Genomatica Produces Chemicals via Synthetic Biology

Table of contents

Table of contents

In an earlier article, we discussed the potential of synthetic biology and how it is now routinely used to genetically reprogram microbes to make biofuels, vaccines, plastics, and antibiotics. One company that is using synthetic biology to produce Butanediol (BDO) is Genomatica.

About Genomatica

Founded in 1998, San Diego based Genomatica has raised $125 million in financing from the likes of Alloy Ventures, Bright Capital, Draper Fisher Jurvetson, Mitsubishi Chemical, and VantagePoint Capital Partners. Genomatica’s current commercial partnerships include BASF, Mitsubishi Chemical, DuPont Tate & Lyle, and Versalis.

Technology

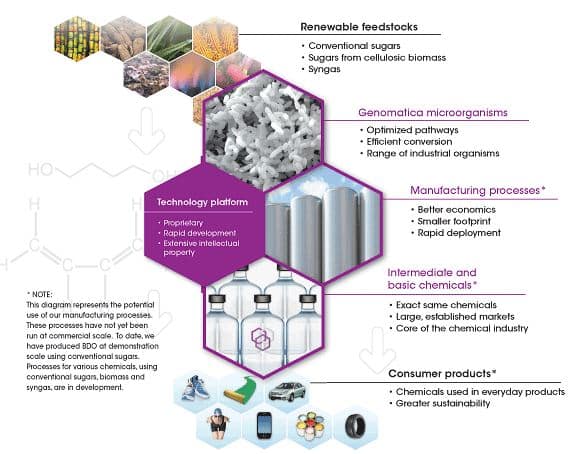

Genotmatica’s patented processes are designed to convert a range of renewable feedstocks into numerous target chemicals for established markets. Genomatica’s current primary focus is on the production of Butanediol (BDO). BDO is an intermediate chemical used in everyday products including athletic apparel, running shoes, electronics and automotive applications. The product sells in the $2000-$2300 range per ton and realized $4 billion in global sales last year. Using a synthetically engineered microorganism which produces BDO through modified e.coli fermentation, Genomatica produced 5 million pounds of BDO in late 2012, all sold and shipped, representing revenues of $5.75 million at current prices. While the Company is initially targeting the production of BDO, their platform is built so that it can be used to produce other potential chemicals from renewable feedstocks:

As of 2011, Genomatica owned or had licensed rights to 23 issued patents and 206 pending patent applications in the United States and in various foreign jurisdictions protecting their technology platform. Genomatica believes their key competitive strengths to be cost-advantaged production, key partnerships with industry leaders, capital efficiency, significant feedstock flexibility from multiple renewable feedstocks such as conventional sugars, sugars from cellulosic biomass, or syngas from a variety of sources, and a management team with over 100 years of combined operations, technology, partnering and licensing experience in the chemical and other technology industries.

Conclusion

In 2011, Genomatica filed an S-1 SEC registration statement for a proposed $100 million initial public offering of shares of its common stock, however, the IPO was withdrawn. Given the large potential market that Genomatica is targeting along with their unique synthetic biology platform, backing by renowned venture capitalists, and strong commercial partnerships, it would seem likely that another liquidation event may happen sooner rather than later.

Sign up to our newsletter to get more of our great research delivered straight to your inbox!

Nanalyze Weekly includes useful insights written by our team of underpaid MBAs, research on new disruptive technology stocks flying under the radar, and summaries of our recent research. Always 100% free.