visualization below to learn more about the Halio system:

Announced this past week, Kinestral Technolog

Update 01/30/2019: Kinestral Technologies has raised more than $100 million in Series D funding to expand manufacturing, sales, and installation of Halio smart-tinting glass to meet rapidly growing global demand. This brings the company’s total funding to $229 million to date.

Another key player in the smart glass market is SAGE Electrochromics, founded back in 1989 in Valley Cottage, New York. The company is now a subsidiary of Saint-Gobain S.A., a French multinational construction corporation. SAGE claims to have installed its smart glass in more than 700 projects. Like other competitors in the electric-powered smart glass market, SAGE says it requires a miniscule amount of energy to tint its windows. In fact, it takes less electricity to operate 2,000 square feet of SageGlass than it does to power a single 60-watt light bulb.

Publicly traded Gentex Corporation (NASDAQ: GNTX), which produces dimmable rearview mirrors based on EC technology (among other automotive tech), might be an interesting investment for those who want an immediate buy-in to the smart glass space. It’s a $6 billion company trading above $20 per share—its highest stock price since going public in 1981—despite a recent tough quarter. Think there’s no money in automotive mirrors? Think again. GNTX sold 35 million auto mirrors in 2015 with a gross margin of 39%. Its smart glass products are also used in the aerospace industry, though n-tech believes aerospace applications will only ever be a niche market.

Conclusion

So, did we answer the question: Is smart glass a smart investment? In construction, the real money is probably in speculative office buildings—and it’s much harder to convince contractors to make big investments when they really want short-term profits. This segment of the industry, like any business tied to construction, will likely follow building booms and busts. The automotive market for smart glass is really more of a premium product, so again, you’re looking at a sector closely aligned to when the economy is booming. Otherwise, when times are tough, we’re happy with the $99 tint job offered in the Wal-Mart parking lot.

Of course, the future is bright—and predicted to get ever hotter—so maybe we want to wear shades after all. We’ll check back in by 2022 …

Sign up to our newsletter to get more of our great research delivered straight to your inbox!

Nanalyze Weekly includes useful insights written by our team of underpaid MBAs, research on new disruptive technology stocks flying under the radar, and summaries of our recent research. Always 100% free.

Hello, nice article! The SAGE Electrochromics website is actually incorrect. I hope this helps.

Thank you for that Ryan. It’s been fixed.

Hello,

More info:

PDLC

It is almost internal use only

SFI GLASS or NCAP PDLC is dominant and can be exposed out

Merck comes with Licrivision technology to make PDLC also on facade with optimal values

EC

It is external

Also have:

– Pleotint USA glass which is thermo, based on solar, no electricity

– EControl, a small German company

Thank you for the additional info Erez!

We didn’t do an exhaustive list for this article but this is certainly a good place to collect all the other names out there.

WOW, comment is removed.